Illicit Flows and Trade Misinvoicing: Are we looking under the wrong lamppost?

Illicit financial flows (IFFs) have become a high profile issue in recent years. The Sustainable Development Goals include a target (16.4: significantly reduce illicit financial and arms flows, strengthen the recovery and return of stolen assets and combat all forms of organized crime), and the issues has been included in the Addis Ababa Action Agenda and the work of the G20 and the OECD. Donors including NORAD and DFID and multilateral organisations such as the World Bank and African Development Bank are also responding.

Introduction

Large estimates of trade misinvoicing have played a key role in shaping perceptions of the issue. The Washington based NGO Global Financial Integrity (GFI) uses mismatches in official trade data to estimate that trade misinvoicing drains US$800 billion from developing countries annually.{1} Their work also inspired UNECA and the African Union to set up a High Level Panel on Illicit Financial Flows from Africa, which estimated US$50 billion of illicit flows from Africa.{2} Based on these estimates, Thabo Mbeki as chair of the panel argued that ”the bulk of illicit financial flows – 60% and more – derive from the activities of the large commercial companies”, through trade misinvoicing, with criminal activities such as drug trafficking accounting for about 30%, and corruption less than 10%.

Manipulation of import and export prices is certainly a real phenomenon. In China overpayments of imports have been used to get around the country’s currency controls. In Venezuela scammers use inflated import invoices to buy cheap dollars from the official currency control agency. There have long been concerns that exporters shipping tropical hardwoods from Papua New Guinea may be underdeclaring their value. Networks involved in smuggling people, drugs and arms use Halawa agents to transfer money, and they may settle up between themselves through shipments of licit goods under-charged. However, it is not clear that the influential and widely quoted estimates of trade misinvoicing derived from mismatches in trade statistics help us to understand the reality of illicit economies and networks in practice.

This briefing looks at some of the key problems with these estimates and argues that continuing to use them as such a bright point of light in shaping our understanding could impede, rather than support targeting of effective action in combatting corruption, organized crime, illegal exploitation of natural resources and tax evasion.

{1} GFI (2015) Global Illicit Financial Flows Report: 2015. Washington DC: GFI.

{2} High Level Panel on Illicit Flows from Africa (2015). Track It! Stop It! Get It!. Report of the High Level Panel on Illicit Financial Flows from Africa, Commissioned by the AU/ECA Conference of Ministers of Finance, Planning and Economic Development.

What are Illicit Flows?

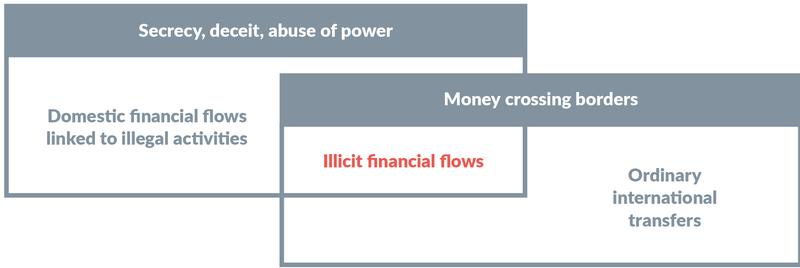

The most common definition of illicit financial flows is that they are international financial transfers that are linked to illegal activities (“money that is illegally earned, transferred or utilized”):

- Motivation ranges from hiding the proceeds of grand corruption, to drug trafficking, to tax evasion, to an individual evading currency controls in order to transfer money to pay for their daughter’s university tuition.

- Means for making international payments include bank transfers and money transfer services, cash or gold smuggled across a border, transfer of ownership of stocks and shares. Illicit financial flows tend to use secrecy or deceit, to hide illicit transactions amongst ordinary international transfers, to make funds difficult to trace and to move money into secret bank accounts and shell companies, for example by invoicing for fictitious consulting fees, undertaking back-to-back ‘mirror trades’ of stocks and shares or misdeclaring the value of goods.

Different means of illicit transfer do not map neatly to different motives. Nevertheless, it is important to note that illicit flows driven by different reasons are associated with different impacts:

- A dollar of money from grand corruption is a direct diversion of resources from the public purse, and causes many more dollars of damage through undermining public institutions and providing a slush fund for maintaining political power.

- Each dollar of criminal money such as that associated with organised crime, drug trafficking or terrorisms is also associated with a hinterland of damage through violence and financing of conflict, and often damage to the environment.

- Using offshore transactions to hide legitimate earnings for the purpose of tax evasion is clearly a form of illicit flow, however it is not the whole face value of the illicit flow that is diverted public money.

- In countries with strict capital controls illicit flows can be associated with evading capital controls. This can be motivated by concern about financial instability or predatory government or by a desire to access international investment and consumption. This should not be conflated with theft of public money or loss of investment funds. However, it might be argued that it reduces the stake of elites in ensuring property rights and development at home.

The Concept of Illicit Flows

Motivations

Proceeds of crime

Proceeds of corruption

Tax evasion

Bribery

Financing of terrorism and conflict

Sanctions busting

Evading capital controls

Means

Bank-transfers

Money transfer services

Cash carried across borders

Transfers of financial assets

Transfer of property

Informal IOUs/ Halawa

Payments using cryptocurrencies

The trouble with the big estimates

A man is searching for car keys under a lamppost. After joining his search you ask whether he is sure that this is where he lost the keys. “No, I’m pretty sure I lost them down the road” he replies, “but the light is better here”.

There are two problems with using the large estimates of trade misinvoicing to represent illicit financial flows. The first is methodological: not all trade misinvoicing shows up as mismatches in the trade data, and conversely not all mismatches in the trade data are evidence of misinvoicing. The second is that that the large and seemingly detailed estimates may attract attention away from other areas of illicit flows for which no such estimates exist.{3}

While the methodological problem is acknowledged in the literature, it is often ignored when calculations are translated into high-level findings. This was illustrated clearly in 2016 when The UN Conference on Trade and Development (UNCTAD) published a study on trade misinvoicing of commodities under the headline “some countries are losing 67% of the value of their exports”.{4} It highlighted specific instances, which were presented as showing the scale of misinvoicing, but in practice show how ordinary differences in the way countries categorise trade can generate large false-positive estimates. Two cases are highlighted here:{5}

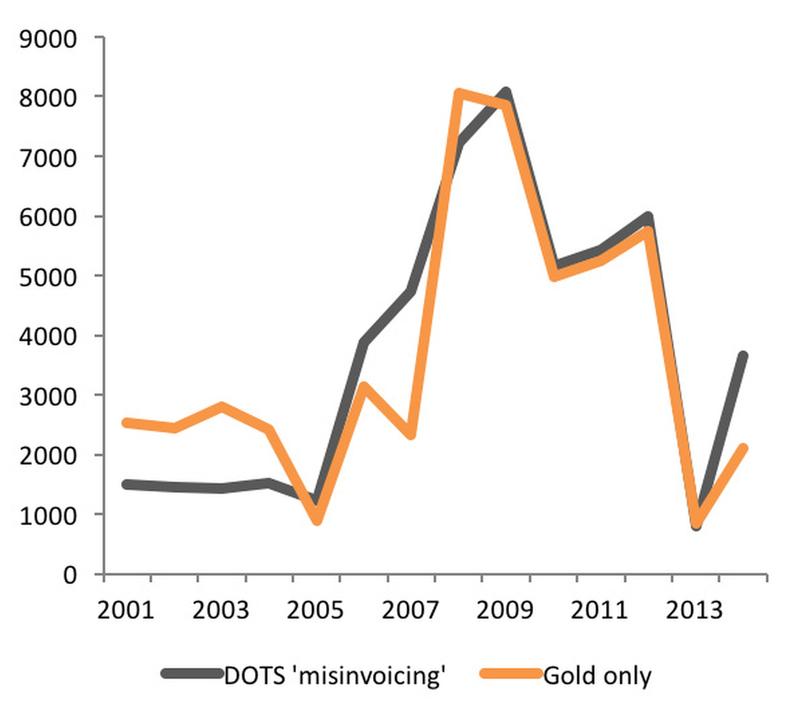

The UNCTAD study looked at mismatches between the gold that South Africa reports as exported to other countries, and the amount of South African gold those countries say they import. There is a large discrepancy and this was interpreted as suggesting that South Africa was the victim of a massive smuggling scam where ”virtually all gold exported by South Africa leaves the country unreported” (giving rise to the 67% statistic above). However South Africa’s trade statistics explain that the country does not yet report gold exports broken down by destination, furthermore up till 2011 gold was reported as a monetary export rather than a manufactured commodity, which explains the mismatch with importers’ records.* The Revenue Service, the Chamber of Mines and the official Statistics Agency all issued statements arguing that the analysis was flawed.

*Van Rensburg, D. (2016). How wrong the UN was on SA gold ‘smuggling’? City Press. 2016-08-01

http://city-press.news24.com/Business/how-wrong-the-un-was-on-sa-gold-smuggling-20160729

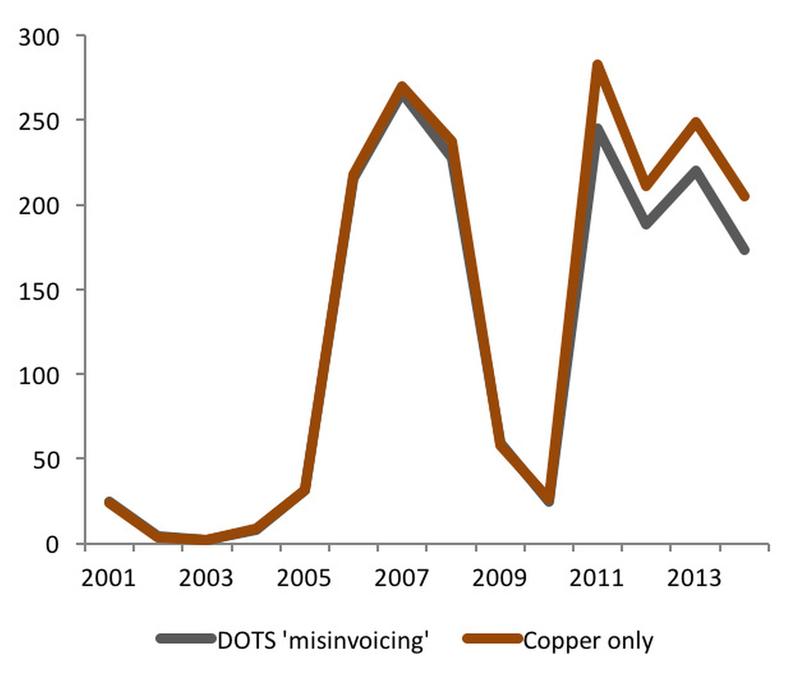

Copper is one of Zambia main exports. Trade statistics show that more copper is exported from Zambia to Switzerland and the UK than arrives in these destinations, but more Zambian copper arrives in countries such as China, Korea, Italy and Saudia Arabia than Zambia reports as exports to them. The UNCTAD report interprets this as underinvoicing and overinvoicing in the two directions. However, it seems more readily explainable by merchanting trade involving companies in Switzerland and the UK, and by the London Metals Exchange system of bonded warehouses.

Are these just a few individual cases, which can safely be viewed as outliers, or should they lead us to question whether the broader misinvoicing estimates are meaningful?

GFI agrees that not every unrecorded transaction is illicit, but argue that “the vast majority of unrecorded [i.e. mismatched] transactions are illicit”.{6} However, this has not been tested. UNCTAD says: ”this what our data has shown us. We do not see a convincing challenge to the source of our data (Comtrade), the data itself, or even the methodology”.{7} However, UN Statistics and the IMF warn that the trade data cannot be reliably used in this way. The IMF says “we caution against attempting to measure [illicit flows] by using discrepancies in macroeconomic datasets… official estimates of trade misinvoicing cannot be derived by transforming trade data from the IMF Trade Statistics and/or UN COMTRADE, either by individual country or in aggregate.”{8}

While it may not be possible to so clearly reveal the patterns behind misinvoicing estimates in every country, in the cases of South-Africa–UK and Zambia–Italy, as shown below, it appears that the vast majority of the mismatch observable within the comprehensive direction of trade statistics, which GFI uses for its annual estimates, can be explained by the false-positive results for single commodities – gold and copper respectively.

Gold and copper data mismatches contribute a large part of apparent export underinvoicing for South Africa-UK and Zambia-Italy

Similar issues are also likely to contribute to the High Level Panel’s calculation of $50billion from Africa. For example the second largest category in the HLP study was precious metals and minerals, with 98% of this from the South African Customs Union, suggesting that the South African gold error plays a part. The largest contributor to the HLP estimates is oil, where it is particularly difficult to interpret data mismatches, due to the liquid nature of the product and its price volatility. Oil may be traded on route from its country of origin, with the price rising or falling in between, and can be held in bonded warehouses and blended before it is delivered to its final destination.

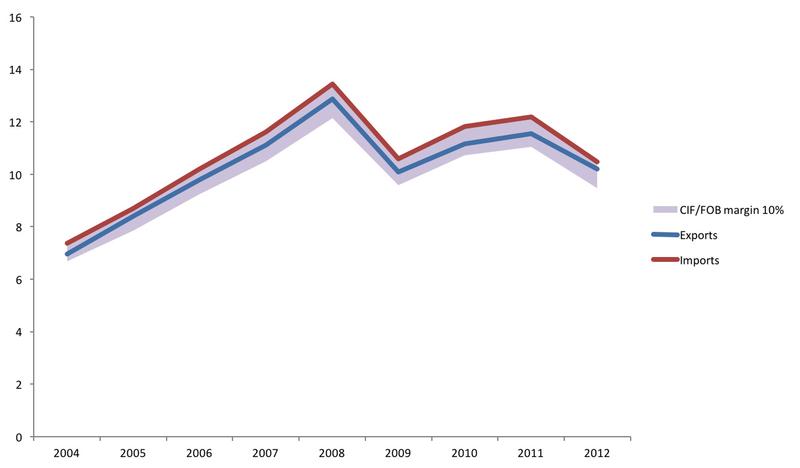

One further clue that ordinary merchanting and transit trade involving international hubs may be significant in generating trade misinvoicing estimates can be seen from the overall pattern of goods trade reported globally. While there are significant mismatches between exports and imports reported by pairs of countries, it is striking that globally, imports and exports track each other closely, falling within the 10% margin conventionally allowed for the cost of transport and insurance overall.{9}

Global reported imports and exports of goods

Why would billions of dollars of over- and underinvoicing cancel each other out so neatly each year, so as to appear invisible? It is hard to imagine how this would happen if the data mismatches mainly reflected separate, hidden frauds carried out by disparate entities to move money across borders. For example, if a Russian businessman organizes to overpay for an import as a means to illicitly transfer funds offshore, there is no reason why another unrelated illicit trader somewhere else should make an underpriced import (or an overpriced export) for the same amount.

However, this pattern of over and under invoicing netting out neatly is consistent with mismatches that would be expected from merchanting and transit trade along commodity supply chains. For example in the Zambia copper case, a shipment of copper from Zambia to Italy by a Swiss trader would result in a mismatch of data between Zambia and Switzerland and an equal and opposite mismatch between Zambia and Italy.

These observations provide concrete illustrations of the general problem with these big estimates. Volker Nitsch in the paper “Trillion Dollar Estimate: Illicit Financial Flows from Developing Countries” reviews the empirical methodology more broadly. He concludes that the quantitative results have no substantive meaning and that therefore the estimate of $800 million of trade misinvoicing globally lacks evidence and is uncorroborated.

Trade misinvoicing is often confused with profit shifting or transfer pricing by multinational companies – and therefore a conclusion has been drawn that tax is the main motivation for the majority of illicit flows, or that multinational corporations are the chief culprits.

However the situation where a multinational company and the tax authority disagree on arms-length pricing is different from the situation where transfer pricing is used illicitly to divert payments into anonymous shell companies in order to pay bribes, embezzle funds or evade taxes. This is not only unlawful, but in a public company would mean hiding funds from shareholders.

An argument has been put forward that the definition of illicit flows should explicitly be expanded to include legal tax avoidance or tax optimization by multinational companies, on the basis that it is socially damaging. The High Level Panel, the UN Independent Expert on the Effects of Foreign Debt and Other Related International Financial Obligations on Human Rights, and the civil society Financial Transparency Coalition all call for such a normative definition. The South African Government has argued against, saying that tax avoidance should be distinguished from fraudulent, illegal and fictitious transactions.*

* GEGAfrica (2016). SOUTH AFRICA’s STATEMENT to develop a strategic and inter-connected policy to combat illicit financial flows, focusing on Commercial Tax Evasion

{3} This second problem is discussed in Reitano, T. and Rodrigues, A. (2015). Development Responses to Organized Crime: new agendas, new opportunities. The Global Initiative Against Transnational Organised Crime.

{4} Ndikumana, L. (2016), Trade Misinvoicing in Primary Commodities in Developing Countries: The cases of Chile, Coté d’Ivoire, Nigeria, South Africa and Zambia. Geneva: UNCTAD

{5} See also https://hiyamaya.wordpress.com/2016/07/20/misinvoicing-or-misunderstanding

{6} UNSTATS (2016) Meta-data submitted on Indicators for Goal 16 as of March 2016. http://unstats.un.org/sdgs/files/metadata-compilation/Metadata-Goal-16.pdf

{7} http://unctad.org/en/pages/newsdetails.aspx?OriginalVersionID=1309

{8} Response to UN IAEG consultation on SDG indicators http://unstats.un.org/sdgs/files/open-consultation-iaeg/Open_Consultation_Compilation-Members_and_Observers-20150915.pdf

Moving away from the lamppost

Illicit flows are, by their nature, difficult to identify and this first generation of estimates have played a critical role in drawing attention to the issue. Difficulties in measurement do not mean that the problem of trade misinvoicing or broader illicit flows should be dismissed, or that the challenges to governance of natural resource revenues should be underestimated. But continuing to circle around the most convenient lamp-post provided by these big numbers is unlikely to lead to fruitful results.

Challenging these estimates is not an argument for no action on illicit flows, nor is it a quest for impossible accuracy, but it is an urgent call for a more realistic conversation that draws in the expertise of revenue authorities, statistical agencies, customs agencies, law enforcement and businesses, as well as experts in natural resource governance and organised crime. There are four areas which are particularly relevant:

- Understanding domestic realities – Domestic studies are critical to understanding the impact of illicit finance on development. Such research is being undertaken in Kenya, Tanzania, West Africa and South Africa, for example. However, the catalyst for these studies has often been the existing estimates of massive commodity trade misinvoicing. This creates a tension as the evidence that they find may challenge rather than provide confirmation of the received wisdom. Mirror trade statistics may provide one source of data for national studies, but they cannot be viewed as clear evidence of misinvoicing, and studies need to develop findings which are recognisable to practitioners. Enabling learning from across these studies about how to analyse illicit flows on the ground is a crucial step to support international understanding.

- Measuring international progress – The UN has so far been unable to reach agreement on an SDG indicator on Illicit Flows. The wished-for indicator has been “total value of inward and outward illicit financial flows” – however it is increasingly clear that this indicator does not exist, cannot be calculated and is unlikely to be meaningful given the range of impacts of different types of illicit flow. Individual-country analyses should feed into understanding of where third-countries are acting as getaway vehicles, and how this can best be addressed. Frameworks such as the Financial Secrecy Index developed by the Tax Justice Network, and the development by the EU and the OECD of criteria for identifying non-cooperative jurisdictions are relevant efforts towards exploring the second question, as are ‘mystery shopper’ exercises in testing how easy it is to register anonymous companies.

- Commodity value chains – It is clear that the extractive sector is prone to leakages, but inflated expectations of massive hidden margins can contribute to policy instability and undermine government accountability. Initiatives such as the Extractive Industry Transparency Initiative and the Natural Resource Governance Institute are doing important work to improve transparency and analysis of extractive revenues at a country level. But there is also potential to advance understanding of illicit flows within global commodity value chains. The G20 has asked the World Customs Organisation to study the issue of IFFs, and their expertise could support such an approach. Industry bodies such as the International Council for Mining and Minerals (ICMM), the oil and gas association for environmental and social issues (IPEICA) and the Swiss Trading & Shipping Association should also contribute to understanding illicit flows risk and provide insight on trading practices and commercial realities.

- The role of multinational companies – The problem of how to tax global commerce effectively is different from how to find corrupt or stolen money, or fight organised crime. Strengthening administration of tax law so that it is neither weakly enforced, nor capricious and predatory is positive for citizens, businesses and government, and ultimately critical for sustainable development. This suggests a key area of shared interest between multinational companies and others concerned with illicit flows, around the effectiveness of beneficial ownership transparency systems.{10} Blurring the distinction between legal and illegal conduct in relation to tax by combining them into a vaguely defined composite category is not something to do lightly, and certainly not on the basis of a combination of wishful thinking and misunderstanding.

{10} This issue has been taken up by The B Team, a not-for-profit initiative formed by a global group of business leaders to catalyse a better way of doing business (http://bteam.org)

Recommended Literature

Baker, R. (2016). Magnitudes versus Methodologies? Global Financial Integrity.

http://www.gfintegrity.org/magnitudes-versus-methodologies/

Forstater, M. (2015). Can Stopping ‘Tax Dodging’ by Multinational Enterprises Close the Gap in Development Finance?. CGD Policy Paper 069. Washington DC: CGD.

Hearson, M. (2014). Tax-motivated illicit financial flows A guide for development practitioners. U4 Anti-Corruption Resource Centre. Bergen: CMI.

Johannesen, N. & Pirttilä, J. (2016). Capital flight and development: An overview of concepts, methods, and data sources. 2016/95. Helsinki: UNU-WIDER.

Nitsch, V. (2016). Trillion Dollar Estimate: Illicit Financial Flows from Developing Countries. In: Darmstadt Discussion Papers in Economics, 227. Darmstadt

Reitano, T. and Rodrigues, A. (2015). Development Responses to Organized Crime: new agendas, new opportunities. The Global Initiative Against Transnational Organised Crime.

Reuter, P (2016, forthcoming). Illicit Financial Flows and Governance: The Importance of Disaggregation. Working Paper for the 2017 World Development Report. Washington DC: World Bank

Reuter, P. (Ed.) (2012). Draining Development? Controlling Flows of Illicit Funds from Developing Countries. Washington DC: World Bank

About this CMI Insight

This briefing is prepared for the project “Taxation, Institutions and Participation (TIP): The dynamics of capital flows from Africa”, funded by the Research Council of Norway.

The author would like to thank Alex Erskine, Odd-Helge Fjeldstad, Leonce Ndikumana, Kathy Nicolaou, Volker Nitsch, Vijaya Ramachandaran, Tuesday Reitano, Peter Reuter and Mathew Salomon for comments and insights. Views and conclusions expressed within this CMI Insight are those of the author alone.