Non-resource taxation in a resource rich setting: A broader tax base will enhance tax compliance in Tanzania

How to cite this publication:

(2016). Non-resource taxation in a resource rich setting: A broader tax base will enhance tax compliance in Tanzania. Bergen: Chr. Michelsen Institute (CMI Brief 8)

CMI Brief December 2015 Volume 14 No.08

Huge reservoirs of natural gas have been discovered offshore the southern coast of Tanzania. The country might become a large producer of gas, and a potential exporter of liquefied natural gas (LNG) during the next decades. With this comes the promise of significant petro-revenues and prospects of natural gas-driven structural transformation, bringing with it improved economic and social conditions for the people of Tanzania. However, experiences from other countries suggest that it is challenging to turn natural resource wealth into improved welfare for the majority of citizens. In this brief, we focus on challenges related to the management of government revenues, particularly tax. We argue that continued efforts to expand the non-resource tax base is essential for successful management of the resource wealth.

Natural gas in Tanzania

Exploration of oil and gas in Tanzania started in 1952, and the first discoveries were made in 1974 and 1982 at Songo Songo Island (Lindi Region) and Mnazi Bay (Mtwara Region), respectively. Commercial production from these reservoirs started in 2004, mainly for domestic electricity generation and some industrial use. Since 2010, large reservoirs of natural gas have been discovered offshore the southern coast of the country. The size of these offshore reservoirs has attracted the interest of international petroleum companies and substantial investments have already been made in the exploration phase. However, the final decision to invest in extraction facilities has been postponed until 2018 due to the recent worldwide decline in petroleum commodities, including natural gas. The African Development Bank estimates that gas revenues will add 13% to existing government revenues during the first decade of production if a positive investment decision is made.

Challenges related to gas discoveries and non-resource tax

In addition to its potential to propel structural transformation, natural gas exports represent an opportunity for the government to improve the welfare of Tanzanians. At the same time, experiences from other countries show that the management of natural resources can be very challenging. Resource rich countries tend to have lower levels of economic and social development than comparable countries with smaller resource endowments, a phenomenon often referred to as the resource curse.

When faced with large gas revenues, the government might be tempted to ignore the development of the non-resource tax base. Our research shows that continued efforts to increase tax compliance and expand the revenue base (including the number of citizens and firms paying tax) are essential for successful revenue management in general.

Taxation can be an important mechanism for citizens to hold their governments accountable for public service provision. There is a strong argument in the literature that a substantial “governance dividend” can be gained from mobilising domestic financial resources through the tax system. Bargaining over taxes is central in building relations of accountability between the state and citizens based on mutual rights and obligations, rather than on patronage and coercion. Taxpayers’ mobilisation around common interests has potentially positive outcomes for governance. This idea of bargaining and negotiation over taxes is central to the concept of a social fiscal contract. This is essentially about stimulating good governance at the interface between state and society, in response to the demands of citizens. A virtuous circle may be generated whereby the generation of tax revenues leads to improved service provision, which in turn increases citizens’ willingness to pay their taxes. Thus, non-resource tax is not only a source of government revenue, but is also likely to have positive effects on transparency, control of corruption and the provision of public goods.

Another argument to maintain non-resource taxation in the presence of large future gas revenues is that natural gas is a non-renewable resource that will eventually be depleted. A well-functioning tax system will be crucial to generate government revenues after resource depletion. Furthermore, petroleum prices tend to fluctuate heavily. Other sources of revenues, such as tax payments, can provide an important buffer to mitigate or reduce the effect of this volatility on the economy.

Though significant progress has been made during the last decade, Tanzania still struggles in its efforts to broaden the tax base. Tax non-compliance is widespread. In November 2010, for instance, only 400 large taxpayers were registered (0.08% of total taxpayers). These large taxpayers contributed about 70% of total domestic revenue collections in Tanzania.

In addition, a large share of the economic activity in Tanzania is located within the informal sector. Some studies estimate the size of the informal sector in percent of non-agricultural GDP to be more than 40%. According to the National Bureau of Statistics’ Integrated Labour Force Survey 2006, the urban informal sector employed 66% of the labour force as the main activity. The widespread and generous tax exemption regime further adds to narrowing the revenue base.

How can tax non-compliance be reduced and the tax base broadened? This is a question tax authorities worldwide, particularly in developing countries, are constantly trying to answer.

Taxpayer attitudes and plausible explanations

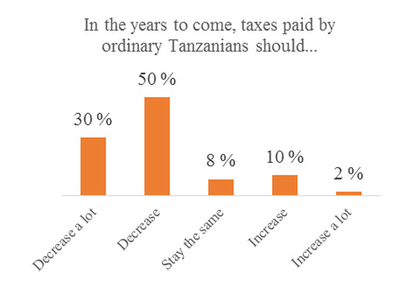

In July and August 2015, a research team from CMI, REPOA and the Norwegian School of Economics (NHH) conducted a survey of 3000 respondents in Dar es Salaam and in the two southern regions of Mtwara and Lindi. The survey confirms that citizens in Tanzania have low willingness to pay tax. As many as 80% of the respondents answered that they preferred taxes paid by ordinary citizens to decrease or decrease a lot. The distribution of the respondent’s answers is illustrated in the following figure.

The answers to why Tanzanians are unwilling to pay tax and what can be done about it are probably complex and affected by different factors. However, further inquiry through focus group discussions suggests that the following factors are part of the explanation:

1. Taxes are perceived to be too high

Many of the participants explained that even though they agree that it is wrong not to pay tax, they think taxes are too high. In the participants’ words:

“People do not pay taxes because rates are too high.”

“Tax rates are unnecessarily high which discourage taxpayers.”

“We are failing to pay tax because we do not have reliable income.”

These statements are in line with results from the Afrobarometer survey for Tanzania from 2011-2012 (see Ali et al. 2014). Fifty percent of the respondents answered that the main reason for why people evade taxes is that “taxes are too high” or “taxes are unaffordable”. Thus, tax rates are perceived to be too high both in terms of what the respondents can afford and in terms of what they perceive to be reasonable.

2. Poor public services

Many of the focus group participants also argued that the quality and quantity of public services provided are not sufficient to justify current tax rates. As one of them put it:

“There is no impact on tax so there is no need of paying tax.”

Another participant also pointed at the poor condition of a particular public service, the sewage system:

“In Tanzania, taxpayers do not benefit from public services. Look at drainage systems in our streets, they are all in a bad shape even though people pay taxes. This discourages taxpayers.”

The importance of public services in explaining taxpayer behaviour is also reflected in findings from the Afrobarometer survey. Sixteen percent of the respondents provided “poor public services” as the main reason for why people evade taxes. Related to this, Ali et al. (2014) find a positive correlation between satisfaction with the provision of certain public services and tax compliant attitudes.

3. Lack of tax knowledge

Many participants also argued that they simply do not know how tax revenue is used and that this makes them unwilling to pay tax.

“Unfortunately, people who do not know the importance of paying tax do not pay tax.”

“(…) what is important now is for the government to give tax education to citizens on how they can benefit from tax because currently we do not see any advantage of paying tax.”

“(…) education should be given to the public as to why they should pay tax and how will they benefit from it.”

Policy implications

In this brief, we have argued that continued efforts to increase tax compliance and expand the tax base (the number of citizens and companies paying tax) is likely to be an important part of a successful fiscal policy in Tanzania. A well-functioning non-resource tax system will also be important to induce citizens to hold the government more accountable for public expenditure, including the use of resource revenues. This, in turn, is likely to improve the provision of public services and thereby to increase citizens’ willingness to pay tax.

The results from our survey show that low willingness to pay tax is a significant challenge. High tax rates, poor public services and lack of awareness on taxation and public spending are important factors in explaining the low willingness to pay.

Based on these findings, the following factors may effectively enhance tax compliance in Tanzania:

1.Provide taxpayers with more information about the purpose and use of tax payments.

2.Improve public services and be more sensitive to citizens’ preferences and needs.

3.Make tax payments more affordable and simplified. Addressing the informal sector and cutting down on tax exemptions are complex, challenging, but potentially rewarding areas to focus efforts to broadening the revenue base and building taxpayer culture. In this perspective, the challenge for Tanzania is not only to tax more (i.e. to increase the tax to-GDP ratio), but to tax a larger number of citizens and enterprises more consensually.

Experiences show that taxpayers’ behaviour can be transformed by reforming the tax and expenditure system, leading to both a greater willingness to pay and an increased propensity to mobilise demand for better public services. During this process it is important to strike the right balance between the expansion of the tax base, compliance and enforcement.

Recommended literature

AfDB 2015. Delivering on the promise: Leveraging natural resources to accelerate human development in Africa. African Development Bank.

Bräutigam, D., Fjeldstad, O.-H. & Moore, M. 2008. Taxation and state building in developing countries: Capacity and concent Cambridge University Press.

Charmes, J. 2000. Informal sector, poverty and gender. A review of empirical evidence. . Background paper for the World Development Report 2001. World Bank, WIEGO, SEWA, UNIFEM and HIID.

IMF 2014. IMF Country Report, United Republic of Tanzania. Washington, D.C.: International Monetary Fund.

Moshi, H. P. B. 2013. Opportunities and challenges for the extraction of gas in Tanzania: The imperative of adequate preparedness. ESRF Discussion Paper No. 48. Dar es Salaam, Tanzania: Economic and Social Research Foundation.

Ross, M. L. 2012. The Oil Curse: How Petroleum Wealth Shapes the Development of Nations, Princeton, Princeton University Press.

URoT 2013. The National Gas Policy of Tanzania - 2013. Dar es Salaam, Tanzania: United Republic of Tanzania.