Taxation and Business Development in Zanzibar Insights from a Business Survey

The survey covered the following topics:

4.1. Characteristics of surveyed firms and respondents

Table 1: Firm and respondent characteristics

4.2. Business expectations and tax expectations

Figure 2: Turnover – last year and future expectations

Figure 3: Number employees – last year and future expectations

Figure 4: Taxation – a barrier to business development

Figure 5: Uncertainties – future demand vs. tax liability

Figure 7: Experienced penalty for paying taxes late

4.4. Perceptions of social norms in paying taxes

Figure 8: Social norm of paying taxes

Figure 9: Perceived fairness of the tax system

Figure 10: Perception of cheating by firms in the same sector

4.6. Satisfaction with and trust in the tax authority

Figure 11: Satisfaction with ZRA services

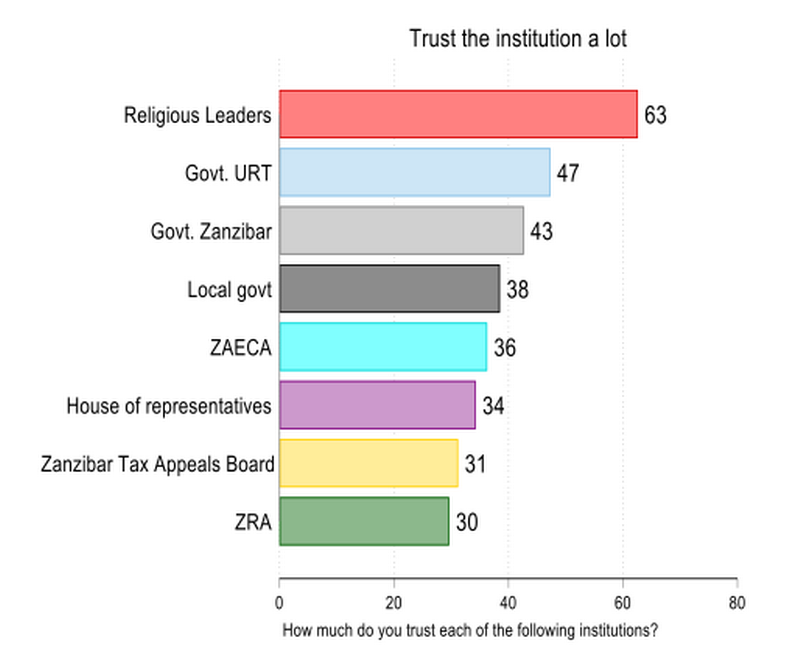

Figure 12: Trust in ZRA compared to other institutions

How to cite this publication:

Viola Asri, Odd-Helge Fjeldstad, Lucas Katera, Samwel Nassary and Ahmed Saadat (2025). Taxation and Business Development in Zanzibar Insights from a Business Survey. Bergen: Chr. Michelsen Institute (CMI Report R 2025:02)

Foreword and acknowledgements

This report is an output of the research and capacity development projects “Trust and Norms: Voluntary Tax Compliance in Zanzibar and mainland Tanzania” and “Successful Advances in Fiscal Architecture”. The projects are developed and implemented in collaboration between Chr. Michelsen Institute (CMI), Zanzibar Revenue Authority (ZRA), REPOA and the Norwegian Tax Administration. They are funded by the Norwegian Research Council (2021-25). The overall objective of the projects is to generate knowledge and build research capacity to address the societal challenge of mobilizing more domestic revenue in Tanzania.

The research focuses on business taxation which has received little attention in research on tax compliance, despite the fact that companies typically account for the majority of tax revenues. Encouraging tax compliance requires a careful understanding of how taxpayers think about and experience taxation. Knowledge about taxpayer attitudes and behaviour is essential when (1) analysing opportunities and constraints for reform, and (2) for the design and implementation of effective policy and administrative measures to enhance compliance.

This report is authored by Dr Viola Asri (CMI), Research Professor Odd-Helge Fjeldstad (CMI and ATI, project leader), Dr Lucas Katera (REPOA), Mr Samwel Nassary (NTNU) and Director Ahmed Saadat (ZRA).

We would like to thank Director Ahmed Saadat’s team at ZRA’s Research and Planning Department for constructive discussions and engaged involvement in the project from the start. Mr Saadat and his team contributed substantially to the design of the current business survey, including the questionnaire. We also thank representatives from Zanzibar Chamber of Commerce (ZNCC), in particular Abubakar Abubakar, Cheherazade Cheikh and Mohamed Wario, for their contribution to the development of the survey questionnaire, which helped tailoring the questions to the specific context in Zanzibar. We are further grateful to Adrien Dautheville (NHH/CMI), Nadja Dwenger (Hohenheim University/CMI), Trond Hjørungdal (NTA), Andrew Mahiga (British High Commission, DSM), Ingrid Hoem Sjursen (CMI), and Vincent Somville (NHH/CMI) who all provided valuable inputs to the design of the survey, including the questionnaire, and who also have commented previous versions of this report. The opinions expressed in the report are those of the authors alone. Responsibility for its contents and any errors rests entirely with the study team.

Bergen/Dar es Salaam/Zanzibar, 7 April 2025

About the authors

Viola Asri: Senior Researcher, Chr. Michelsen Institute (CMI), and Postdoctoral Researcher at the University of Konstanz

Odd-Helge Fjeldstad: Research Professor, Chr. Michelsen Institute (CMI), and Extraordinary Professor, African Tax Institute (ATI), University of Pretoria.

Lucas Katera: Director of Collaborations and Capacity Building, REPOA

Samwel Nassary: PhD-candidate, Department of Economics, Norwegian University of Science and Technology (NTNU)

Ahmed Saadat: Director, Research and Planning Department, Zanzibar Revenue Authority (ZRA)

1. Introduction

The private sector is a critical driver of economic growth in Tanzania. The government has expressed a strong commitment to fostering a vibrant business environment while ensuring sufficient public resources for economic development. However, balancing taxation and business growth remains a challenge. This report presents findings from a survey of businesspeople in Zanzibar, examining their perspectives on taxation, compliance burdens, fairness, and trust in the tax system.

Tanzania’s leadership emphasizes the importance of collaboration between the private sector and the government:

“Let me emphasize that Tanzania is highly committed to seeing a vibrant private sector capable of facing the challenges of the global economy through our industrialization drive”

President Samia Suluhu Hassan when addressing the business forum between Tanzania and Kenya, 5 August 2021.

“I urge the private sector, especially ZNCC members, to continue working with the government by following laws and increasing production”

Omar Said Shaaban - Minister of Trade and Industrial Development. Statement during Zanzibar National Chamber of Commerce (ZNCC) 15th Annual General Meeting (AGM), 19 February 2024.

While taxation provides necessary resources for infrastructure and public services, businesses often perceive tax policies as barriers to growth. Understanding business perspectives is crucial for developing a fair and efficient tax system.

This report is based on an empirical analysis of a survey conducted in Zanzibar in the period July - August 2023 in collaboration between CMI, REPOA, the Norwegian Tax Administration (NTA), Zanzibar National Chamber of Commerce (ZNCC), and Zanzibar Revenue Authority (ZRA) The survey targeted businesspeople – primarily owners and managers – to examine their experiences with taxation, perceptions of fairness, and trust in tax authorities.

The main contribution of this study lies in shifting attention from individual taxpayers, commonly studied in the existing literature, to businesspeople who until now have received less attention in uncovering the behavioural side of paying taxes. The survey highlights both optimism and significant challenges in Zanzibar’s business environment. It examines businesspeople’s expectations on business development in Zanzibar, major constraints, including compliance costs, satisfaction with the revenue administration’ services, perceived fairness of the tax system and trust in the authorities.[1]

While businesses recognize the necessity of taxation, compliance burdens, perceived unfairness, and trust deficits hold back economic potential. Addressing these issues through policy reforms can foster a more business-friendly tax system, ultimately supporting long-term economic growth in Zanzibar.

The report is structured as follows: In the following, Section 2 provides the relevant background information for this report, Section 3 describes the survey methodology, Section 4 presents the empirical results and Section 5 discusses policy implications and recommendations.

2. Background

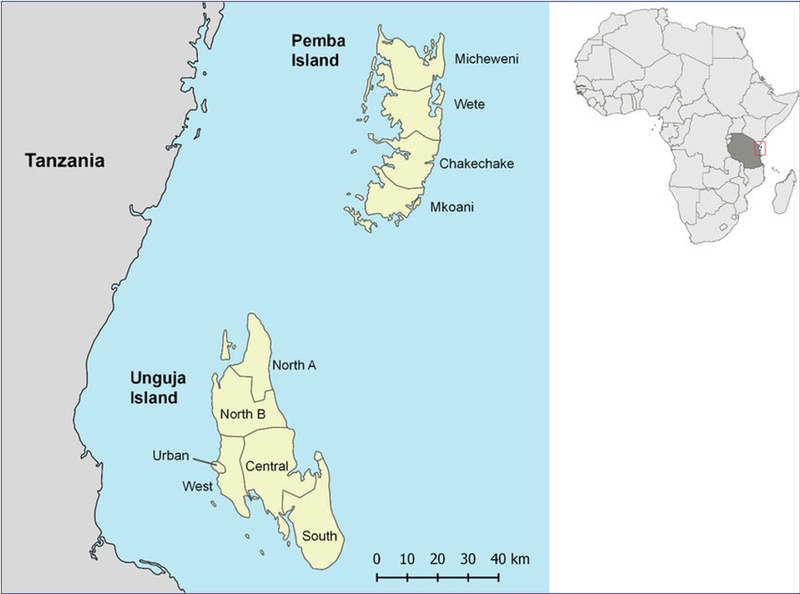

Zanzibar, a semi-autonomous region of Tanzania (see map in Figure 1), plays a vital role in the country’s overall economic landscape. With a predominantly service-based economy that includes tourism, agriculture, and fisheries, Zanzibar’s private sector is an essential driver of economic activity and growth. The government has been striving to create an enabling environment for business, with a focus on improving infrastructure, promoting investment, and enhancing public service delivery. However, a key challenge remains the balancing act between raising sufficient revenue through taxation and fostering a thriving private sector.

Taxation is a crucial mechanism through which the government generates revenue to fund public services such as education, healthcare, infrastructure, and security. In Zanzibar, the tax system is designed to meet these needs, but it is also viewed by many businesses as a barrier to growth. The complexity of tax laws, the administrative burden of compliance, and the perceived unfairness of the tax system often create frustration among businesses, particularly smaller and medium sized enterprises. These challenges can hinder business expansion and discourage new investments, which, in turn, affects job creation and economic development.

Tanzania's and Zanzibar’s leadership have in recent years emphasized the need for collaboration between the private sector and the government.[2] This collaboration is essential for achieving sustainable economic growth. However, businesses frequently express concerns about the efficiency and fairness of the tax system. These concerns range from the complexity of tax filing procedures and the lack of transparency in the allocation of public funds to the inconsistent enforcement of tax policies.

Figure 1: Map of Zanzibar

Source: Ashton et al., 2019.

To address these issues, it is essential to gain a deeper understanding of how businesspeople in Zanzibar perceive taxation and its impact on their operations. By examining the experiences of business owners and managers, it is possible to identify key obstacles to compliance and explore strategies for improving the tax system. This report presents findings from a comprehensive survey of businesspeople in Zanzibar, aiming to shed light on the challenges they face with taxation, the level of trust in tax authorities, and the potential reforms needed to create a more business-friendly environment.

Understanding how businesspeople perceive and experience taxation in Zanzibar is crucial for informing policy reforms. Tax policies that are considered as fair, transparent and efficient can contribute to voluntary tax compliance and thereby reduce the need for monitoring and enforcement. It can also contribute to business growth and investments in the region.

3. Survey methodology

To design the survey, Zanzibar National Chamber of Commerce (ZNCC) provided a list of 802 firms, which was complemented with a list of 402 firms from other business associations. Sampling was designed to select businesses randomly while ensuring sectoral representativeness of the largest private sectors in Zanzibar – manufacturing, trade (both retail and wholesale), and the hospitality sector. In total, 452 businesspeople from Unguja (n=330) and Pemba (n=122) completed the survey. Businesspeople represented firms of different sizes – according to turnover using the previous threshold for VAT registration.

The questionnaire was developed by the researchers from CMI and REPOA in collaboration with ZRA’s Research and Policy Department and the Zanzibar National Chamber of Commerce (ZNCC). Some questions were adapted from well-established surveys such as the Afrobarometer and business surveys conducted in other contexts by some of the involved researchers. In general, however, the questions were tailored for the specific Zanzibar context and extensively piloted to be relevant and understandable for the businesspeople surveyed. The collaboration with ZNCC was instrumental in encouraging businesspeople to participate and provide truthful responses. The survey was conducted in Swahili.

Since businesses in Zanzibar have to pay taxes both to the Zanzibar Revenue Authority (ZRA) and the Tanzania Revenue Authority (TRA), questions that referred to the revenue authority were asked in reference to both.

The survey covered the following topics:

- Characteristics of surveyed firms and respondents

- Business expectations and taxation expectations

- Perceptions of social norms in paying taxes

- Tax compliance burden

- Satisfaction with and trust in the tax authority

The survey was conducted during the period July to August 2023.

4. Results

4.1. Characteristics of surveyed firms and respondents

The surveyed businesspeople are from firms in trade (65%), the hospitality sector (15%) and manufacturing (11%). Based on the previously used threshold of annual turnover requiring VAT registration, we further classified firms into small (less than TZS 14 million), medium (TZS 14 to 100 million), and large (more than TZS 100 million) with 28% of the firms represented being small, 45% medium sized and 27% large.

Table 1 presents firm and respondent characteristics. Firms report that they on average had an annual turnover of TZS 273.0 million in the last year and employed on average 7.66 employees, with small firms employing on average 2.6 employees, medium firms on average 4.4 employees and large firms on average 18.2 employees. In terms of legal status, about 73% of the firms are registered as sole proprietorship, about 20% as partnership and about 8% as limited company. 51% of the firms report being VAT-registered, and 5% of the firms are owned by a foreign company. Most of the respondents are managers or owners (81%) followed by accountants (13%). The respondents’ average age is 40.1 years, and most respondents are male (80.3%). 15% of the businesspeople have university education and 56% have secondary school education. Only 5% of the interviewed businesspeople are foreign citizens.

Table 1: Firm and respondent characteristics

|

Variable |

Average |

N |

|

Variable |

Average |

N |

|

Turnover (in TZS Mill) |

273.9 |

452 |

Manager or owner |

81% |

452 |

|

|

Number of employees – all firms |

7.6 |

452 |

Accountant |

13% |

452 |

|

|

Small firms |

2.6 |

125 |

Age |

40.1 |

452 |

|

|

Medium firms |

4.4 |

204 |

Male |

83% |

452 |

|

|

Large firms |

18.2 |

123 |

University Education |

15% |

452 |

|

|

Sole proprietorship |

73% |

452 |

Secondary School Education |

56% |

452 |

|

|

Partnership |

20% |

452 |

Foreign citizen |

5% |

452 |

|

|

Limited Company |

8% |

35 |

|

|

|

|

|

VAT registered firms |

51% |

452 |

|

|

|

|

|

Owned by foreign company |

5% |

452 |

|

|

|

4.2. Business expectations and tax expectations

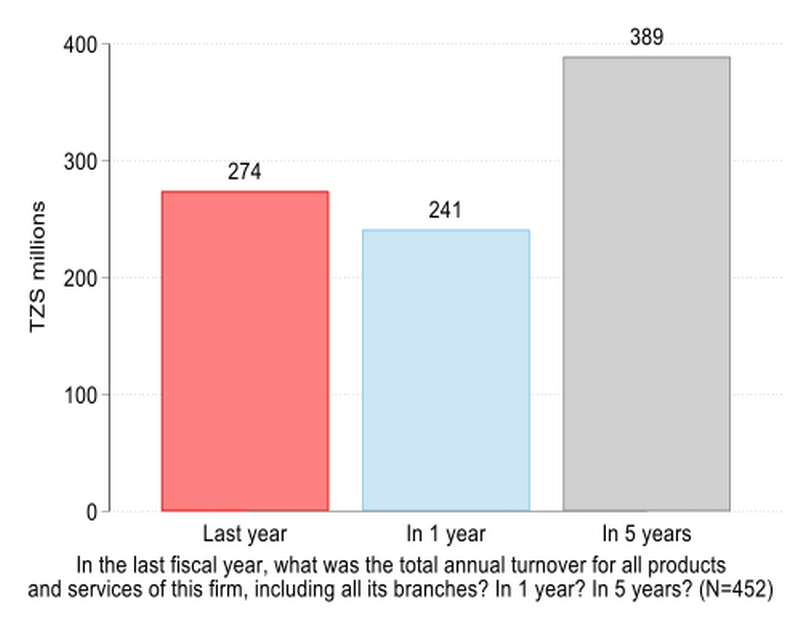

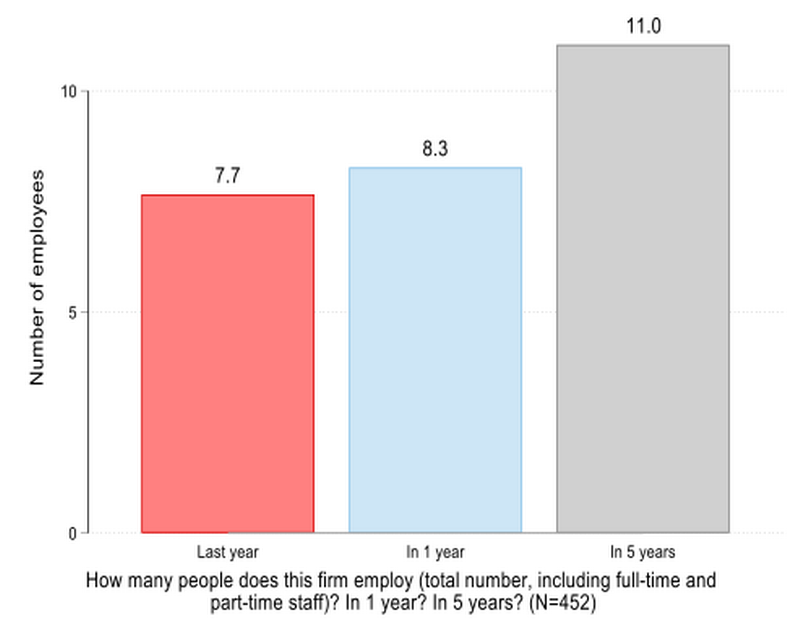

To elicit firms’ business expectations, respondents were first asked to report their turnover in the previous year followed by two questions about their turnover expectations in one year’s time and after five years. Similarly, firms were asked about the number of employees. Firms anticipate a moderate decrease in revenue in the short term, potentially due to high interest rates in 2023 from on average TZS 274 million in the last year to TZS 241 million in one year after the survey. However, over the next 5 years, they expect significant revenue growth expecting an annual turnover of on average TZS 389 million, as illustrated in Figure 2. They also plan to increase their workforce from last year to next year from on average 7.7 to 8.3 and in the next 5 years to 11 employees on average, reflecting optimism about long-term business conditions, as shown in Figure 3.

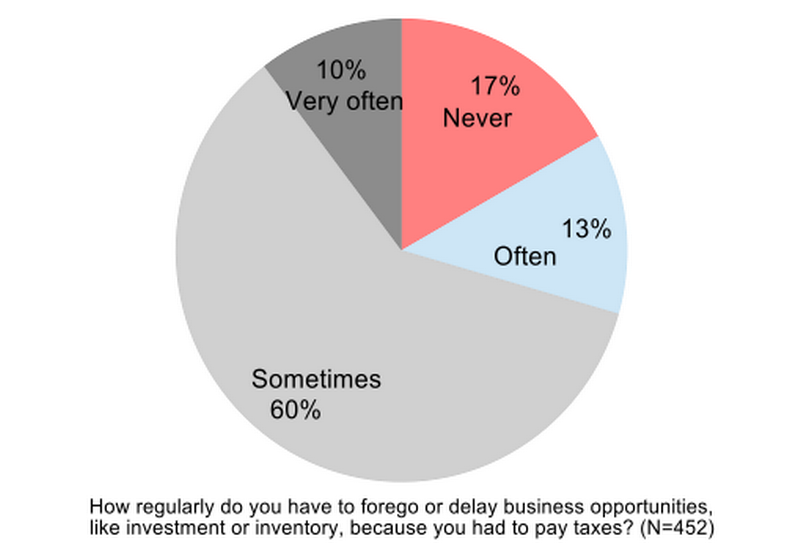

Despite this optimism about the future, taxation is perceived as a barrier to business development. Respondents were asked how regularly in the last year they had to forgo or delay business opportunities to pay their taxes. About 83% of the surveyed firms reported that they have to delay or forego business opportunities due to tax-related concerns sometimes (60%), often (13%) or very often (10%), as reflected in Figure 4. This result suggests that many respondents perceive the firm’s tax liability as unpredictable. They are uncertain about the amount as well as the timing for tax payment.

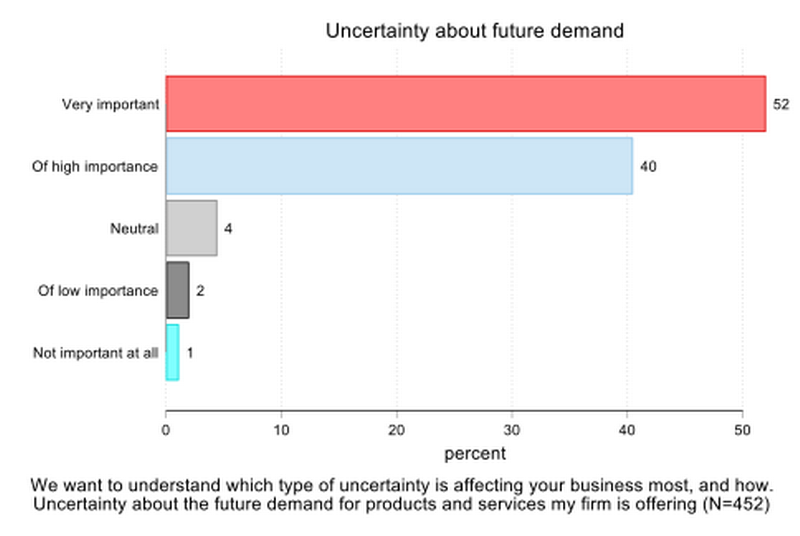

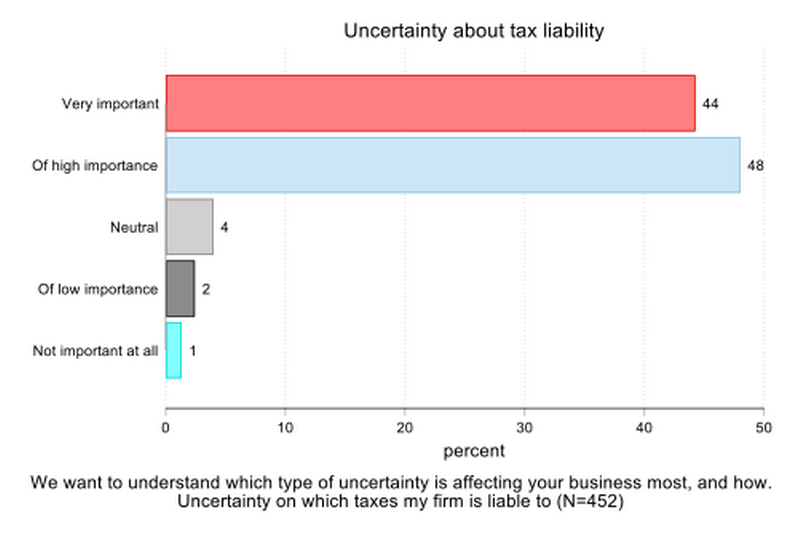

Relatedly, firms were asked to indicate how different types of uncertainties affect their business the most. The respondents rated their uncertainty about tax liability almost as important as their uncertainty about future demand with approximately 92% of the respondents considering their uncertainties about future demand and their uncertainty about tax liability as very important or of high importance.[3] The only difference comes from 52% of the respondents rating the uncertainty about future demand as very important compared to 44% for tax liability, and 40% of the respondents rating uncertainty about future demand of high importance compared to 48% for tax liability, as illustrated in Figure 5.

Figure 2: Turnover – last year and future expectations

Figure 3: Number employees – last year and future expectations

Figure 4: Taxation – a barrier to business development

Figure 5: Uncertainties – future demand vs. tax liability

4.3. Tax compliance burden

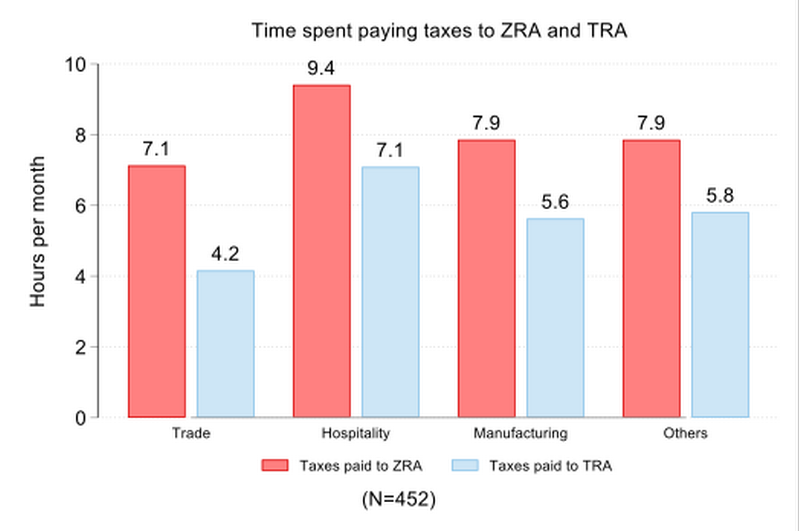

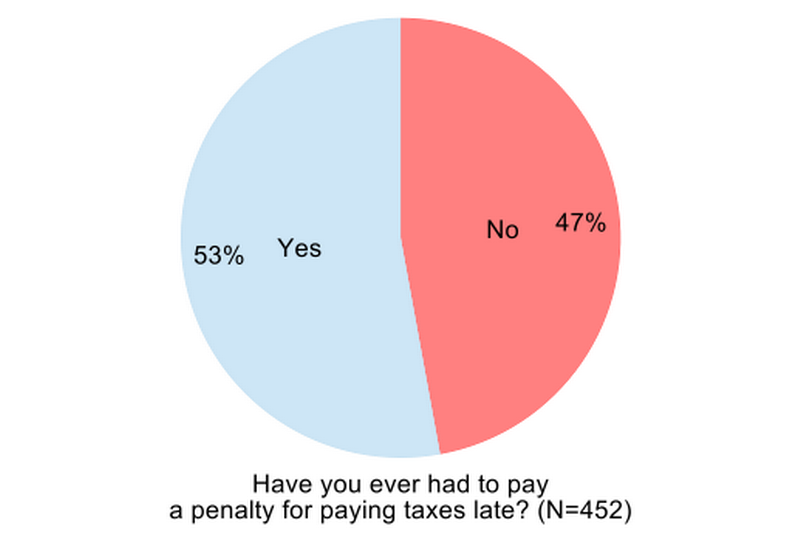

Apart from uncertainty about taxation affecting firms’ future expectations negatively, paying taxes is also time-consuming and thereby costly for many firms. Generally, larger firms and VAT-registered firms report to spend more time on tax compliance, and the hospitality sector reports to spend slightly more time than other sectors, as shown in Figure 6, with more time spent on taxes paid to ZRA than taxes paid to the Tanzania Revenue Authority (TRA). Related to the time required to file taxes, about 53% of the firms report having paid penalties for late tax payments with larger firms reporting to face penalties more frequently than small or medium-sized firms (Figure 7).

Figure 6: Tax compliance time

Figure 7: Experienced penalty for paying taxes late

4.4. Perceptions of social norms in paying taxes

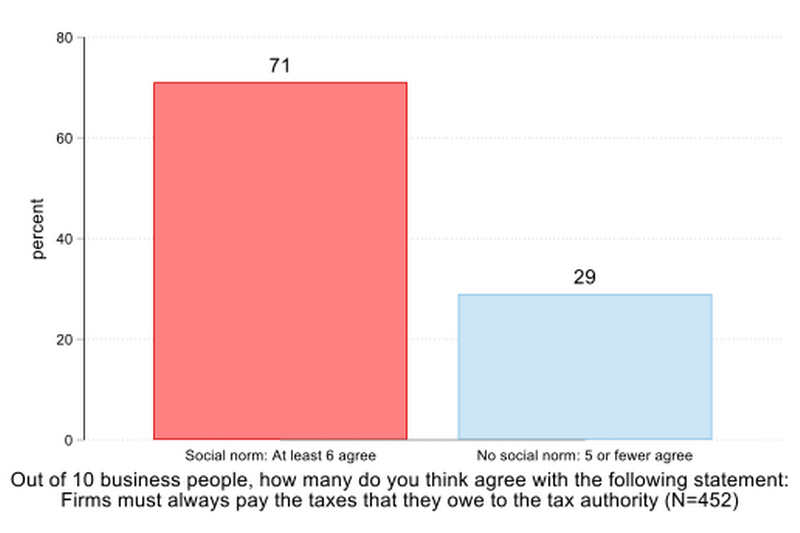

To understand whether businesspeople perceive a social norm with respect to paying taxes, they were asked to indicate how many out of 10 businesspeople they think would agree with the statement that “Firms must always pay the taxes that they owe to the tax authority”. Among the businesspeople themselves, about 78% expressed agreement with the statement that paying taxes is a business obligation and 71% perceived at least 6 out of 10 other businesspeople agreeing with the statement that paying taxes is a business obligation and 29% perceived 5 or fewer out of 10 agreeing to the statement. This suggests that 71% of the surveyed businesspeople see a social norm in the obligation to pay taxes while 29% do not, as shown in Figure 8.

Despite a majority of respondents perceiving that paying taxes is a business obligation, the survey was also designed to elicit under which conditions businesspeople would consider tax evasion as justified. Although most businesspeople perceive that paying taxes is a business obligation (i.e. a social norm), about 63% of the respondents agreed with the statement that tax evasion would be justified if public service provision is inadequate, which implies a more nuanced perspective on the obligation.

Figure 8: Social norm of paying taxes

4.5. Fairness of taxation

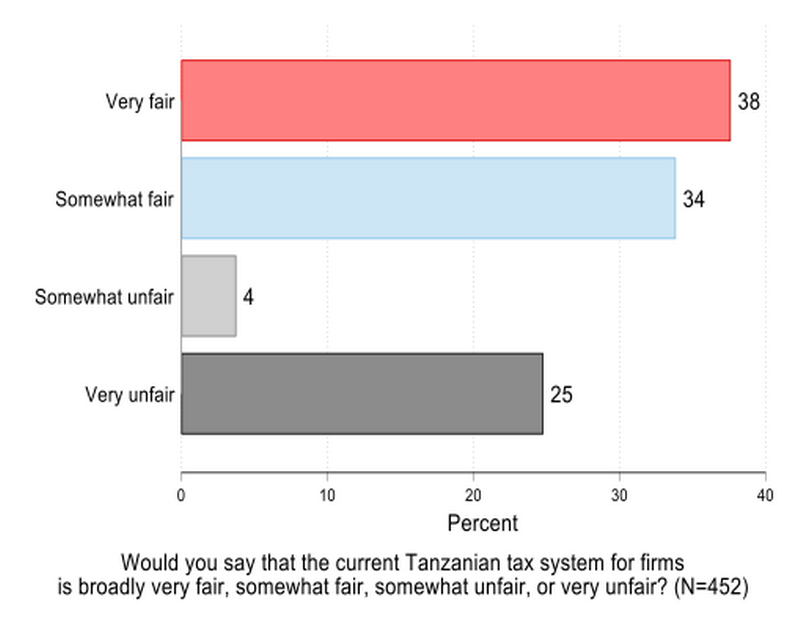

Apart from the perception of a social norm, it also appears to be a crucial factor influencing voluntary tax compliance whether firms perceive a tax system as fair or rather unfair. Businesspeople were therefore asked: “Would you say that the current Tanzanian tax system is broadly very fair, somewhat fair, somewhat unfair, or very unfair?”. Figure 9 shows that about 38% of the respondents considered the tax system as very fair and about 34% as somewhat fair. However, 4% and 25%, respectively, find the tax system somewhat unfair or very unfair suggesting scope to improve the fairness of the tax system (Figure 9). Further, large and medium sized firms perceive it as fairer than small firms, and firms in the hospitality sector find it fairer than firms in the other sectors.

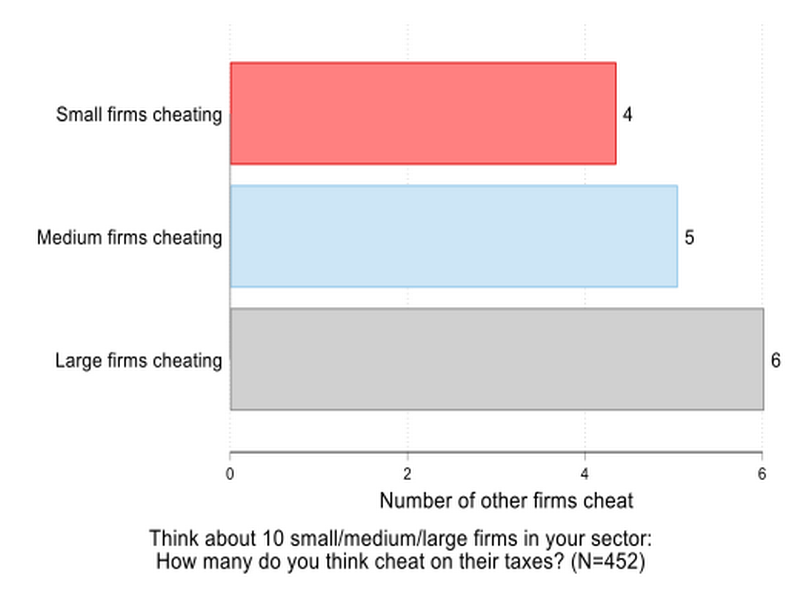

The perceived fairness of the tax system may also be closely linked to whether respondents think that other firms in their sector cheat on their taxes. Accordingly, respondents were asked to indicate how many out of 10 small/medium/large firms in their sector they perceive to be cheating. As shown in Figure 10 firms reported that they perceive on average four small firms, five medium firms and six large firms out of 10 to be cheating on their taxes. This can undermine the perceived fairness of the tax regime and, thus, voluntary compliance with taxation.

Figure 9: Perceived fairness of the tax system

Figure 10: Perception of cheating by firms in the same sector

4.6. Satisfaction with and trust in the tax authority

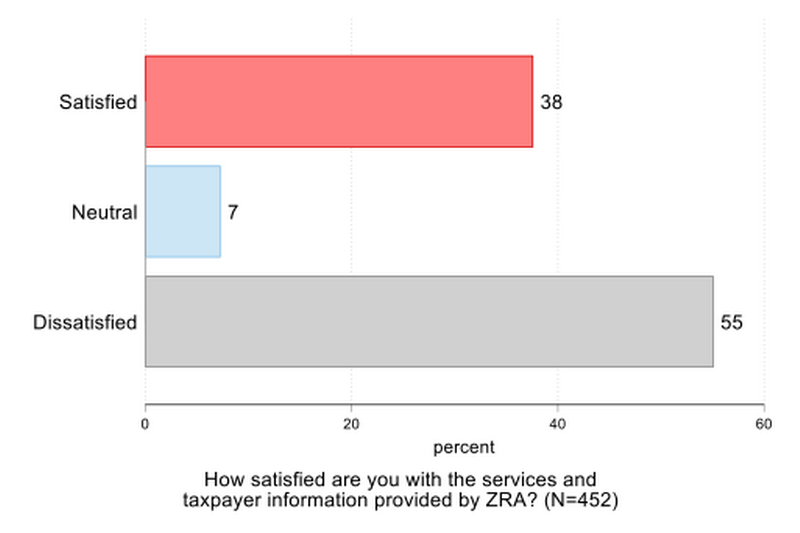

When asked how satisfied businesspeople are with the taxpayer information provided by ZRA, 38% of businesses are satisfied with ZRA’s services and information, while as many as 55% express dissatisfaction, as illustrated in Figure 11.

Tanzania ranks high compared to other African countries with respect to citizens’ trust in the revenue authority. In Afrobarometer surveys, composed of representative samples of citizens, it ranked 7th out of 32 countries in 2014-2015[4] and 1st out of 33 countries in 2019-2021[5]. Yet, businesspeople are likely to perceive and experience taxation differently than ordinary citizens as their tax compliance issues generally are more complex in terms of the number of taxes they have to pay.[6] For this reason, businesspeople’s trust in the tax system generally tends to be lower than the trust of ordinary citizens. Our survey data allows us to examine in more detail the trust of businesspeople in the tax system. Closely shaped by prior experiences made with taxation and satisfaction levels, trust in ZRA varies substantially among the businesspeople with about 30% of the firms expressing a high level of trust, 37% trusting it somewhat and 33% not trusting the tax authority. Trust is higher for female than male respondents and differs by sector with higher trust levels in the manufacturing sector. Overall, trust in the tax authority is lower than trust in other public institutions with religious leaders, the Government of the United Republic of Tanzania and the Government of Zanzibar being trusted significantly more, as shown in Figure 12.[7]

Figure 11: Satisfaction with ZRA services

Figure 12: Trust in ZRA compared to other institutions

5. Policy implications and recommendations

In the past decades, much as has been achieved in Zanzibar to improve and strengthen the tax system and business environment but more remains to be done. It is encouraging to observe that businesspeople are overall optimistic about the future suggesting a positive business development. At the same time, it is important to recognize that businesspeople face high levels of uncertainty not only regarding their future demand but also regarding their future tax liability. Many businesspeople perceive taxes as barriers to realizing business opportunities. It is also concerning that businesspeople perceive that about 50% of other firms are cheating on their taxes, which suggests that tax evasion is widespread and contribute to undermine voluntary tax compliance.

Improving tax compliance goes beyond enforcement; it also involves fostering voluntary compliance by building trust and making payments easier, including improvement of the online tax filing platforms - all supported by a credible, fair, and equitable enforcement system. Taxpayer education programs should be tailored to firm size, sector, and demographics to enhance understanding and compliance. Promoting transparency and equal treatment of businesses will improve perceptions of fairness. Long-term stability in tax policies will also ensure predictability for businesses. Strengthening trust in the tax system requires improvements in ZRA’s service delivery and responsiveness. Clear and consistent tax regulations, with fewer exemptions, should be implemented to enhance transparency. Greater engagement with the business community in tax policy discussions will further build confidence in the system.

Future research should aim to improve our understanding of how these challenges can be addressed, including the development of concrete measures. Building on this report, CMI, ZRA, NTA and REPOA are collaborating on a study of the tourism sector in Zanzibar. As it is the fastest growing business sector in Zanzibar it is crucial to understand in-depth the tax challenges from the perspectives of the businesspeople in the sector. The purpose of the study is to identify areas for reforms and provide advice to the Government on how to improve the tax system and strengthen the business environment of this important sector in Zanzibar.

6. Appendix: Questionnaire of businesspeople survey

|

Question |

Choices |

|

Background Respondent |

|

|

First, we want to know a bit more about your personal background, and your role in the firm. |

[Enumerator Note] |

|

What is your gender? |

[1] Female |

|

How old are you? |

[Integer] |

|

Are you a citizen of this country? |

[1] Yes |

|

Are you from Mainland Tanzania or Zanzibar? |

[1] Mainland Tanzania |

|

What is the highest level of formal education you have completed? |

[1] University degree or higher |

|

Other Education: Please specify |

[Text] |

|

What is your role in the firm? |

[1] Owner |

|

Other role: please specify |

[Text] |

|

How long have you been working with the firm? |

[1] Less than 1 year |

|

Background Firm |

|

|

We will now ask you some questions related to your firm. When we are talking about your firm or business in this survey, it includes all the branches of the firm. We are interested in the whole firm you are working for. |

[Enumerator Note] |

|

What is the main activity of the firm? [Multiple Choice] |

[1] Manufacturing |

|

Other firm Activity: please specify |

[Text] |

|

What is the legal status of the business? |

[1] Sole proprietorship (individual ownership) |

|

Other legal status: Please specify |

[Text] |

|

How many branches does this firm have? |

[Integer] |

|

Where is the headquarter of this firm located? |

[1] Mainland Tanzania |

|

Other area headquarters located: Please specify |

[Text] |

|

Is the firm own by a foreign company? |

[1] Yes |

|

When was this firm established? |

[Integer] |

|

How many people does this firm employ (total number, including full-time and part-time staff)? |

[Integer] |

|

In the last fiscal year, what was the total annual turnover for all products and services of this firm, including all its branches? |

[Text] |

|

Annual turnover is ${Annual_turnover} ${Q2} TZS |

[Enumerator Note] |

|

Size of the firm is ${Size_firm} |

[Enumerator Note] |

|

Is the firm VAT registered? |

[1] Yes |

|

General Questions on Taxes |

|

|

We are interested in learning more about how your business is affected by taxation. First, we would like to know about the different taxes your firm pays to the fiscal authorities and other governmental institutions. Please be reminded that your personal and business identity will remain confidential. |

[Enumerator Note] |

|

What taxes does the firm pay? [Multiple Choice] |

[1] VAT |

|

Other taxes paid: Please specify |

[Text] |

|

We would like to know the total amount of taxes your firm paid last fiscal year (2022/23). We know it can be difficult to know the exact value, so could you give us your best estimation? |

[Text] |

|

Tax paid is ${Tax_paid} ${Q25} TZS |

[Enumerator Note] |

|

How confident are you with your estimation? |

[1] Very Confident |

|

Does your company make regular payments to other government institutions than TRA? |

[1] Yes |

|

Institution Name |

[Text] |

|

Types of taxes, licenses, fees and charges |

[Text] |

|

Can you estimate broadly how much your firm paid to [INSTITUTION -TAX] in a year? |

[Text] |

|

Does your firm use, occasionally or regularly, an external accounting company or individual tax consultant to handle tax affairs? |

[1] Yes |

|

How much do these services cost, on average, per year? |

[Text] |

|

How satisfied are you with the services and taxpayer information provided by TRA? |

[1] Very dissatisfied |

|

Do you know the threshold, in terms of turnover, to pay the VAT? |

[1] Yes |

|

Starting at which amount of turnover, does a firm have to pay VAT? |

[Text] |

|

Does the threshold in terms of turnover to pay the VAT will change or remain the same next year? |

[1] It will Change |

|

What will be the new threshold? |

[Text] |

|

Dealing with Uncertainty |

|

|

We know that businesses in Tanzania are operating in an environment with uncertainty, which sometimes may make it hard to plan investments, tax payments, and future production. We want to understand which type of uncertainty is affecting your business most, and how. |

[Enumerator Note] |

|

Several factors are important to plan your business activities, and yet, they are often hard to predict. For each of the types of uncertainties listed below, please tell me how important it is to your firm when making business decisions on a scale from “Not important at all (1)” to “Very important (5)” |

[Enumerator Note] |

|

Uncertainty on which taxes my firm is liable to |

[1] Not Important at all |

|

Uncertainty about which tax rates apply to my firm |

[1] Not Important at all |

|

Uncertainty about the future demand for products and services my firm is offering |

[1] Not Important at all |

|

Uncertainty related to how the tax law will change |

[1] Not Important at all |

|

Uncertainty related to how the business regulations law will change |

[1] Not Important at all |

|

Which uncertainty is the most harmful for your firm, the uncertainty about the tax environment, or uncertainty about the business environment (demand or supply)? |

[1] Uncertainty about tax environment much more harmful |

|

In your experience, does it happen that your firm’s ability to pay tax is limited because the taxes are due at times when your firm’s cashflow is low? |

[1] Yes, very often |

|

How regularly do you have to forego or delay business opportunities, like investment or inventory, because you had to pay taxes? |

[1] Very often |

|

Have you ever had to pay a penalty for paying taxes late? |

[1] Yes |

|

If you had the choice, would you rather pay your taxes at a time of your convenience, but earlier than the due date, to overcome the problem of limited cashflow? |

[1] Yes |

|

Taxes and Business Expectations |

|

|

Taxes and Business Expectations Now, we would like to ask you about your expectations for your future business activities and tax payments, given the uncertainties we just discussed. There are no right or wrong answers here, so please just try to be as honest and precise as you can. |

[Enumerator Note] |

|

How long do you expect your firm to be in business? We know it can be difficult to predict exactly, so could you give us your best estimation? |

[Text] |

|

You told us that the total turnover of your firm in the last fiscal year was ${Annual_turnover} ${Q2} TZS. We would like to know the total amount of turnover you expect to make during the next fiscal year. We know it can be difficult to know the exact value, so could you give us your best estimation? |

[Text] |

|

Annual turnover in the next fiscal year is ${Annual_turnovernext} ${Q14} TZS |

[Enumerator Note] |

|

We would like to know the total amount of turnover you expect to make during the next fiscal year. We know it can be difficult to know the exact value, so could you give us your best estimation? |

[Text] |

|

|

[Enumerator Note] |

|

We would like to know the annual turnover you expect to make in 5 years from now. We know it can be difficult to know the exact value, so could you provide us your best estimation? |

[Text] |

|

Annual turnover in the next 5 years is ${Annual_turnovernextfive} ${Q8} TZS |

[Enumerator Note] |

|

You told us that the current number of employees in your firm is ${business_07}. We would like to know the total number of employees you expect to have during the next fiscal year. We know it can be difficult to know the exact value, so could you provide us with your best estimation? |

[Integer] |

|

We would like to know the total number of employees you expect to have during the next fiscal year. We know it can be difficult to know the exact value, so could you provide us with your best estimation? |

[Integer] |

|

We would like to know the total number of employees you expect to have in 5 years from now. We know it can be difficult to know the exact value, so could you provide us with your best estimation? |

[Integer] |

|

You told us that in the last fiscal year, the total amount of taxes you paid was between ${gen_tax_02}. We would like to know the total amount of taxes you expect to pay next fiscal year. We know it can be difficult to know the exact value, so could you provide us your best estimation? |

[Text] |

|

How confident are you with the predictions you just gave us? |

[1] Very Confident |

|

What are the main threats to the realization of your business expectations? Choose up to three options in the following list [Multiple Choice] |

[1] Lack of demand |

|

Other threats, Specify |

[Text] |

|

Tax Policy |

|

|

The Turnover Tax (TT), which is also called Presumptive Tax, Presumptive Tax (PT) is paid based on a firm's annual turnover. In most cases TT is paid by firms without the audited books of accounts. By contrast, audited books of accounts are required for firms to be liable to the Corporate Income Tax (CIT), which is imposed on profits. According to Tanzania tax laws firms with a turnover below 100 million TZS are liable to the TT. Firms with a turnover above 100 million TZS are required to pay CIT and they are required to maintain the audited books of accounts. |

[Enumerator Note] |

|

What is the threshold above which firms have to pay the turnover tax? |

[Text] |

|

Threshold for turnover tax is ${threshold} ${Q38} TZS |

[Enumerator Note] |

|

What is the threshold above which firms have to pay the corporate tax? |

[Text] |

|

Threshold for turnover tax is ${threshold_Vat} ${Q48} TZS |

[Enumerator Note] |

|

If a firm has a turnover of 20 million Tsh, what is that turnover tax rate that it has to pay? |

[Text] |

|

If a firm has a turnover of 600 million Tsh, what is that Corporate Income tax rate that it has to pay? |

[Text] |

|

If a firm has a turnover of 6 billion Tsh, what is that Corporate Income tax rate that it has to pay? |

[Text] |

|

The main advantage of a turnover tax is that it is simple for firms: firms only need to evaluate their yearly turnover. They do not need audited books of account. One important drawback is that the turnover tax does not take into account firms’ costs. As a result, firms with higher costs have to pay a larger share of their profits in tax than firms with lower costs. Taxpayers may therefore perceive the turnover tax as unfair. |

[Enumerator Note] |

|

The main advantage of the turnover tax is that it is simple for the firms: firms only need to evaluate their yearly turnover. They do not need audited books of account. One important drawback is that it may be inefficient: From the tax perspective, it is not attractive for firms under the presumptive tax system to invest and to recruit employees because they cannot deduct those costs from their taxes. |

[Enumerator Note] |

|

If you could choose, What do you prefer for your business (i) the turnover tax or (ii) the corporate tax? |

[1] Turnover Tax |

|

Why? |

[1] Easier to understand |

|

Please Specify |

[Text] |

|

Why? |

[1] Paying taxes on profits is fairer |

|

Please Specify |

[Text] |

|

What do you prefer for Tanzania as a country? |

[1] Turnover Tax |

|

Why? |

[1] Easier to understand |

|

Please Specify |

[Text] |

|

Why? |

[1] Paying taxes on profits is fairer |

|

Please Specify |

[Text] |

|

Think of firms paying the turnover tax now. In your view, would they invest more or less if they were under a corporate income tax regime |

[1] Invest much more |

|

Think of firms paying the turnover tax now. In your view, would they recruit more if they were under a corporate income tax regime |

[1] Recruit much more |

|

In your view, is the turnover tax fair or unfair? |

[1] It is very fair |

|

Why? |

[Text] |

|

Why? |

[Text] |

|

In your view, is the corporate tax fair or unfair? |

[1] It is very fair |

|

Why? |

[Text] |

|

Why? |

[Text] |

|

Knowing that the thresholds for paying Corporate Tax instead of turnover tax is 100 millions TZS, would you rather: |

[1] Increase the thresholds, and therefore having more firms paying the turnover tax rather than the corporate tax |

|

Why? |

[Text] |

|

Trust |

|

|

We will now ask you about your trust in different institutions. |

[Enumerator Note] |

|

How much do you trust each of the following institutions? |

[Enumerator Note] |

|

The Parliament of Tanzania |

[1] Don't trust at all |

|

The Government of the United Republic of Tanzania |

[1] Don't trust at all |

|

Your local government authority |

[1] Don't trust at all |

|

Tanzania Revenue Authority |

[1] Don't trust at all |

|

Religious leaders |

[1] Don't trust at all |

|

PCCB |

[1] Don't trust at all |

|

The Tax Revenue Appeals Tribunal |

[1] Don't trust at all |

|

Generally speaking, would you say that most businesspeople can be trusted or that you must be very careful in dealing with people? |

[1] Most people can be trusted |

|

For the following statement, please tell me whether you disagree or agree |

[Enumerator Note] |

|

TRA officials are fair when it comes to applying the tax law to firms. |

[1] Strongly disagree |

|

Local Government officials are fair when it comes to applying the regulations to firms |

[1] Strongly disagree |

|

Fairness |

|

|

We will now ask you some questions related to the fairness of how tax contributions are distributed among businesses. |

[Enumerator Note] |

|

For every 1000 TZS that you earn after deducting your costs (e.g., materials, salaries) from your turnover, how many TZS does your firm pay in taxes? |

[Text] |

|

Out of the ${fair_01}, how much is paid to TRA |

[Text] |

|

Out of the ${fair_01}, how much is paid to the Local Government (Manispaa) |

[Text] |

|

Do you think that firms of similar size pay approximately the same share of taxes relative to their turnover after deducting cost? |

[1] Firms of similar size pays more or less the same share of taxes |

|

Do you think that firms of different size pay approximately the same share of taxes relative to their turnover after deducting cost? |

[1] Firms of different size pays more or less the same share of taxes |

|

Which type of firms, in terms of size, pays the higher share of taxes relative to their turnover after deducting cost? |

[1] Big firms |

|

Which type of firms, in terms of size, pays the lowest share of taxes relative to their turnover after deducting cost? |

[1] Big firms |

|

Firms are usually classified by their size, defined by their turnover. We define 3 groups: 1. Small: turnover less than 14 million TZS 2. Medium: turnover between 14 and 100 million 3. Large: turnover above 100 million TZS. You told us that you firm had a turnover of ${Annual_turnover} ${Q2} TZS, so you are part of group ${Size_firm} size firms. |

[Enumerator Note] |

|

Think about a (small) firm with less than 14 million TZS of turnover. For every 1,000 TZS that such a firm earns after deducting costs (e.g., materials, salaries) from their turnover, how many TZS does such a firm pay in taxes? |

[Text] |

|

Think about a (medium-sized) firm with a turnover between 14 and 100 million TZS. For every 1,000 TZS that such a firm earns after deducting costs (e.g., materials, salaries) from their turnover, how many TZS does such firm pay in taxes? |

[Text] |

|

Think about a (large) firm with more than 100 million TZS of turnover. For every 1,000 TZS that such a firm earns after deducting costs (e.g., materials, salaries) from their turnover, how many TZS does such firm pay in taxes? |

[Text] |

|

Now think about the largest firm in Tanzania, the top 0.1% of firms in terms of size. For every 1000 TZS produced in turnover after deducting cost in the private sector, how many TZS are produced by the largest 0.1% firms? |

[Text] |

|

Firms in Tanzania mainly pay taxes on their income and on their sales (VAT, excise/duties). Last fiscal year, TRA collected around 7.9 trillion TZS in such taxes. What percentage of this total do you think was paid by the largest firms in Tanzania, the top 0.1%? |

[Text] |

|

According to the official statistics, the largest 0.1% of firms paid over 75% of the revenues collected through the taxes on firms’ income and sales (VAT, excise/duties). |

[Enumerator Note] |

|

Now think about what you consider a fair distribution of taxes. |

[Enumerator Note] |

|

Think about a (small) firm with less than 14 million TZS of turnover. For every 1,000 TZS that such a firm earns after deducting costs (e.g., materials, salaries) from their turnover, how many TZS does firm pay in taxes? |

[Text] |

|

Think about a (medium-sized) firm with a turnover between 14 and 100 million TZS. For every 1,000 TZS that such a firm earns after deducting costs (e.g., materials, salaries) from their turnover, how many TZS should firm pay in taxes? |

[Text] |

|

Think about a (large) firm with more than 100 million TZS of turnover. For every 1,000 TZS that such a firm earns after deducting costs (e.g., materials, salaries) from their turnover, how many TZS should firm pay in taxes? |

[Text] |

|

In its effort to ensure that firms comply with their taxes, which type of firms should TRA prioritize for enforcement? |

[1] Small firms |

|

If the government were to change the tax laws, keeping the total tax revenue unchanged, which type of firms should have their taxes increased? |

[1] Small firms |

|

If the government were to change the tax laws, keeping the total tax revenue unchanged, which type of firms should have their taxes decreased? |

[1] Small firms |

|

Thinking about a fair distribution of taxes: What share of the total tax revenue collected from all the Tanzanian firms should be paid by the very large firms (top 0.1%)? |

[Text] |

|

Would you say that the current Tanzanian tax system for firms is broadly very fair, somewhat fair, somewhat unfair, or very unfair? |

[1] Very fair |

|

The thresholds for paying VAT will be increased from 100 million TZS to 200 million TZS next year. This means that firms with a turnover between 100 and 200 million TZS will be no longer required to pay VAT, only firms with a turnover bigger than 200 million TZS will have to pay it. Do you support this reform? |

[1] Yes, very much in favour |

|

Norms and Tax Moral |

|

|

We will now ask you about your perception of the norms and morality with respect to paying taxes |

[Enumerator Note] |

|

Please tell me if you Strongly Agree, Agree, neither agree nor disagree, Disagree or Strongly Disagree with the following statement: Firms must always pay the taxes that they owe to the tax authority. |

[1] Strongly disagree |

|

Out of 10 businesspeople, how many do you think agree or strongly agree with the following statement: Firms must always pay the taxes that they owe to the tax authority. |

[0] 0 |

|

Firms could refuse to pay taxes if they are not receiving public services of adequate quality. |

[1] Strongly disagree |

|

Out of 10 businespeople, how many do you think agree or strongly agree with the following statement: Firms must always pay the taxes that they owe to the tax authority. |

[0] 0 |

|

Think about 10 small firms in your sector How many do you think cheat on their taxes? |

[0] 0 |

|

Think about 10 medium firms in your sector How many do you think cheat on their taxes? |

[0] 0 [10] 10 |

|

Think about 10 large firms in your sector How many do you think cheat on their taxes? |

[0] 0 |

|

Compliance Costs |

|

|

In the next few questions, we are interested in how much effort it takes you to fulfil your tax obligations. We will focus on those taxes we consider most difficult to comply with. |

[Enumerator Note] |

|

Within the last 5 years, were there any changes to how to pay VAT that increased or reduced the time required (filing, payment, claiming refunds, etc.)? |

[1] No |

|

If Yes, Please explain |

[Text] |

|

Within the last 5 years, were there any changes to how to pay CIT that increased or reduced the time required (filing, payment, etc.)? |

[1] No |

|

If Yes, Please explain |

[Text] |

|

How much time does your firm spend each month on each of the following activities for paying taxes to the TRA? (in minutes) |

|

|

How much time does your firm spend each month on each of the following activities for paying taxes to the TRA? (in minutes) |

[Enumerator Note] |

|

Understanding which taxes to pay and how |

[Text] |

|

Preparing your firm’s tax declaration |

[Text] |

|

Completing the tax forms |

[Text] |

|

Submitting forms to tax authorities, including time for electronic filing, waiting time at tax authority etc. |

[Text] |

|

Discussions with the tax authorities |

[Text] |

|

How much time does it take to get VAT-refunds from TRA? |

[Text] |

|

How much time does your firm spend each month on activities for paying taxes, levies, licenses, etc. to the Local Government (Manispaa)? |

[Text] |

|

Additional Questions |

|

|

In the last part of this questionnaire, we will ask a few more questions about you and your firm. Recall that the information obtained here will remain in the strictest confidentiality. You can of course decline to answer to some of these questions. |

[Enumerator Note] |

|

Does your firm have a TIN number? |

[1] Yes |

|

Can you give it to us? |

[1] Yes |

|

Please mention the number |

[Text] |

|

Would you consent that we as researchers use this number to get information on your firm from the tax authority, guaranteeing your anonymity? |

[1] Yes |

|

GPS coordinate |

[Lat, Long, Alt] |

|

Signature of Researcher |

[Image] |

Notes

[1] This report complements a study by Mahangila & Anderson (2017) who investigate the tax administration burden in the tourism sector in Zanzibar, including the structure of tourism taxes, the uncertainty and complexity of tax laws, and the role played by business associations in facilitating collective action to reform the business environment of the tourism sector. The study Tax Morale: What Drives People and Businesses to Pay Tax? (OECD, 2019) provides an overview of factors that motivate taxpayers – both businesses and individuals – to pay tax in developing countries.

[2] The United Republic of Tanzania (2009). National Public Private Partnership (PPP) Policy. Prime Minister’s Office, Dar es Salaam. [Link] The United Republic of Tanzania (2023). The Public Private Partnership (Amendment) Act, 2023. [Link]

[3] Tax certainty seems to have a stronger impact on business decisions in developing countries than in OECD countries, leading to adjustments in business structures, higher costs, and shifts in investment strategies (OECD, 2019: 13).

[4] Afrobarometer (2016). Merged Round 6 data (36 countries). [Link]

[5] Afrobarometer (2016). Merged Round 8 data (34 countries). [Link]

[6] See the report Public Trust in Tax 2024 (ACCA, IFAC & OECD, 2024).

[7] Since the Afrobarometer focuses on individual citizens, we cannot compare the trust levels of businesspeople in the tax authorities across various countries.