The role of ICT in property tax administration: Lessons from Tanzania

Is implementation of ICT the solution?

The Local Government Revenue Collection Information System (LGRCIS)

Experiences from Arusha City Council in using the LGRCIS

How to cite this publication:

William McCluskey, Chyi-Yun Huang (2019). The role of ICT in property tax administration: Lessons from Tanzania. Bergen: Chr. Michelsen Institute (CMI Brief 2019:06)

A key problem facing revenue administrations in many developing countries is that they operate manual paper-based recording systems. This is particularly the case for property taxation. Revenue leakages are common and occur because of untimely collection, corruption and under-collection. Difficulties emerge in estimating how many taxpayers are missing from their registered rolls, how many of those who are registered are inactive, and how much is actually being evaded through non-payments, corruption and ineffective billing systems. To address these challenges and with recent advances in information and communications technology (ICT), there has been a strong drive to use ICT across developing economies to increase the efficient collection of tax revenues. However, experiences with the introduction of ICT-systems are mixed and many initiatives have failed. This briefing presents lessons from an ICT system that was successfully implemented to manage property registration and revenue collection in municipal councils in Tanzania.

Is implementation of ICT the solution?

Creating a sustainable administrative revenue system that can administer own source revenues in an easy, efficient and cost effective manner is a goal that many national and sub-national governments around the world share. Key challenges for revenue departments are to: (1) raise more revenue; (2) improve internal organisation; (3) ensure greater accountability, transparency and integrity; (4) improve taxpayer compliance; and (5) improve service delivery to taxpayers.

Modernisation of revenue administration attempts to improve tax efficiency and tax fairness as pillars to support revenue collection. The utilisation of ICT can bridge the gap between taxes, fees and charges owed and those that are collected. However, ICT administration projects are often complex, expensive and take time to realise the benefits and savings. It is therefore important for revenue departments to make the right decisions. This is particularly important in a developing economy, where purchasing an 'off-the-shelf' system may not be suitable. ICT solutions have to meet the needs of the surrounding environment. This may mean that simpler, more robust systems are the best option.

The Local Government Revenue Collection Information System (LGRCIS)

It is well documented that local governments in Tanzania face important challenges in the areas of revenue administration, which includes revenue collection, budgeting, internal audits and general issues around accountability and transparency within the whole cycle of revenue management (McCluskey and Franzsen 2005; Fjeldstad and Katera 2017).

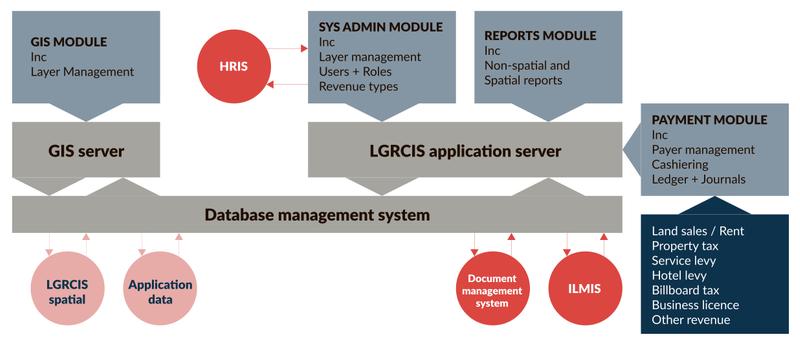

To address these challenges the Local Government Revenue Collection and Information System (LGRCIS) was developed. It was established by the Government of Tanzania, with support from the World Bank and the Danish International Development Agency (DANIDA). LGRCIS is an information system used for managing revenue collection in municipal councils. When it was developed, the system managed revenue collection from all municipal own sources, including property tax, billboard tax, service levy, hotel levy and business licenses. The platform uses Geographic Information Systems (GIS) to support the entire chain of revenue collection. The LGRCIS is designed to support enhanced local revenue collection with proper identification of the taxpayer, invoicing, receipting, demand note generation, defaulter identification and facilitating electronic or online payment through a single payment gateway. Supporting the municipalities’ efforts to collect their own source revenues using modern technology is part of the overall efforts to improve financial sustainability of urbanisation in the long run. Figure 1 illustrates the key components of LGRCIS.

Figure 1: Components of the LGRCIS

In short, the LGRCIS is an integration of three systems: (1) Human resources information system; (2) Document and file management system; and (3) Revenue collection system. The system enabled easy connection via mobile phone to money transfer networks such as M-pesa, Tigo-pesa, Airtel Money and Max Malipo. In an interview, then Deputy Minister, Mr Seleiman Jafo in the President's Office, Regional Administration and Local Government (PO-RALG) stated,

“…this system would improve government revenue collection as it would enable more transparency during operations and explore more reliable sources of taxes throughout and finally make easier settlements of bills and other transactions.” (Tanzania Daily News, 21 January 2016).

Box 1: Objectives of the Local Government Revenue Collection Information System

- Collect and report revenue on a real time basis

- Geographically locate all taxpayers/properties

- Be capable of allowing multiple payment modes (mobile money, banks, etc.)

- Be able to allow for integration with other systems such as banks

- Allow for intelligent reporting and analysis

- Produce secure receipts and licenses which cannot be forged

- Allow citizens to transact easily with the revenue agency

Experiences from Arusha City Council in using the LGRCIS

Arusha City Council was chosen to pilot the LGRCIS with it being implement in FY 2012/13. Before the introduction of the LGRCIS, the register of taxpayers in Arusha was largely incomplete, with as many as 70 percent of citizens unfamiliar with paying taxes. Many of the city’s small businesses did not keep recorded accounts. The room for improvement was significant, but building up a brand new tax system was no easy task.

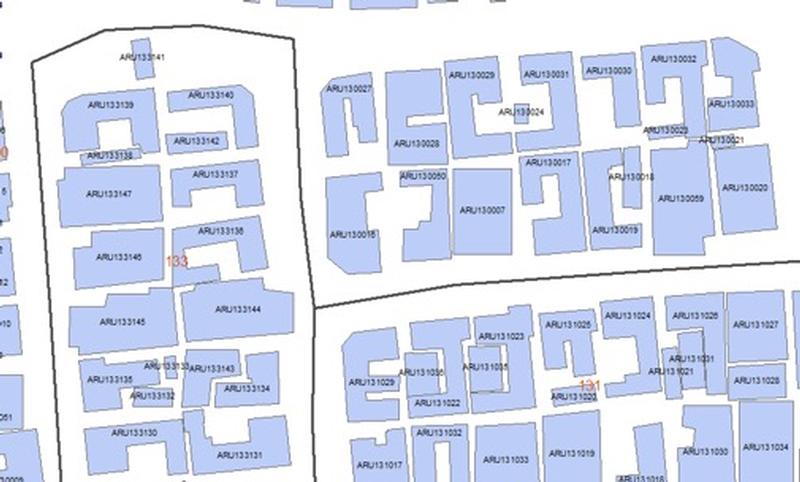

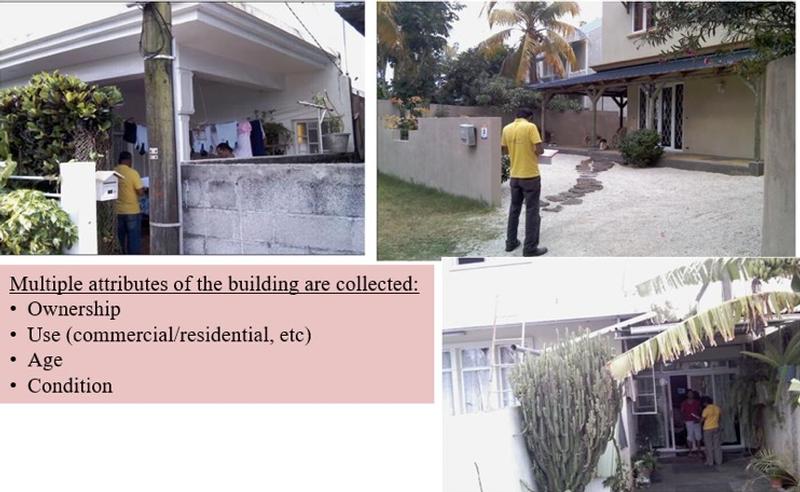

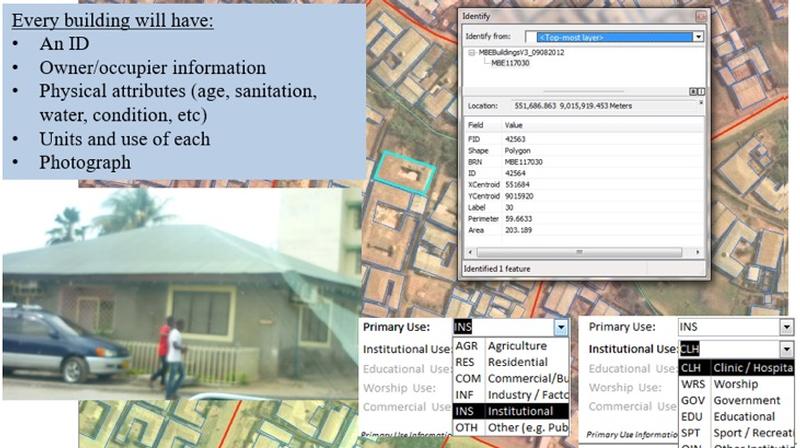

Arusha CC used GIS to identify buildings and to digitise them into LGRCIS thus providing a record of taxable properties (Figures 2a, 2b and 2c). The core data collection was conducted in three phases. First, satellite imageries were acquired and processed, and roads and buildings digitised. Second, systematic fieldwork was undertaken to collect other details on the ground, including name of the occupier, age, use of the building, etc. (Figure 2d and 2e). Third, a comprehensive database was built to support revenue collection (Figure 2f).

Figure 2a: Initial data from satellite images, Arusha CC

Figure 2b: Buildings and roads updated and captured into a GIS Database, Arusha CC

Figure 2c: Sample of GIS digitized buildings, Arusha CC

Figure 2d: Identification of building and taxpayer

Figure 2e: Property and building characteristic in-field data collection, Arusha CC

Figure 2f: Core field data collection in detail, Arusha CC

Arusha CC planned and undertook massive public campaigns explaining to citizens why they should pay their taxes. In the beginning, the project met scepticism, but as the newly collected taxes were invested in better roads, new secondary school facilities and hospital facilities, the citizens recognized the enhanced benefits they were receiving. Through continuing dialogue and public announcements as to how much had been collected each month, the City Council managed to create the transparency needed to build trust within the city communities. The slogan used by Arusha CC of “Our money, our project”[1] illustrates the importance of being able to collect own source revenues.

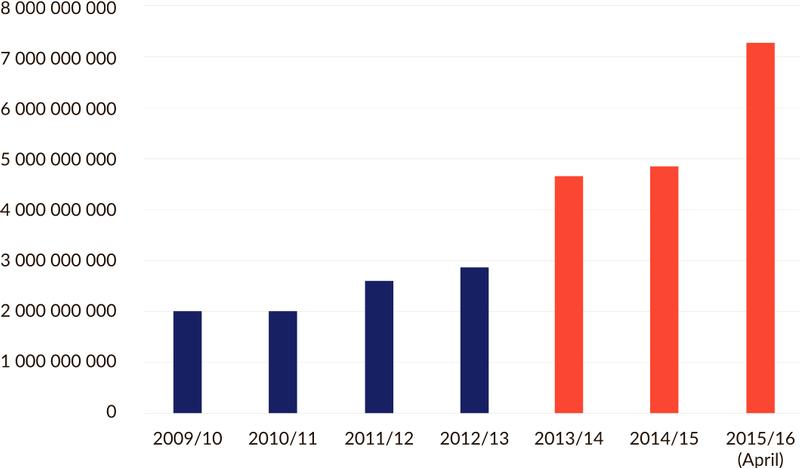

With the additional revenue, the city council became less dependent on financial transfers from the central government and donors. Local politicians became better able to react to the needs they see in their communities. Figures 3 and 4 demonstrate the growth in the main revenue sources for Arusha CC particularly after the implementation of LGRCIS in FY 2012/13. Figure 3 shows that there was a moderate but quite significant growth in collected revenues across the top five revenue sources (property tax, service levy, business licences, billboards and hotel levy).

Figure 3: Arusha: top 5 revenue sources 2009/10 – 2015/16

Source: World Bank (2016)

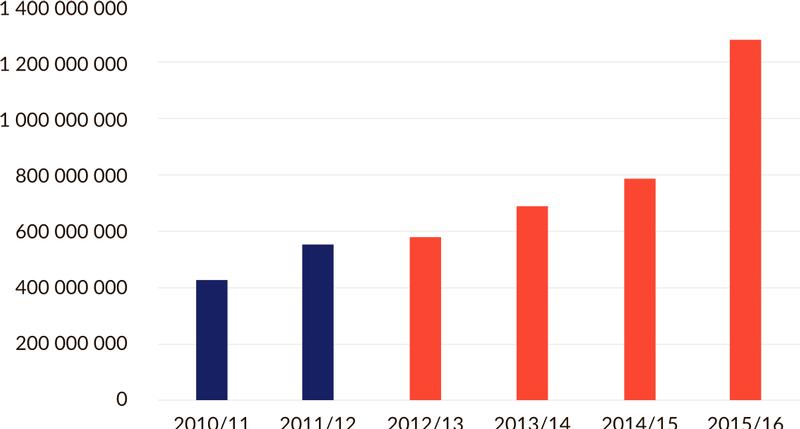

With respect to property tax collection, Figure 4 illustrates that after the implementation of LGRCIS revenue collection levels clearly improved. The trend is as one would expect given the lead in time required for staff to efficiently employ the system and to have the data entry completed.

Figure 4: Arusha growth in property tax revenue

The introduction of LGRCIS in Arusha led to a significant increase in collected own revenues largely due to several improvements including:

- Broadened Database – increased coverage of the main revenue sources including property tax, business licence, hotel levy and service levy;

- Transparency - the LGRCIS increased transparency for both taxpayers in terms of accuracy of bills, accountability and improved budgeting for the city management;

- Carbon slipping – previously with a manual system, there were inconsistencies in the original customer receipts with the second and third copies kept in city records;

- Deterrence effect – with LGRCIS in place, staff is aware of the difficulty of forgery and thus errant behaviors are deterred;

- Taxpayers’ confidence - taxpayers believe that by having receipts produced directly from the LGRCIS, the receipts are genuine and their money reaches the proper place and is captured in the system without forgery;

- Efficiency improvements - LGRCIS helps revenue collection staff to know the exact location of compliant taxpayers and those who are in default through the use of geographic information system (GIS). This facility support recovery actions by the council;

- No negotiation between taxpayer and staff since all data is contained within the system.

Concluding remarks and implications for policy

The experience of Arusha CC demonstrates the potential that utilising modern information technology can have in improving revenue administration. An effective revenue property tax administration system is largely about maintaining accurate property and taxpayer records, which is a prerequisite for the implementation of a sound collection and enforcement system.

If properly designed and implemented, computerisation may yield benefits of efficiency and transparency over current paper-based tax administration systems. An ICT-system may also contribute to limit opportunities for corruption. During the period it operated, the LGRCIS contributed to transform and improve the way property taxes were collected in selected municipalities in Tanzania, with gains in transparency, accountability and a customer service.

In June 2016, the Government of Tanzania decided to centralise the administration of the property tax to the national tax administration, the Tanzania Revenue Authority (Fjeldstad et al. 2019). This move implies that TRA now is responsible not only to collect the property tax, but also to undertake property registration and valuation. LGRCIS will no longer be used to collect the property tax, but the system will continue to be used to administer other own source revenues at the local government level. It is still uncertain how the abolishment of the LGRCIS will impact on property tax collection. It is likely that there will be a negative effect in the short term. But how this will be managed is equally important, including the use of ICT. Experiences from Arusha provides TRA with highly relevant lessons on the design and implementation of an effective ICT-system for revenue administration.

This briefing is an output from the project Taxing the urban boom in Tanzania: Interests, incentives and real estate in Dar es Salaam and Mtwara. The project is funded by the Norwegian Embassy in Dar es Salaam under the framework agreement between the Embassy and Chr. Michelsen Institute on Development analysis as basis for aid transformation, public debate and policy change. The authors would like to thank Odd-Helge Fjeldstad and an anonymous reviewer for valuable comments on earlier drafts. Views and conclusions expressed in this CMI Briefing are those of the authors alone.

Recommended literature

Bahl, R. W. and R. Bird. 2008. Subnational taxes in developing countries: The way forward. Public Budgeting and Finance 28(4): 1–25.

Fish, P. 2015. Practical aspects of mobilising property tax: experience in Sierra Leone and Malawi. Commonwealth Journal of Local Governance, Issue 16/17, June, 242-262.

Fjeldstad, O.-H. 2015. When the terrain does not fit the map: Local government taxation in Africa. Chapter 10 (pp. 147-158) in A.M. Kjær, L. Engberg Pedersen and L. Buur (eds.) Perspectives on politics, production and public administration in Africa. Essays in honour of Ole Therkildsen. Copenhagen: Danish Institute for International Studies.

Fjeldstad, O.-H., M. Ali and L. Katera. 2019. Policy implementation under stress: Central-local government relations in property tax administration in Tanzania. Journal of Financial Management of Property and Construction, Vol. 24, Issue 2, 2019. https://doi.org/10.1108/JFMPC-10-2018-0057

Fjeldstad, O.-H. and L. Katera. 2017. Theory and practise of decentralization by devolution: Lessons from a research programme in Tanzania (2002-13). Chapter 4 (pp. 34-56) in Donald Mmari and Samuel Wangwe eds. (2017). Research and policy nexus: Perspectives from twenty years of policy research in Tanzania. Dar es Salaam: Mkukui na Nyota Publishers Ltd.

Franzsen, R.C.D. and W.J. McCluskey (eds.). 2017. Property tax in Africa: Status, challenges and prospects. Cambridge MA: Lincoln Institute of Land Policy.

Kelly, R. 2013. Making the property tax work. International Center for Public Policy Working Paper Series 13-11. Andrew Young School of Policy Studies, Georgia State University.

Lall, S.V., J.V. Henderson and A.J. Venables. 2017. Africa’s cities. Opening doors to the world. Washington DC: The World Bank.

McCluskey, W. J. and Franzsen, R. 2005. An evaluation of the property tax in Tanzania: An untapped fiscal resource or administrative headache? Property Management, 23, 43-69.

Norregaard, J. 2013. Taxing immovable property: revenue potential and implementation challenges. IMF Working Paper WP13/129. Washington D.C.: International Monetary Fund.

Notes

[1] http://tanzania.um.dk/en/news/newsdisplaypage/?newsid=9e871df6-d5f2-41d9-9b3d-6e901d1fa034