Too big to fault? Effects of the 2010 Nobel Peace Prize on Norwegian exports to China and foreign policy

2. Estimating effects of the 2010 Nobel Prize on Norwegian exports to China

2.1 Effects on Norwegian exports of fish

2.2 Effects on Norwegian total exports

3. Effects of the 2010 Nobel Prize on Norwegian foreign policy

Appendix A. Variables used in the empirical analysis

Appendix B. Effects of the sanctions on competition in the Chinese market for fish

How to cite this publication:

Ivar Kolstad (2016). Too big to fault? Effects of the 2010 Nobel Peace Prize on Norwegian exports to China and foreign policy. Bergen: Chr. Michelsen Institute (CMI Working Paper WP 2016:03)

Abstract

In October 2010, the Norwegian Nobel Committee awarded the Nobel peace prize to Chinese dissident Liu Xiaobo. The Chinese government responded by freezing political and economic relations with Norway, introducing sanctions against imports of fish and other products, and limiting diplomatic interaction. Using a synthetic control approach, this paper estimates the effect of Chinese sanctions following the peace prize on Norwegian exports to China, and on Norwegian foreign policy. Allowing for potential interference (effects of the sanctions on control units), we find that the sanctions reduced direct exports of fish to China by between 125 and 176 million USD in the period 2011–13, and direct total exports from Norway to China by between 780 and 1300 million USD. By 2014, however, exports had rebounded to normal levels. One possible explanation for this normalization could be Norwegian government efforts to distance itself from the peace prize committee, and a weakening of the Norwegian foreign policy position on human rights. This paper shows that immediately following the peace prize, Norwegian agreement with Chinese voting in the United Nations on human rights resolutions increased. The results suggest that the Chinese government can effectively use economic sanctions to affect the foreign policy positions of democratic governments, with potentially chilling effects for international progress on human rights. China has become too big to fault.

Keywords: Sanctions, trade, foreign policy, international political economy, China, Norway

JEL codes: F14, F51, F53, P33

1. Introduction

The Chinese dissident Liu Xiaobo was awarded the Nobel peace price on 8 October 2010 for “his long and non-violent struggle for fundamental human rights in China”.{1} In response to the decision of the Norwegian Nobel Committee, the Chinese government introduced a number of limitations to political and economic interaction with Norway. High-level bilateral political meetings and a planned free trade agreement were put on hold, and sanctions in the form of non-tariff barriers were introduced against Norwegian exports, with extended quarantine practices for Norwegian salmon attracting the most media attention, though other industries also faced increased bureaucratic obstacles. Following the announcement of the prize, fears ran high in Norway of a Dalai Lama effect (Fuchs and Klann, 2013), where crossing the Chinese government on human rights issues would have severe consequences for exports to China. Later studies of export patterns played down the effect, however, pointing out that in the years following the prize, exports to China largely continued to increase (Skivenes, 2011; Chen and Garcia, 2015; Sverdrup-Thygesen, 2015), possibly with the more symbolic exception of Norwegian salmon. However, estimating the causal effect of Chinese sanctions on Norwegian exports requires the construction of a credible counterfactual, and assuming that exports would have remained at 2010 levels in the absence of the Nobel prize, as these studies implicitly do, does not appear reasonable given the high growth in exports in previous years. While economic effects were viewed as limited, perceptions prevailed that the Chinese government reactions had an impact on Norwegian foreign policy, with the decisions to not meet with the Dalai Lama during his visit to Norway in 2014 given as a prominent example (Chen and Garcia, 2015). However, it is not obvious that foreign policy decisions of this kind were caused by the Chinese government reactions to the Nobel prize; given the degree of economic interaction with China it is possible that the Norwegian government would have acted similarly even in the absence of the prize. Again, identification of a causal effect of the prize and sanctions on Norwegian foreign policy requires the construction of a credible counterfactual.

This paper uses the synthetic control approach introduced by Abadie and Gardeazabal (2003) to estimate the causal effect of Chinese government sanctions following the peace prize on Norwegian exports and foreign policy. This approach entails constructing a synthetic Norway as a weighted average of other countries, where the weights of the countries reflect their similarity with Norway on variables predicting export performance and foreign policy positions, respectively. The evolution of exports and foreign policy in this synthetic control country is taken as the counterfactual against which the actual evolution of Norwegian exports and foreign policy is estimated. While awarding the Nobel peace prize to a Chinese dissident may not be an unexpected decision, the timing of the decision could not be anticipated, and the 2010 prize can therefore be viewed as an exogenous event. The use of the synthetic control method is in this case complicated by the fact that there is interference; the sanctions imposed against Norway may have helped the export performance of the countries included in the synthetic control country. We show, however, that the sanctions did not affect the degree of competition in the overall Chinese fish or exports market, which means that we can calculate lower and upper bounds for the effect of the sanctions on Norwegian exports. Our results show that the effect of the Chinese sanctions on Norwegian exports were substantial. In the three years following the announcement of the peace prize, direct fish exports to China dropped by between 125 and 176 million USD compared to the synthetic control country, and direct total exports were reduced by between 780 and 1300 million USD. These numbers suggest that direct fish exports would have been 10 to 14 per cent above their actual levels in the three years in the absence of the prize, and that direct total exports would have been 10 to 16 per cent above their actual levels. {2} By 2014, however, exports from Norway to China had normalized, suggesting that the duration or effect of the sanctions were temporary. A possible explanation for the normalization are changes in Norwegian foreign policy in the period after the prize. Using the synthetic control approach, we show that Norwegian voting agreement with China on United Nations human rights resolutions increased in the year following the Nobel prize announcement. This suggests that the Chinese economic sanctions had a causal effect on Norwegian foreign policy, where the Norwegian government may have attempted to trade human rights concessions for market access. We do not find effects on UN voting agreement in subsequent years, however, but cannot assess whether the sanctions caused concessions to be made in other areas of foreign policy.

Our analysis contributes to a large theoretical and empirical literature on the use and effectiveness of economic sanctions to influence policy in sanctioned countries. Many of these studies emphasize the ineffectiveness of sanctions in achieving their targets of policy or regime change, for a variety of reasons including free-riding among sanctioning parties, circumvention of sanctions by the sanctioned countries, costs to domestic interests such as consumers or firms in the sanctioning countries, actions by elites in sanctioned countries to shift the burden of sanctions onto or more heavily repress opposition groups, or nationalist tendencies in sanctioned countries to rally round the flag when pressured (Pape, 1997; Elliott and Hufbauer, 1999; Levy, 1999; Davis and Engerman, 2003; Wood, 2008; Oechslin, 2014; Bapat and Kwon, 2015). Our results are in line with existing theory in finding sanctions effective where the cost to the sanctioning country is small and costs to the sanctioned country large (Eaton and Engers, 1999). However, they could also reflect a greater level of insulation against lobbying from affected social groups in autocratic states as compared to democratic nations. Moreover, in our case the impact of sanctions are found to be negative in terms of their effect on human rights. This raises questions of whether sanctions will become a tool increasingly and successfully used by autocratic states as their economic power grows, with detrimental effects on international human rights conditions.

Our study is most closely related to that of Fuchs and Klann (2013), which shows that meetings with the Dalai Lama at a political level reduces a country’s exports to China by on average 16.9 per cent in the year of and the year following the visit but with no effect in subsequent years, and the study of Heilmann (forthcoming) which examines the effect of consumer boycotts on trade, finding only a small and short-term effect on Japanese exports to China of the territorial dispute over the Senkaku/Diaoyu islands in 2012. In contrast to these studies, we identify not just the effect of Chinese sanctions on trade, but also suggest that they were effective in changing policy in the targeted country. The effect we find on exports of the Chinese sanctions following the 2010 Nobel prize are comparable to the ‘Dalai Lama’ effect of Fuchs and Klann in size and larger than the effects of the Chinese consumer boycott studied in Heilmann, but we also find that the effects of the sanctions against Norway lasted longer than in the other cases. There might be several explanations for this, one is that the Nobel prize poses a more visible and direct challenge to the power and legitimacy of the Chinese regime, another is the size and power of Norway compared to the sanctioned countries of the other studies, and the consumer boycott against Japan may of course be subject to free-rider and coordination problems that government sanctions are not.

We also speak to the literature on the link between corporate interests and foreign policy. While some studies suggest that multinational corporations prefer democracy in their host countries (Asiedu and Lien, 2011), other studies cast doubt on the incentives corporations have to support institutional improvement, democracy or human rights. Using an event study approach, Dube et al. (2011) show that US-supported coups in Iran, Guatemala and Congo increased the share prices of US companies that had had their assets nationalized by governments of these countries, suggesting that corporate interests may have been a driver of the coups. Guidolin and La Ferrara (2007) find a negative impact on diamond companies operating in Angola of the death of the leader of the UNITA movement, an event which in practice ended a decades long civil war. Consistent with this, our results suggest that the corporate sector may face substantial losses following criticism of powerful autocratic governments, suggesting similar disincentives to support increased accountability of these regimes. Moreover, this may in our case have had implications not just for the foreign policy approach towards the regime in questions, but also for the approach taken towards the international human rights system.

The implications of the increasingly powerful role played by China in the global order, economically and politically, has been the subject of substantial discussion and analysis. A large part of this discussion has focused on the role of Chinese bilateral economic and political relations with the developing world. Some view the increasing presence of China as favourable in challenging the hegemony of the West, in particular the United States (Campbell, 2008), others suggest that the Chinese development success offers useful lessons for developing countries and that politically the Chinese approach is not necessarily much different from that taken by Western countries (Brautigam, 2009). Some recent empirical studies suggest, however, that the political effect of the Chinese economic presence in developing countries is not all that favourable. Dreher et al. (2015) find that Chinese aid flows favour the birth regions of current political leaders in recipient countries, in contrast to World Bank aid. Bader (2015) finds that export dependence on China increases the survival of autocratic regimes. As for China’s role in the evolving global order, in particular its participation in multilateral fora like the United Nations, there is agreement that China is playing an increasingly assertive and important role, but opinions diverge as to whether there is a clearly distinguishable strategy guiding Chinese activities (Breslin, 2013). In the area of human rights, however, where China has among other things played an active role as a member of the UN Human Rights Council 2006–2012, a clear strategy of deflecting criticism, and promoting stability and group rights over individual rights has been viewed as undermining meaningful progress on human rights at the international level (Sceats and Breslin, 2012). Our results are consistent with the more critical of these perspectives, and suggest that the Chinese use of economic power can be effective in promoting its less than progressive international approach to human rights. Building on the theoretical arguments of Eaton and Engers (1999) it is also possible that the sanctions we are observing are the tip of the iceberg, that the mere threat of sanctions by the Chinese regime is enough to create policy change by other nations. In this perspective, the 2010 Nobel prize and Dalai Lama visits may simply constitute highly visible opportunities for the regime to signal its resolve.

The paper is structured as follows. Section 2 presents the Nobel prize decision and its implications in terms of Chinese trade policies towards Norway, using the synthetic control approach to estimate the effects of Chinese government sanctions on Norwegian exports of fish and on total Norwegian exports. Section 3 discusses the political implications of the Nobel prize, and then uses the synthetic control approach to study the effect of the Chinese economic sanctions on Norwegian voting patterns in the United Nations. Section 4 concludes.

{1} http://nobelpeaceprize.org/en_GB/laureates/laureates-2010/announce-2010/

{2} It is possible that some of this reduction was compensated through higher exports through third countries such as Hong Kong or Vietnam (Chen and Garcia, 2015), but the extent of such circumvention is hard to quantify. We therefore focus on effects on direct exports to China.

2. Estimating effects of the 2010 Nobel Prize on Norwegian exports to China

The Nobel peace prize to Liu Xiaobo was announced on 8 October 2010 by the chairman of the Norwegian Nobel Committee, a committee whose members are appointed by the Norwegian parliament. The laureate is a veteran from the Tiananmen Square protests of 1989, and a leading author of Charter 08, a manifesto of human rights signed by a number of Chinese intellectuals and activists. The Chinese government has kept Liu in prison since 2009, on an accusation of subversion of state power. After the announcement, the Chinese government reacted with indignation, condemning the award and warning that it could damage China-Norwegian relations. The Norwegian ambassador to China was summoned to the Chinese Foreign Ministry, where he received an official protest. While the Norwegian prime minister congratulated Liu on the prize, the Norwegian government response otherwise emphasized the independence of the Nobel committee from the government.

Overt Chinese sanctions against Norwegian exports to China would have been in conflict with WTO rules. There can nevertheless be little doubt that non-tariff barriers to Norwegian exports were introduced following the Nobel peace prize. Sanctions on Norwegian exports of fish to China received the most attention in Norway. As detailed by Chen and Garcia (2015), Norwegian exports of salmon were subjected to more stringent and time-consuming sanitation and veterinary controls at the border, and importers were unable to get licences for larger quantities of Norwegian salmon. In 2010, fish exports were the largest Norwegian export category (in the two-digit harmonized system classification of commodities) to China, constituting almost 30 per cent, making a focus on this sector important. However, Norway also export for substantial sums in metals and metals products, chemicals, and transport equipment. More anecdotal evidence from the media suggests that these sectors may also have been affected. Greater difficulties in obtaining visas for Norwegian business travellers were noted, but possibly more significant were forgone connections with Chinese counterparts both directly and through diplomatic access to state officials (Sverdrup-Thygeson, 2015). The free trade agreement between Norway and China that was expected to be completed in 2011 was also put on the shelf.

That sanctions were put in place does not necessarily imply that they were consequential for Norwegian exports. To assess their effect on exports to China, we use the synthetic control method to construct a counterfactual, a synthetic Norway which captures the evolution of exports had the sanctions not been introduced. In the following, we will estimate the effect of sanctions on fish exports and total exports in turn. We focus on the effect on direct exports to China. While it is possible that the sanctions were circumvented by transporting products through third countries like Hong Kong and Vietnam, the extent of such redirection is difficult to quantify.

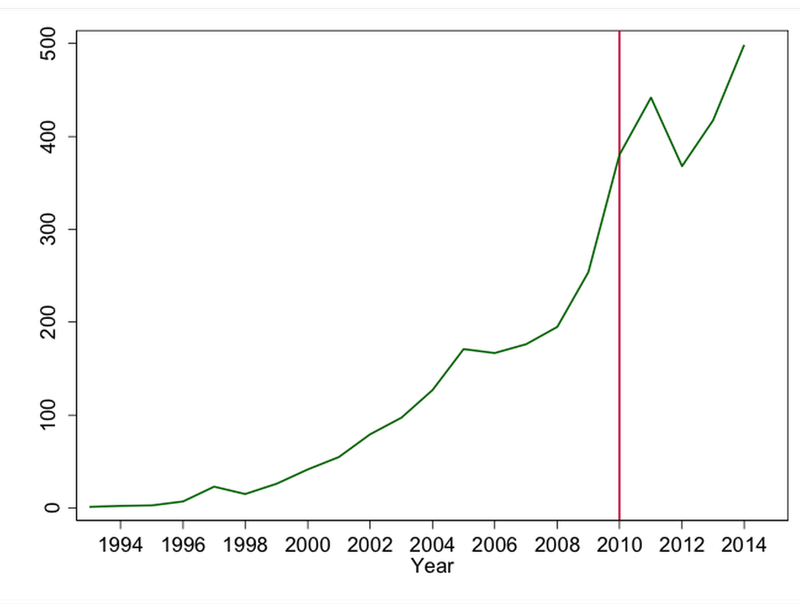

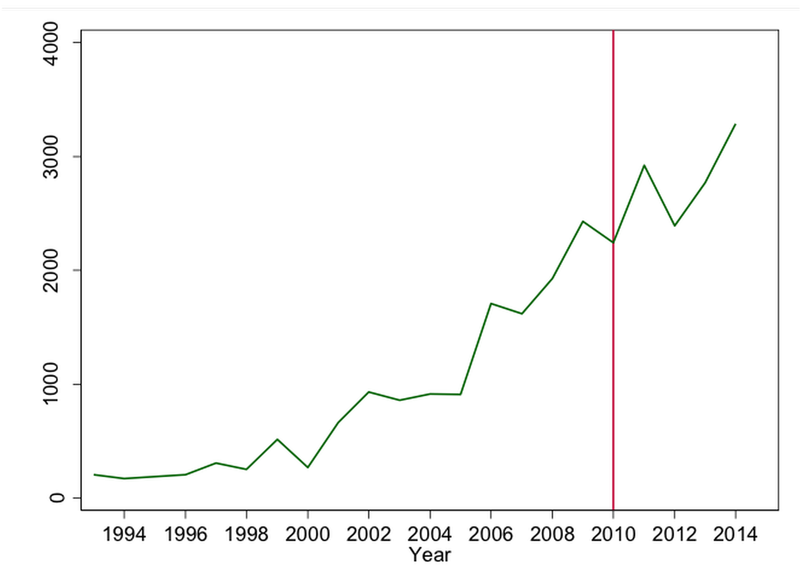

As a backdrop to our analysis, Figure 1 maps the evolution of Norwegian exports to China of fish and other seafood products (corresponding to code 03 in the Harmonized System classification of commodities). The figure suggests that an upward trend in exports tapered off in 2011, followed by an outright drop in 2012, and then a recovery in the following two years. For the years 2011–2014, this would entail a net reduction in exports of almost 60 million USD compared to a situation where exports had stayed constant at its 2011 level, and a reduction of 585 million USD compared to a scenario where exports kept increasing at its average growth rate in the period 2005–2010 of 17.5 per cent. However, it is not obvious that either of these scenarios provide a good counterfactual for Norwegian exports following the Chinese government sanctions. A similar picture is provided in Figure 2, which presents the total value of Norwegian exports to China in all sectors over the same period. The break in trend seen in fish exports in 2011 is not as apparent in total exports, but there is a drop in 2012, and a recovery in the following two years. The numbers suggest a net reduction of total exports of 322 million USD in the period 2011–2014 compared to exports staying constant at its 2011 level, and a reduction of more than 3000 million USD compared to exports increasing from 2010 with its average growth rate of almost 20 per cent from the preceding five years. Again, it is not obvious that either of these alternative paths represent good counterfactuals in the absence of Chinese sanctions. In the following, a synthetic control approach is used to construct counterfactuals, to estimate more accurately the effect of the sanctions.

2.1 Effects on Norwegian exports of fish

The synthetic control approach introduced by Abadie and Gardeazabal (2003) can be used to construct a synthetic control country which resembles Norway in the relevant characteristics affecting exports. The synthetic control country is created as a weighted average of other countries drawn from the total “donor pool” of all countries, and the evolution of exports in this control country after the imposition of Chinese sanctions provides a counterfactual against which one can assess their effect on Norwegian exports. This method addresses the challenge encountered in time series analysis that any estimated changes may reflect changes in export for all countries, and for cross sectional analysis that there may be differences in the characteristics of countries which influence their growth in exports in the period in question. In addition, the approach provides a structured way of analyzing effects of a treatment (in our case Chinese sanctions) affecting a single unit (in our case Norway), and in this way provides a systematic approach to comparative case study analysis, in contrast to more arbitrary or less explicit choices of control units often employed in these forms of analyses. Specifically, the synthetic control approach entails estimating two sets of weights; the weights given to each of the countries that go into the synthetic control country, and the weights given to each of the country characteristics influencing exports. Following the approach taken in Abadie and Gardeazabal (2003), these weights are essentially calculated by imposing two conditions; that the resulting weights minimize the squared difference between the treated country (Norway) and its synthetic control country in background characteristics, and minimizes the mean squared error of the control country in predicting the dependent variable (exports) of the treatment country in the pre-treatment period.

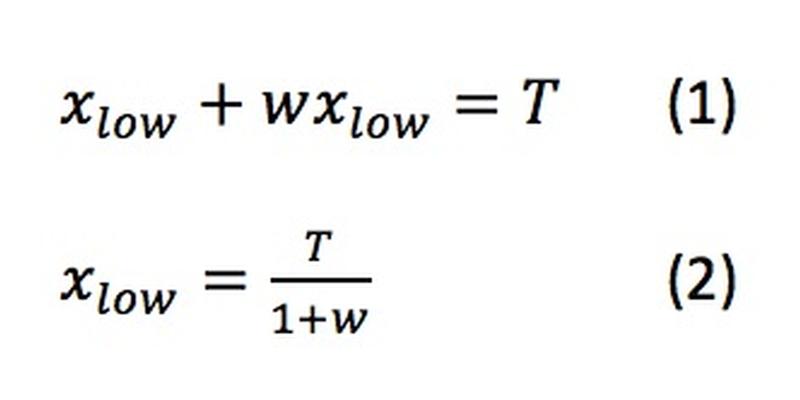

The use of this method is in our case complicated by the fact that the treatment (Chinese sanctions) affects not only the treated unit, but also potentially the control units, as exports from the other countries may increase when one exporter is prevented from serving the Chinese market. If any of the countries that receive positive weights in constructing the counterfactual for Norway see their market position improve when Norway is sanctioned, this would entail a counterfactual that is too high, and hence bias the estimate of the Norwegian decrease in exports upwards. The size of this potential bias is greater the more the sanctions against Norway affect the level of competition in the market, as less intense competition would entail higher revenues to the other countries. However, while Norway had a substantial market share in specialized market segments like salmon, its share in total exports of fish to China is small, in 2010 it was 10.4 per cent. It is hence unlikely that sanctions against Norway affected the level of competition substantially in the overall market. In Appendix B, we also show this to be the case. Using the synthetic control method to estimate the evolution of imports of fish to China compared to a counterfactual constructed as a weighted average of other fish importing countries, we find no significant effect of the 2010 sanctions on the quantity (in tonnes) of fish imported 2011–2013 (the last year for which there is data on the quantity of fish imported). If the sanctions against Norway had affected the degree of competition in the market for fish, import quantities should have gone down assuming fish is not a Giffen good. The absence of an effect on market competition means that other countries at most replaced the value of exports lost by Norway when sanctions were imposed. This allows us to construct a lower bound for the effect of the sanctions on Norwegian exports of fish to China. The greatest bias would occur if the full loss of Norway was picked up by the country with the highest weights in its synthetic control country. If we denote the loss to Norway as x, the highest weight in the synthetic control as w, and the estimated difference in exports between the synthetic control and Norway as T, the lower bound for the Norwegian loss in exports (in absolute terms) can be calculated as:

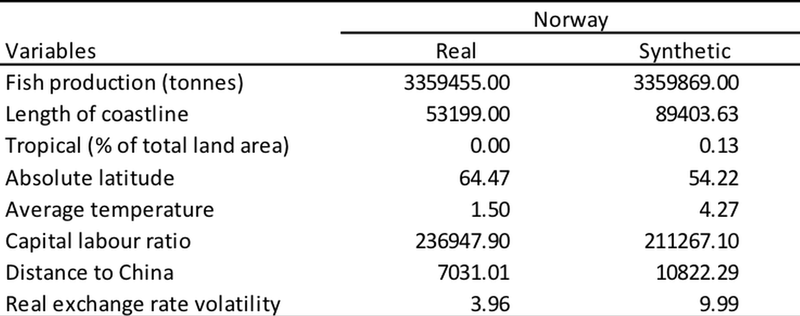

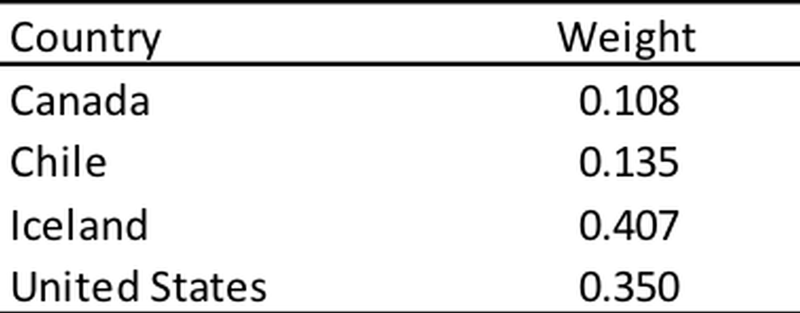

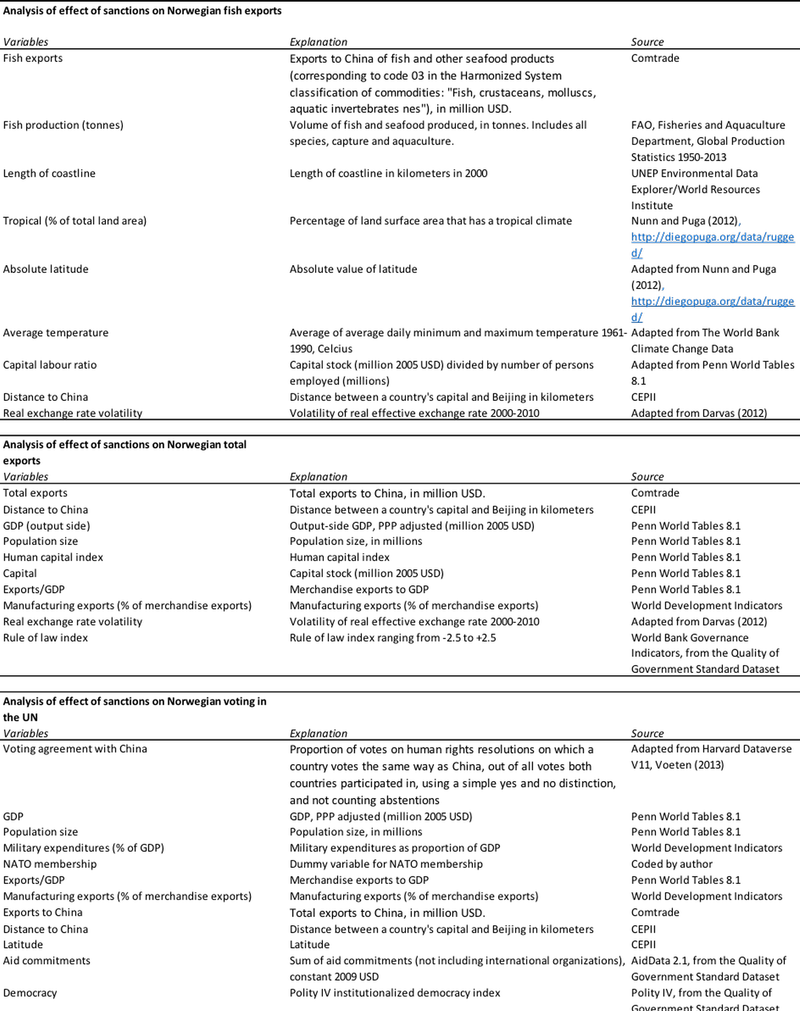

Given these observations, we can use the synthetic control approach to estimate the impact of Chinese sanctions following the 2010 Nobel peace prize on Norwegian fish exports to China. Table 1 presents the variables included in the analysis as predictors of fish exports to China. The idea here is to create a synthetic control country as similar as possible to Norway in production capacity (as reflected in actual fish production of the country, and potential for production captured by the length of its coastline and its climate and temperature), production technology and costs (captured by the capital labour ratio of the economy), and trade costs and constraints (captured by the distance to China and volatility in the exchange rate). This is consistent with gravity model estimates of bilateral fish trade (Natale et al. 2015), and with supply specifications emphasizing factor costs (e.g. Steen and Salvanes, 1999) and biological carrying capacity (Pauly and Christensen, 1995). All variables used in the analysis are further specified in Appendix A. The pre-treatment period over which predictor variables are averaged is 2000 to 2009, though results are robust to changes in this period. As the table reveals, the synthetic control thus created is similar to Norway in these background predictors of exports to China, however, some differences remain given a limited donor pool of 36 countries for which there is data on exports to China, and on the predictor variables. Table 2 presents the weights of the countries that constitute the synthetic Norway, which is made up of about 40 per cent Iceland, 35 per cent the United States, and 14 and 11 per cent Chile and Canada.

The evolution of fish export to China of Norway and the synthetic control country is shown in Figure 3. The dashed line represents exports of the synthetic country, and suggests that in the absence of Chinese sanctions, Norwegian exports would have been somewhere between the two naive scenarios of constant production levels or constant growth discussed above, with a higher level achieved in 2011 than 2010 and with this level being maintained in the following three years. A comparison of actual Norwegian exports (the full line) and the synthetic control suggests a drop in Norwegian export of fish of almost 6 per cent in 2011, 22 per cent in 2012, and 10 per cent in 2013. However, here we must adjust for possible interference. In total over the years 2011–2013, the results suggest that the sanctions reduced Norwegian exports of fish to China by at least 125 million USD (in the case where Iceland picked up the full drop in export value experienced by Norway), and at most 176 million USD (in the case where none of the four control units saw sanctions increase their export values). However, while the sanctions were likely costly to Norway, their effect was also temporary, as suggested by the estimates for 2014.

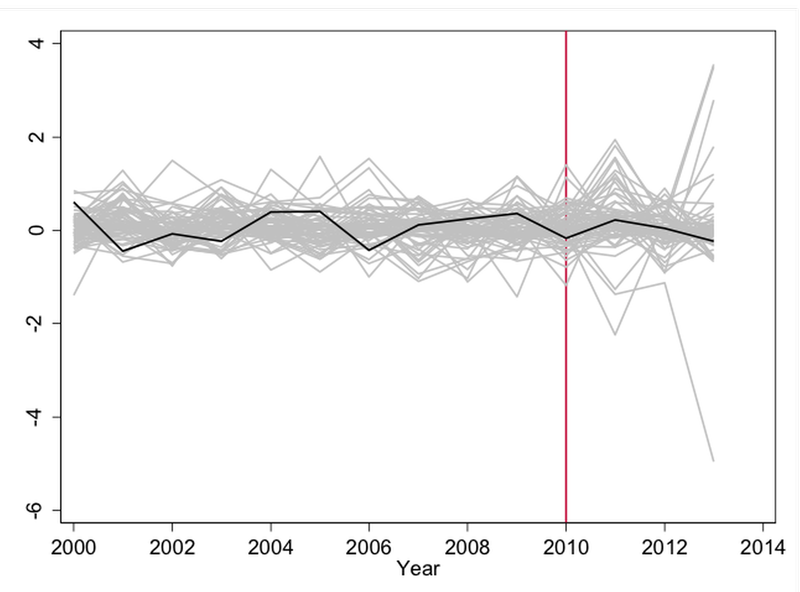

To assess the probability with which our results are driven by chance, we use the inferential method developed in Abadie et al. (2010). In the manner of a permutation test, this approach entails conducting a series of placebo analyses where each of the countries in the donor pool is assigned treatment status. This provides a distribution of effects for countries that did not face sanctions. If the differences between Norway and its synthetic counterpart are large compared to estimated differences for the other countries in these placebo analyses, we have a basis for concluding that the effect of the sanctions are unlikely to be due to chance. Figure 4 presents the results of the placebo analyses. The differences in exports for the other countries compared to their respective synthetic control units are given by the grey lines, with the black line capturing the differences for Norway. While the effect for Norway does not stand out in 2011, 2013 or 2014, the estimated difference is the second most negative in the sample for 2012. With 35 control countries, the probability of estimating an effect of this magnitude under a random permutation of the intervention is 2/36, which means that the effect is significant at a 10 per cent level (p<0.056). As for the issue of interference, additional calculations show that at most one additional country could have had a more negative difference to its synthetic control country in 2012 than Norway, which means that the effect for Norway stays significant (p<0.084) even under the most disadvantageous allocation of the loss in Norwegian exports to other countries. {3} In addition, one should note that the country with the greatest negative gap to its synthetic control is Japan, where reductions in exports may reflect other political disputes after 2010 with China, in particular over territorial issues related to the Senkaku/Diaoyu islands (Nagy, 2013; Heilmann, forthcoming). In principle and in line with Abadie et al (2010) one could argue that Japan be excluded from the sample used in this analysis, in order to more cleanly compare exports from sanction affected Norway with exports from countries unaffected by sanctions. This brings the level of significance of the effect on Norwegian fish exports in 2012 below conventional levels of 5 per cent (p<0.029), or below 10 per cent (p<0.058) under the most disadvantageous allocation of Norwegian exports to other countries. The effect remains insignificant in other post-intervention years.

{3} Details of calculations available on request.

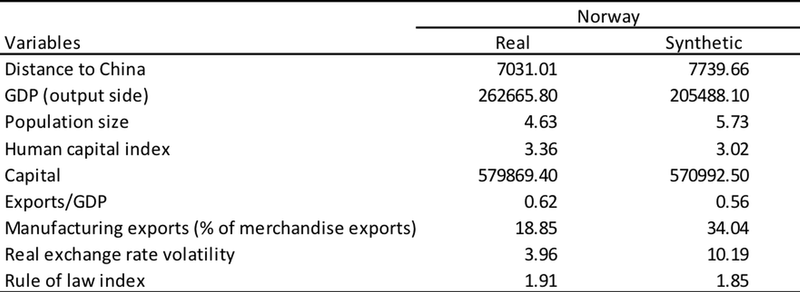

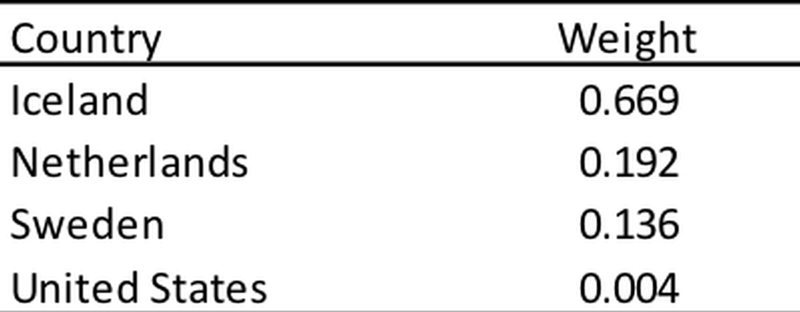

2.2 Effects on Norwegian total exports

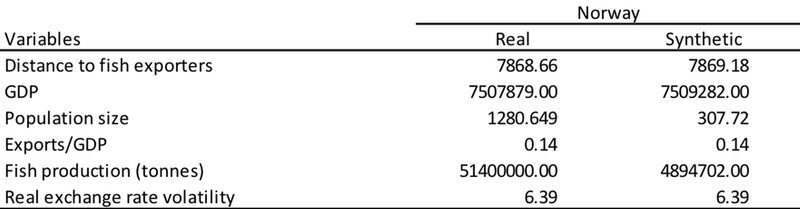

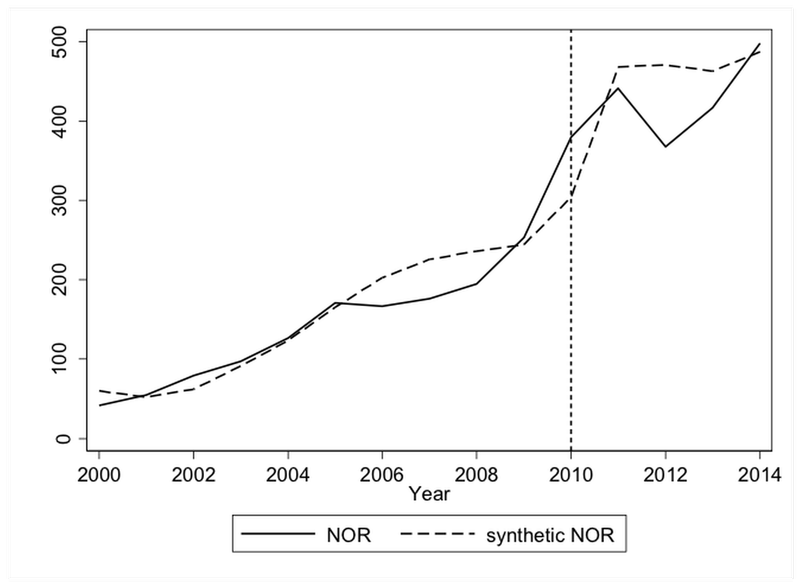

In the following, the same approach is used to estimate the impact of Chinese sanctions following the 2010 Nobel peace prize on total Norwegian exports to China across all sectors. A new synthetic control country is created using determinants of total exports to China. We maintain the assumption that the sanctions against Norway did not affect competition in the overall market in China, which seems even more reasonable in this case since the market share of Norway in total imports to China is tiny, at 0.2 per cent in 2010. A lower bound for the loss in total Norwegian exports can therefore be calculated in the same way as above. Table 3 shows the values of Norway and the synthetic country on the predictors of exports to China. The control region is created to be similar to Norway in trade costs and constraints (distance to China, exchange rate volatility), production capacity and economic structure (output side GDP, human and physical capital, openness to trade, sectoral composition), and institutions (rule of law). The specification is consistent with gravity models of bilateral trade (Anderson, 1979; Anderson and van Wincoop, 2003), factor based models of trade, and empirical studies relating trade flows and patterns to institutions and exchange rate volatility (Anderson and Marcouiller, 2002; Levchenko, 2007; Nunn, 2007; Chowdhury, 1993). There is balance on most variables, but given the high level of oil exports from Norway it is difficult to recreate the country fully from a combination of the others in terms of share of manufacturing exports. The countries that form the synthetic control region for Norway are presented in Table 4; Iceland comprises 67 per cent, the Netherlands 19, Sweden 14, and the United States a tiny fraction.

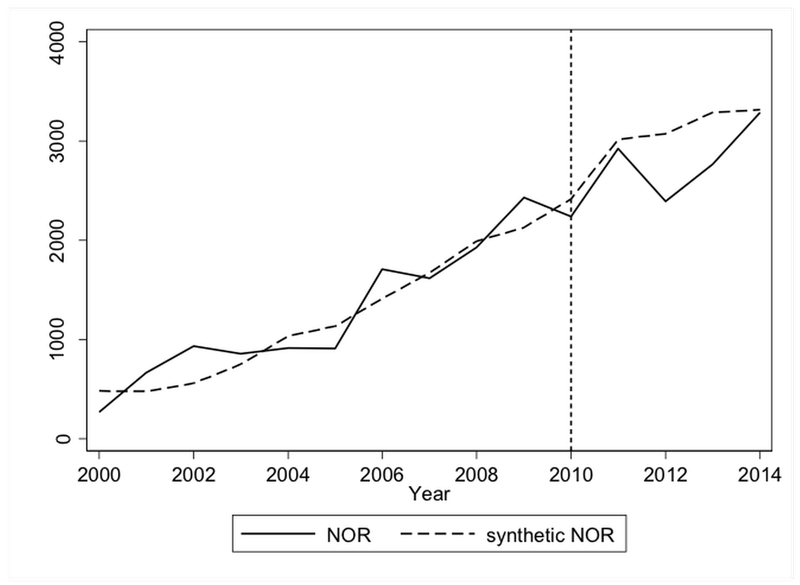

In Figure 5, the evolution of Norwegian total exports to China and that of its synthetic control are displayed. As with the analysis of fish exports, the figure suggests effects somewhere in between the naive scenarios discussed earlier. In the absence of sanctions, Norwegian exports would have been a little higher in 2011, and then grown in subsequent years, albeit at a lower rate than in the pre-sanctions period. Compared to the synthetic Norway, Norwegian total exports to China seemingly dropped by 3 per cent in 2011, 22 per cent in 2012, 16 per cent in 2013, and almost recovered by 2014. However, we must again take into account the possibility that some of the control units saw increased export volumes due to the sanctions against Norway. The resulting calculations using equation (2) suggest that the combined loss of direct export revenue in the period 2011–2013 constituted between 780 and 1300 million USD. The profile of the losses is similar to that of fish exports, with substantial reductions in exports in 2012, but suggest that for other industries 2013 was also a year that saw large drops in exports. By 2014, however, total exports had largely rebounded to the level that would have been realized in the absence of sanctions.

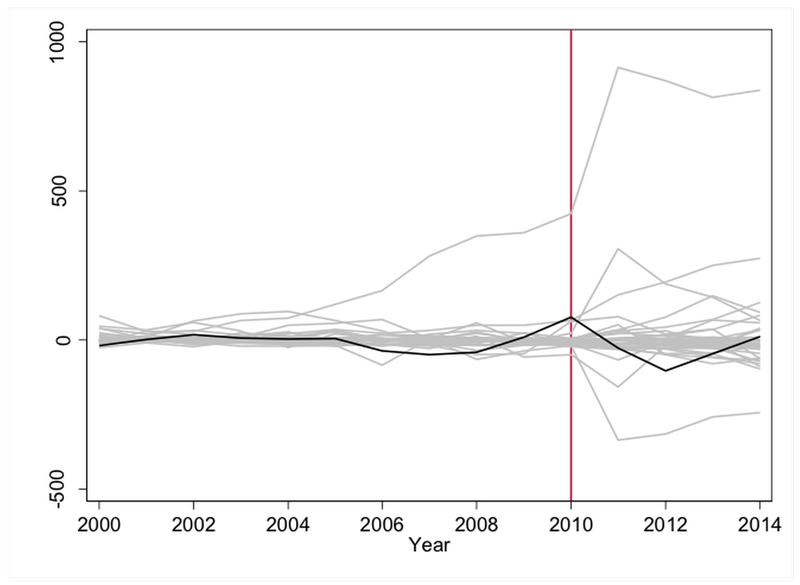

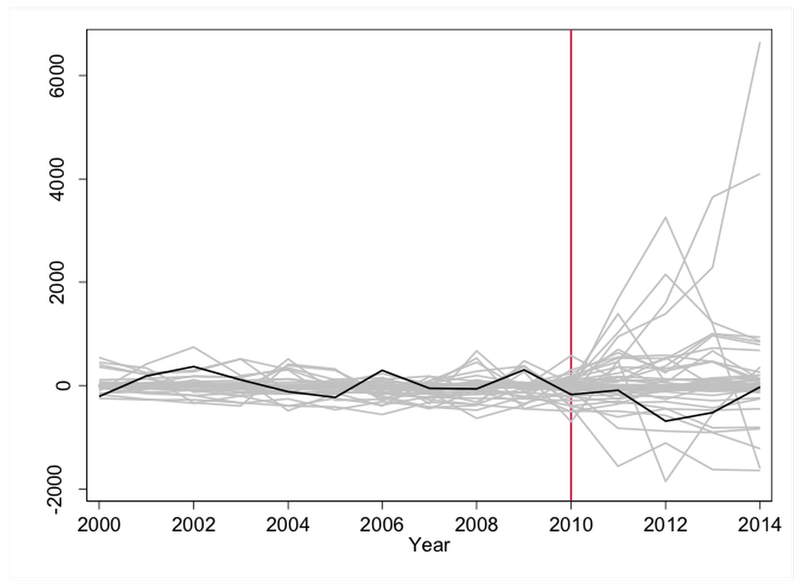

We present a placebo analysis for the effect of the sanctions on total Norwegian export to China in Figure 6. In line with Abadie et al. (2010), we have excluded countries with pre-treatment root mean squared prediction errors more than two times that of Norway in Figure 6. This leaves 55 countries including Norway, which as before is represented by the black line against the grey of the placebo countries. For 2012, Norway has the fourth most negative difference from its synthetic control country, suggesting that the effect is significant at a 10 per cent level (p<0.073). In this case, however, at most three additional countries could have differences below that of Norway for all possible allocations of the Norwegian loss in exports to other countries, which means that under some extreme assumptions about which countries took over the market share of Norway, the effect of the sanctions becomes insignificant. It appears unlikely that the three countries that follow Norway in negative differences relative to their respective synthetic controls should be the ones taking over Norway’s market share, however, since we should then observe positive differences for them unless they also happen to be hit by negative shocks at the same time. Under the more reasonable assumptions that the market share Norway lost due to the sanctions was taken over by the countries with positive differences to their respective synthetic control countries, or was more widely spread among the other countries, the effect stays significant. For the other years, the Norwegian deviation from its synthetic control country does not stand out compared to the placebo countries.

3. Effects of the 2010 Nobel Prize on Norwegian foreign policy

The resurgence of Norwegian exports to China to pre-sanctions levels in 2014, suggests that the sanctions were short-lived. There are several possible explanations for this. One is that keeping Norwegian suppliers out of the Chinese markets for fish and other commodities raised prices for Chinese consumers and businesses, which could be a costly policy in terms of political support that even an autocratic government may rely on. Given the limited size of Norway in total fish and exports markets, and our results suggesting there was no effect on the level of competition in the Chinese market, this explanation seems unlikely to carry much force. Another explanation is that the Norwegian government traded concessions in other areas for renewed access for its companies to the Chinese market. Following the announcement of the 2010 peace prize, and subsequent Chinese reactions, the Norwegian government took several steps which can be interpreted as attempts to placate the Chinese government. One was the repeated insistence on the independence of the Norwegian Nobel Committee. More interesting, though, are the possible changes in foreign policy. Much has been made of a possible effect of the sanctions on the decision to not meet the Dalai Lama at an official level during his visit to Norway in May 2014 (Chen and Garcia, 2015). One can also speculate about the reasons Norway had in supporting the admission of China as an observer in the Arctic Council in 2013. However, it is difficult to establish that either of these decision were influenced by the Chinese responses to the 2010 peace prize, it is possible that these decisions would have been made even in the absence of the sanctions. And since our results suggest that exports to China had normalized by 2014, avoiding contact with the Dalai Lama does not seem necessary to reinstate Norwegian trade access.

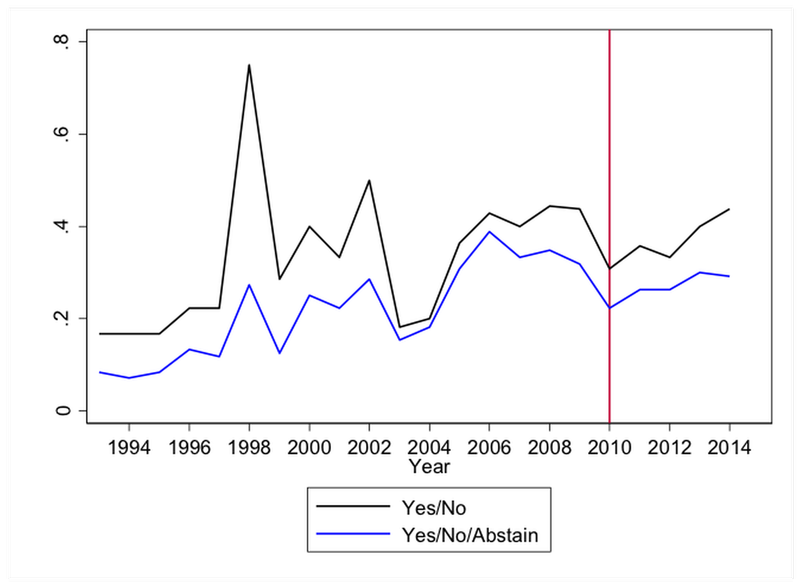

An alternative way to assess the extent to which Norwegian government concessions in the area of foreign policy occurred and may be behind the apparent normalization in exports by 2014, is to look at Norwegian voting behaviour in the United Nations. To the extent that there was greater agreement between Norwegian and Chinese positions on UN resolutions after the sanctions were introduced, this could reflect policy concessions by the Norwegian government. While there is substantial debate over how to measure voting agreement (or more generally preference alignment) using UN data, Figure 7 presents two measures of the extent of agreement between Norwegian and Chinese votes in the UN General Assembly on human rights resolutions. The upper graph measures the proportion of votes on which Norway and China voted in the same way, out of all votes they both participated in, using a simple yes and no distinction, and not counting abstentions (as in Kegley and Cook (1991)). The lower graph measures the same proportion but with abstentions included. There is an apparent increase in voting agreement between Norway and China immediately following the Nobel prize decision of 2010. As noted by Bailey et al. (forthcoming), however, the measures of voting agreement used here do not necessarily reflect greater alignment of preferences or foreign policy positions, they could simply reflect different issues being voted over in different years, with for instance the issues voted on in 2011 being of a nature where the preferences of Norway and China coincide. In addition to its other advantages in creating a credible counterfactual, the synthetic control approach also addresses this challenge, however. If changes in voting agreement simply captures differences in issues being voted on across years, then Norway and its synthetic counterpart should have the same evolution of voting agreement. If, however, increased agreement is due to a change in foreign policy position, we should see a divergence between Norway and the synthetic control country in their voting agreement with China. The synthetic control approach hence makes the alternative ideal point approach to measuring state preferences suggested by Bailey et al. redundant for our purposes, and in fact represents an alternative method to estimate dynamic state preferences. In the following, we therefore use the proportion of votes in agreement with China (not including abstentions) as our dependent variable; however, results are robust to also including abstentions.

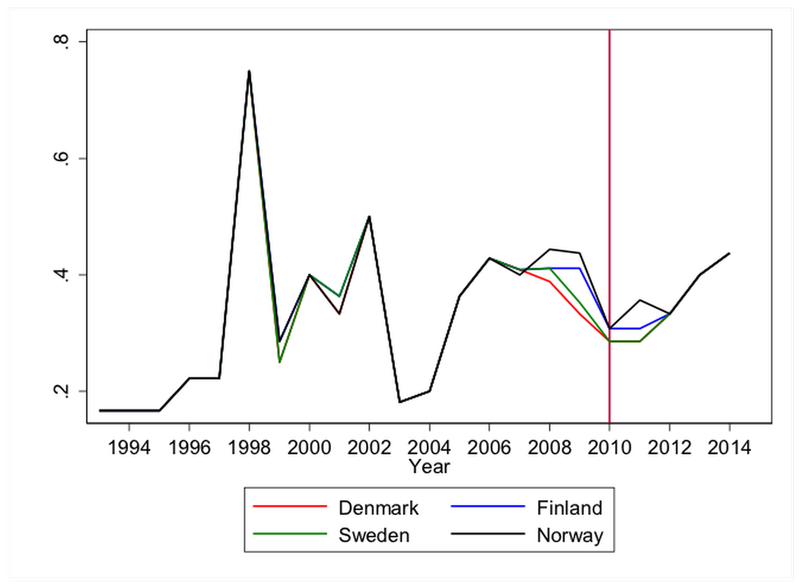

The upper graph in Figure 7 suggests that Norwegian voting agreement with China increased by 5 percentage points in the year following the Nobel prize announcement, and by a further 8 percentage points by 2014. As an initial suggestion that this is not all due to changes in the issues voted over, Figure 8 maps how Norwegian voting patterns compare with those of the other Scandinavian countries of Denmark, Finland and Sweden (using the voting agreement measure that excludes abstentions). Norway clearly diverges from the others between 2010 and 2011, adopting a position more in agreement with China. How much the Norwegian position diverged in 2011 depends, however, on the country of comparison. It is worth noting that from 2012 and onwards there is little divergence between the Scandinavian countries in terms of their voting agreement with China. The synthetic control approach can be used to analyze these issues in a more systematic way, however. And in contrast to the case of exports, is seems unlikely that the Chinese sanctions affected the foreign policies of the control units, at least in the immediate aftermath of the sanctions, meaning we can identify the effect of the sanctions on Norwegian foreign policy more precisely. If, however, there is competition among countries to stay on the good side of the Chinese government, it is possible that the control units will follow suit if Norway changes its voting pattern, but this would tend to underestimate the effect of the sanctions.

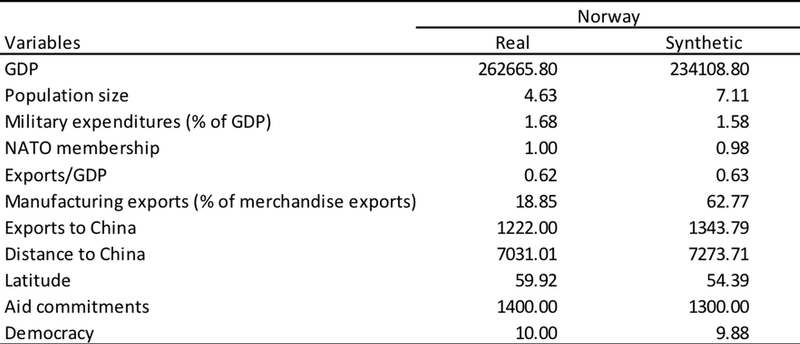

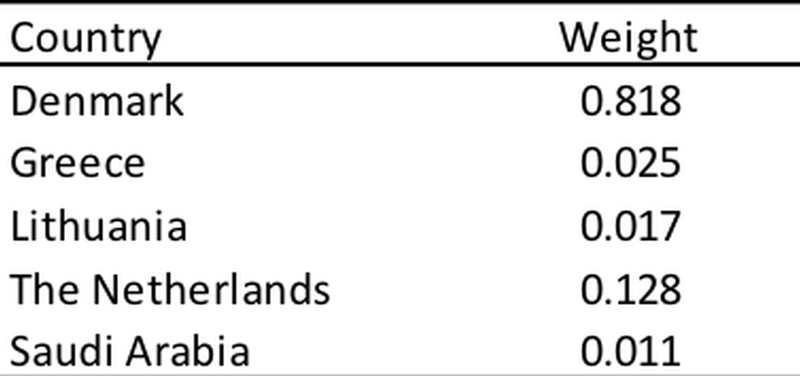

Table 5 presents mean values on predictor variables of UN voting for Norway and a synthetic control country created to resemble Norway on these variables. The predictor variables reflect power (GDP, population size, military expenditures), economic interests in general and in relation to China (openness to trade, industry structure, exports to and distance to China), strategic interests (military alliance membership and latitude), and idealistic orientation (aid commitments and democratic accountability). Adapted to our context, these variables capture the main country characteristics determining UN voting behaviour as summarized in Dreher and Sturm (2012). As before, the synthetic country resembles Norway closely on most dimensions, with the industrial composition of Norway being difficult to recreate through a weighted average of the other countries. Table 6 shows the weights of the different countries in the synthetic control group, these mainly include Denmark (82 per cent) and the Netherlands (13 per cent), with the remaining 5 per cent divided among Greece, Lithuania and Saudi Arabia.

Note: The following countries received zero weight: Australia, Austria, Belgium, Brazil, Canada, Chile, Colombia, Cyprus, Czech Republic, Germany, Spain, Estonia, Finland, France, United Kingdom, Hungary, India, Ireland, Italy, Japan, South Korea, Kuwait, Luxembourg, Latvia, New Zealand, Portugal, Qatar, Romania, Slovakia, Sweden, Thailand, United States, South Africa.

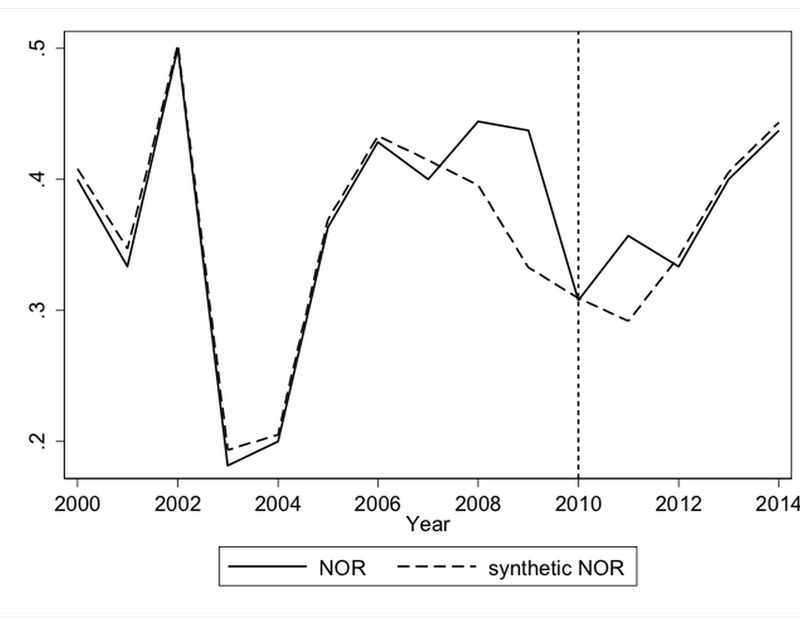

The evolution of voting agreement with China of Norway and its synthetic counterpart are presented in Figure 9. The diverging paths of the two from 2010 to 2011 clearly suggests that the peace prize and the Chinese response generated a knee-jerk reaction from the Norwegian government to align its voting behaviour with the Chinese government. The response of the Chinese government to the Nobel prize caused an increase in Norwegian voting alignment with the Chinese government of 6.5 percentage points. This cannot be due to a change in preferences of the Chinese government, as the synthetic country would then have the same level of voting agreement with China as Norway did. As noted, nor can it be attributed to changes in the content of the resolutions voted over from one year to the next. While this constitutes evidence that the Norwegian government changed its foreign policy positions in the area of human rights as a result of Chinese reactions to the Nobel prize in 2011, there is little evidence of later changes in position after 2011, when voting patterns of Norway returned to the path predicted by the synthetic country. However, it is possible that there is interference between units after 2011, where Norwegian foreign policy changes created incentives for the countries in the synthetic control group to follow suit and change their level of agreement with China.

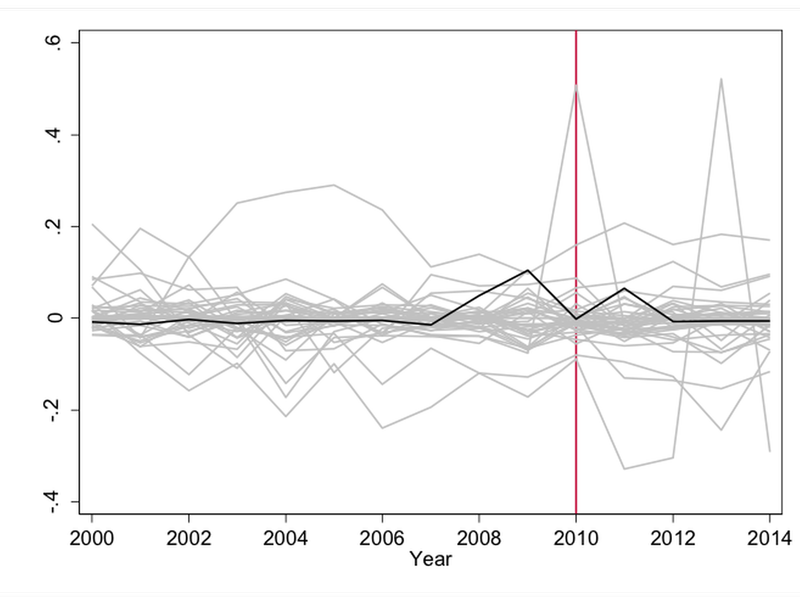

To assess whether the estimated changes in Norwegian voting patterns in the US are due to chance, we run placebo analyses which assign treatment status to the other 38 countries in our donor pool. The results are shown in Figure 10. In 2011, the year where Norwegian voting patterns diverged from its synthetic counterpart, the difference was the third highest among the countries included in the analysis, with only South Africa and Chile having larger positive differences in voting agreement with China compared to their respective synthetic countries. This suggests that the increased agreement of Norwegian voting with China in 2011 was not due to chance (p<0.077). We can thus conclude that Chinese government reactions to the 2010 peace prize significantly influenced Norwegian foreign policy in the area of human rights.

A closer look at the resolutions on which Norway diverged from the synthetic control units is informative here. With 19 human rights resolutions voted over in 2011, the difference in agreement with China between Norway and the main countries in synthetic control (Denmark and the Netherlands) boils down to different voting on one resolution. The resolution in question was a proposal on “Global efforts for the total elimination of racism, racial discrimination, xenophobia and related intolerance and the comprehensive implementation of and follow-up to the Durban Declaration and Programme of Action”. {4} The proposal was put forward by China and the G77 group of developing countries, and discussed and voted over in the United Nations General Assembly on 19 December 2011. The resolution was adopted by the general assembly with 138 votes in favour, including those of Norway and China, 6 votes against including Australia, Canada and the US, and 46 abstentions including all the European Union countries.

While the resolution in question appears to advance human rights, it is not obvious that is in fact does, and as noted by Boockmann and Dreher (2011:447), resolutions in the UN sometimes weaken human rights or deflect attention “e.g., by stressing self-determination of countries rather than individual liberties”. Moreover, the human rights strategy of China in the UN is widely perceived as one that frustrates rather than advances international progress on human rights, emphasizing collective rights over individual ones, and stressing the state responsibility to maintain public order as fundamental (Sceats and Breslin, 2012). The resolution in question has been criticized by human rights organizations in that it “goes beyond the admirable goals of preventing racial violence and discrimination and would curtail the freedom of expression” (Trister, 2012:5), which is part of a greater concern among civil society organizations that autocratic governments may use bans on hate speech as a pretext for censorship and political persecution. The UN representatives of the countries voting against the resolution or abstaining voiced similar forms of criticism in the General Assembly debate, with the European Union stating that the resolution “introduced restrictions to the freedom of expression that were not in line with international law” and “did not recognize the role that freedom of expression played in combating racism, racial discrimination, xenophobia and related intolerance”. {5} In voting with China on this resolution, Norway apparently chose to turn a blind eye to these problems. The fact that this resolution brought Norway’s voting coincidence with China to higher levels than other Western countries is also noted by Sceats and Breslin (2012), however, without relating this to the preceding Nobel price and ensuing sanctions, as our analysis explicitly does.

{4} Resolution A/RES/66/144, for details see http://research.un.org/en/docs/ga/quick/regular/66, accessed 9 March 2016.

{5} http://www.un.org/press/en/2011/gashc4033.doc.htm, accessed 9 March 2016.

4. Concluding remarks

This paper uses the synthetic control approach of Abadie et al. (2003) to estimate the effect of Chinese government sanctions following the 2010 Nobel peace prize, on Norwegian export to China. This approach creates a credible counterfactual against which to assess the evolution of Norwegian exports after the sanctions were introduced, and suggests that the effect on direct exports to China were substantial, in contrast to claims of previous studies using more ad hoc counterfactuals. The effect of the sanctions was also temporary, by 2014 Norwegian exports were back to normal. While several studies have documented the effect of Chinese sanctions on trade (Fuchs and Klann, 2013; Heilmann, forthcoming), our study additionally shows that the sanctions were effective in changing foreign policy in the targeted country. In essence, the Norwegian government appears to have traded concessions on human rights for resumed trade access to the Chinese market.

The results raise some important broader questions. Over recent decades, Western democracies have been only to happy to trade with China, an increasingly productive and prosperous country whose government continues to lack democratic legitimacy. No doubt economic self-interest of Western countries has played a large part in this, but support for expanding trade relations have also been based on the modernization view that economic progress will result in democracy (Lipset, 1959), or on ideas that trade will reduce incentives for international conflict. The Chinese experience and quantitative empirical evidence suggest, however, that the modernization thesis may not hold for China specifically or for countries generally (Acemoglu et al., 2008). If expanding trade with China had empowered the Chinese people, that would have been fine, but instead what seems to have happened is that it has increased the power of the Chinese regime. Western democracies willing to temper human rights concerns for market access may now face a reckoning as this increased power is used to further stifle criticism and frustrate international progress on human rights. In the way some companies are sometimes described as too big to fail, China has become too big to fault.

For Western democracies and other countries to play a progressive role in advancing human rights in this context, some important implications emerge. To avoid the types of negative effects on foreign policy witnessed in the case studied here, it seems vital to ensure the independence of human rights promoting institutions from commercial and economic interests. While the independence of the Norwegian Nobel committee may have been sufficient to award the 2010 prize even in anticipation of some economic backlash for Norway, the observed consequences for Norway may prompt a committee mostly consisting of politicians from the major Norwegian political parties to think again before making a similar decision in future. Similarly, the close integration that we see in foreign policy of promoting a country’s own economic interests can be detrimental to the credibility of policy to promote human rights internationally. To play an effective role in advancing democracy and human rights, it also would appear important to not be too economically dependent on trade with countries governed by autocratic regimes, but rather ensure diversification away from these kinds of countries, which can also help circumvent any sanctions that may occur. Finally, while the sanctions following the 2010 peace prize are unlikely to have fully eroded the emphasis of Norway and similar countries on human rights, it seems likely that future activities and initiatives in this area are going to be coordinated with other countries, in order to avoid being singled out for economic sanctions by increasingly powerful, undemocratic regimes.

References

Abadie, A., Diamond, A. and Hainmueller, J. (2010), “Synthetic control methods for comparative case studies: Estimating the effect of California’s tobacco control program”, Journal of the American Statistical Association, 105, 490, 493–505

Abadie, A. and Gardeazabal, J. (2003), “The economic costs of conflict: A case study of the Basque Country”, American Economic Review, 93, 1, 112–132

Acemoglu, D., Johnson, S. Robinson, J. A. and Yared, P. (2008), “Income and democracy”, American Economic Review, 98, 3, 808–842.

Anderson, J. (1979), “A theoretical foundation for the gravity equation”, American Economic Review, 69, 106–116.

Anderson, J., & Marcouiller, D. (2002), “Insecurity and the pattern of trade: An empirical investigation”, Review of Economics and Statistics, 84, 342–352.

Anderson, J., & van Wincoop, E. (2003), “Gravity with gravitas: A solution to the border puzzle”, American Economic Review, 93, 1, 170–192.

Asiedu; E. and Lien, D. (2011), “Democracy, foreign direct investment and natural resources”, Journal of International Economics, 84, 99–111

Bader, J. (2015), “China, autocratic patron? An empirical investigation of China as a factor in autocratic survival”, International Studies Quarterly, 59, 23–33

Bailey, M. A., Strezhnev, A. and Voeten, E. (forthcoming), “Estimating dynamic state preferences from United Nations voting data”, Journal of Conflict Resolution

Bapat, N. A. and Kwon, B. R. (2015), “When are sanctions effective? A bargaining and enforcement framework”, International Organization, 69, 131–162

Boockmann, B. and Dreher, A. (2011), “Do human rights offenders oppose human rights resolutions in the United Nations?”, Public Choice, 146, 443–467

Brautigam, D. (2009), The Dragon’s gift: The Real Story of China in Africa, Oxford: Oxford University Press

Breslin, S. (2013), “China and the global order: Signalling threat or friendship?”, International Affairs, 3, 615–634

Campbell, H. (2008), “China in Africa: challenging US global hegemony”, Third World Quarterly, 29, 1, 89–105

Chen, X. and Garcia, R. J. (2015), “China’s salmon sanction”, NUPI working paper 845, Oslo: Norwegian Institute of International Affairs

Chowdhury, A. R. (1993), “Does exchange rate volatility depress trade flows? Evidence from error-correction models”, The Review of Economics and Statistics, 75, 4, 700–706

Darvas, Z. (2012), “Real effective exchange rates for 178 countries: a new database”, Working Paper 2012/06, Brussels: Bruegel

Davis, L. and Engerman, S. (2003), “History lessons: Sanctions: Neither war nor peace”, Journal of Economic Perspectives, 17, 2, 187–197

Dreher, A., Fuchs, A., Hodler, R., Parks, B. C., Raschky, P. A. and Tierney, M. J. (2015), “Aid on Demand: African Leaders and the Geography of China’s Foreign Assistance”, CESifo Working Paper, No. 5439, Munich: CESifo

Dreher, A. and Sturm, J. E. (2012), “Do the IMF and the World Bank influence voting in the UN General Assembly?”, Public Choice, 151, 363–397

Dube, A., Kaplan, E. and Naidu, S. (2011), “Coups, corporations, and classified information”, Quarterly Journal of Economics, 126, 1375–1409

Eaton, J and Engers, M. (1999), “Sanctions: Some simple analytics”, American Economic Review, 89, 2, 409–414

Elliott, K. A. and Hufbauer, G. C. (1999), “Same song, same refrain? Economic sanctions in the 1990’s”, American Economic Review, 89, 2, 403–308

Fuchs, A. and Klann, N. H. (2013), “Paying a visit: The Dalai Lama effect on international trade”, Journal of International Economics, 91, 164–177

Guidolin, M. and La Ferrara, E. (2007), “Diamonds are forever, wars are not: Is conflict bad for private firms?”, American Economic Review, 97, 5, 1978–1993

Heilmann, K. (forthcoming), “Does political conflict hurt trade? Evidence from consumer boycotts”, Journal of International Economics

Kegley, C. W. Jr. and Cook, S. W. (1991), “U.S. foreign aid and U.N. voting: Did Reagan’s linkage strategy buy deference or defiance?”, International Studies Quarterly, 35, 3, 295–312

Levchenko, A. (2007), “Institutional quality and international trade”, Review of Economic Studies, 74, 3, 791–819.

Levy, P. (1999), “Sanctions on South Africa: What did they do?”, American Economic Review, 89, 2, 415–520

Lipset, S.M., (1959), “Some social requisites of democracy”, American Political Science Review, 53, 1, 69–105

Nagy, S. R. (2013), “Territorial disputes, trade and diplomacy”, China Perspectives, 4, 49–57

Natale, F., Borrollo, A. and Motova, A. (2015), “Analysis of the determinants of international seafood trade using a gravity model”, Marine Policy, 60, 98–106

Nunn, N. (2007), “Relationship-specificity, incomplete contracts, and the pattern of trade”, Quarterly Journal of Economics, 122, 2, 569–600

Nunn, N. and Puga. D. (2012), “Ruggedness: The blessing of bad geography in Africa”, Review of Economics and Statistics, 94, 1, 20–36

Oechslin, M. (2014), “Targeting autocrats: Economic sanctions and regime change”, European Journal of Political Economy, 36, 24–40

Pape, R. A. (1997), “Why economic sanctions do not work”, International Security, 22, 2, 90–136

Pauly, D. and Christensen, V. (1995), “Primary production required to sustain global fisheries”, Nature, 374, 255–257

Sceats, S. and Breslin, S. (2012), China and the International Human Rights System, London: Chatham House (The Royal Institute of International Affairs)

Skivenes, I. (2011), “Export and import from China: No Nobel effect yet”, https://www.ssb.no/en/utenriksokonomi/artikler-og-publikasjoner/no-nobel-effect-yet, accessed 8 March 2016

Steen, F. and Salvanes, K. G. (1999), “Testing for market power using a dynamic oligopoly model”, International Journal of Industrial Organization, 17, 147–177

Sverdrup-Thygeson, B. (2015), “The flexible cost of insulting China: Trade politics and the ‘Dalai Lama effect’”, Asian Perspective, 39, 101–123

Trister, S. (2012), “Assessing the 2012 UN Human Rights Council elections: One-third of candidates unqualified for membership”, Policy Brief, Washington D.C.: Freedom House

Voeten, E. (2013), “Data and Analyses of Voting in the UN General Assembly”, in Reinalda, B. (ed.), Routledge Handbook of International Organization, New York: Routledge, 54–66

Wood, R. M. (2008), “’A hand upon the throat of the nation’: Economic sanctions and state repression, 1976–2001”, International Studies Quarterly, 52, 3, 489–513

Appendix A. Variables used in the empirical analysis

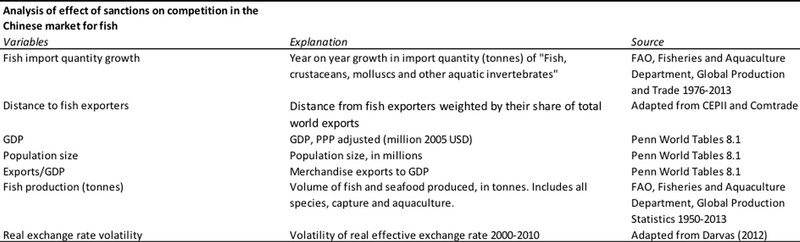

Appendix B. Effects of the sanctions on competition in the Chinese market for fish

In theory, if the sanctions against Norwegian fish exports reduced the level of competition in the Chinese market, this should increase prices, everything else equal. Given that fish is a non-Giffen good, an increase in prices should produce a reduction in demand, i.e. a lower quantity of fish imports to China, everything else equal. The everything else equal condition in these statements can be kept by performing a synthetic control analysis of Chinese imports, where the effect of the sanctions on Chinese imports is assessed against a counterfactual constructed from other import countries. While fish prize data is not readily available, the FAO has data on fish imports quantities, a data series that ends in 2013, which is sufficient for our purposes. Using the synthetic control method to assess the evolution of imported quantities of fish after 2010 is complicated by the fact that China in the pre-treatment period was by far the largest importer globally, so creating a counterfactual as a convex combination of the other countries is difficult. For this reason, we focus the subsequent analysis on the year-on-year growth of Chinese fish imports, using the synthetic control approach to approximate the rate of growth in the absence of sanctions against Norway.

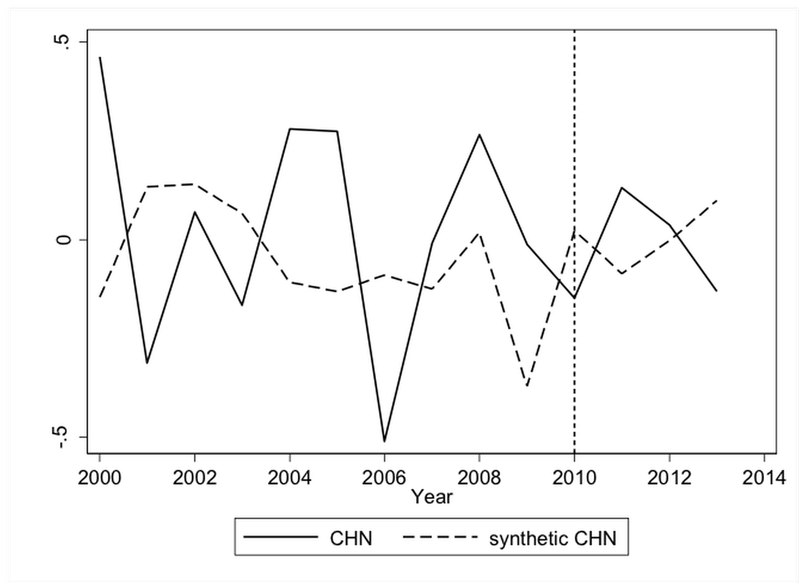

The fully drawn line in Figure B1 shows the growth in the Chinese quantity of fish imports in the period 2000–2013. The dotted line is the synthetic country constructed to be similar to China on demand (GDP and population size), domestic supply (fish production), trade openness and costs (exports to GDP, volatility of exchange rates, and distance from exporters weighted by their share of total world exports). As can be seen in Table B1, the synthetic control region (with country weights given in Table B2) is similar to China on most predictors, but population size and fish production are of course hard to replicate. The errors in predicting pre-treatment growth also tend to be non-trivial. Nevertheless, there is little evidence that growth in Chinese fish imports was negatively affected by the sanctions against Norway. Growth of import quantities was positive in 2011 and 2012 and larger than in 2010, and above growth in the synthetic control country. While growth in 2013 was negative and lower than that of the synthetic control country, results from a placebo analysis presented in Figure B2 show that the difference to the synthetic control region is not statistically significant. Out of 60 countries, China has the 15th most negative difference, which is far from being significant at any conventional level. The countries with pre-treatment root mean squared prediction errors greater than two times that of China have been excluded from the figure, but this does not affect these results. We therefore conclude that the sanctions imposed on Norwegian fish exports after 2010 did not reduce the level of competition in the Chinese market for fish.