Does aid work?

1. How is foreign aid initially spent

2. The impact of aid on economic growth

2.1 Identification of causal effects

3. The impact of aid on components of GDP

4. Aid and transfer of technology

5.1 Crowding out of private firm activities

5.2 Crowding out of government activities (fungibility)

5.3 Crowding out of labor efforts

6. The impact of aid on poverty reduction

6.1 Country level evidence on aid and poverty reduction

6.2 Project level evidence on aid and poverty reduction

How to cite this publication:

Magnus Hatlebakk (2021). Does aid work? Bergen: Chr. Michelsen Institute (CMI Report 2021:11)

This report attempts to understand why research findings differ on the impacts of foreign aid on in particular economic growth, but as a corollary also on the impacts of aid on poverty and other welfare indicators. The report has to go in some detail on the econometric techniques used, and a main finding is that recent research using instrumental variables provides findings that in reality are not so different from earlier findings. There is thus some convergence in estimates, although not necessarily in the interpretation of these estimates. It appears to be a robust finding that economic growth increases a few years after an increase in foreign aid. Some authors interpret this as a causal effect, others not, and we are not able to resolve this issue. If we believe the full effect has a causal interpretation, then the impact of aid is large. The new estimates are consistent with earlier reports saying that aid at the level of 10% of GDP will raise the growth rate by one percentage point. This is a large effect, an increase in the growth rate from, for example, 2% to 3% means that GDP will double in 23 years instead of 35 years. The estimates for poverty reduction and other welfare indicators are also positive, although with variation between indicators. For poverty the estimates are large, but based on only a few studies, and with borderline significance levels. The study comparable to the growth estimates above reports that aid at the level of 5% of GDP will reduce poverty by as much as 15 percentage points. It is also found that aid has positive impacts on schooling and infant mortality rates. Returning to the underlying mechanisms, we find, for example, that aid increases investments and private consumption, but not necessarily government consumption. And there is some, but not full, fungibility, so that aid to the health sector, for example, seems to stick and contribute to the decline in infant mortality. The report also go in some detail on policies for poverty reduction, with a focus on so-called multifaceted programs that target village level poverty traps in remote areas. And there is some discussion of policies targeting the private sector, and the inherent problem of crowding out of private capital.

Preface and acknowledgements

This report is commissioned by Norad, the Norwegian development cooperation agency. It is an update on a previous review commissioned by the Ministry of Foreign Affairs, Norway: Hatlebakk, M. (2016). "Hva virker i utviklingspolitikken. En gjennomgang av forsknings-litteraturen". CMI Report 2016:7. The new report goes in more detail on the econometric techniques needed to establish any causal impacts of aid on economic growth, poverty and other welfare indicators. A careful reader will find some overlap with the previous report. The report is an independent product that represent the analysis and views of the author, and not Norad.

Acknowledgement: Thanks to Espen Villanger for useful comments.

Magnus Hatlebakk

CMI, Bergen, December 2021

Summary

This report attempts to understand why research findings differ on the impacts of foreign aid on in particular economic growth, but as a corollary also on the impacts of aid on poverty and other welfare indicators. The report has to go in some detail on the econometric techniques used, and a main finding is that recent research using instrumental variables provides findings that in reality are not so different from earlier findings. There is thus some convergence in estimates, although not necessarily in the interpretation of these estimates. It appears to be a robust finding that economic growth increases a few years after an increase in foreign aid. Some authors interpret this as a causal effect, others not, and we are not able to resolve this issue. If we believe the full effect has a causal interpretation, then the impact of aid is large. The new estimates are consistent with earlier reports saying that aid at the level of 10% of GDP will raise the growth rate by one percentage point. This is a large effect, an increase in the growth rate from, for example, 2% to 3% means that GDP will double in 23 years instead of 35 years. The estimates for poverty reduction and other welfare indicators are also positive, although with variation between indicators. For poverty the estimates are large, but based on only a few studies, and with borderline significance levels. The study comparable to the growth estimates above reports that aid at the level of 5% of GDP will reduce poverty by as much as 15 percentage points. It is also found that aid has positive impacts on schooling and infant mortality rates. Returning to the underlying mechanisms, we find, for example, that aid increases investments and private consumption, but not necessarily government consumption. And there is some, but not full, fungibility, so that aid to the health sector, for example, seems to stick and contribute to the decline in infant mortality. The report also go in some detail on policies for poverty reduction, with a focus on so-called multifaceted programs that target village level poverty traps in remote areas. And there is some discussion of policies targeting the private sector, and the inherent problem of crowding out of private capital.

Introduction

William Easterly argues that aid is bad for development putting weight on the lack of understanding in the aid industry of what poor people need. Jeffrey Sachs focuses on the massive needs in poor countries, and argues that a large increase in aid is necessary to solve these problems. Between these extremes, we find, among leading development economists, different degrees of aid optimism, or shall we rather say pessimism. Angus Deaton says; “I have come to believe that most external aid is doing more harm than good”, via Abhijit Banerjee and Esther Duflo; “We simply do not know, we are just speculating on a grand scale”, Martin Ravallion; “External development assistance should continue to play a role....It must be acknowledged, however, that the record of development aid has been uneven”, and Paul Collier; “aid is part of the solution rather than part of the problem”.

Is it possible to reconcile these views, and what does the empirical literature say? In this report we will discuss what aid is, including its likely impact on different parts of the recipient economy and society, and we will discuss the empirical support for any such impacts. The latter requires that we dig into the econometric techniques that are used to establish any causal impacts of aid on economic growth, poverty and other welfare indicators. The underlying motivation for foreign aid must be that poor countries lack the necessary funds or the knowledge that may be imbedded in aid projects.

Foreign aid is one of three sources of foreign currency that constitutes approximately the same percentage of GDP in developing countries, the other two are remittances and FDI. Foreign currency will ultimately be spent abroad, and some of it ends up there as financial investments with a very short time lag. Some aid is used directly to import goods and services that may contribute to domestic development. While the rest will circulate domestically in terms of purchases of services, consumer and investment goods, and thus create Keynesian multiplicator effects, before the money ultimately is spent abroad by those who benefitted from the increased domestic demand.

This Keynesian multiplicator effect of foreign aid is, in on our view, underappreciated in the aid debate. We know that most aid goes to salaries, divided between donor and recipient countries, and these are spent on all types of consumer goods and services, which in turn gives incomes to others and ultimately is spent on import on everything from toothpaste to automobiles. The domestic multiplicator effect is likely to be higher the lower are the salaries of the recipients. Thus aid that finance local teachers, nurses, drivers and other lower income groups will contribute more to the local economy than aid to international staff in both recipient and donor countries.

As already indicated, aid will, as all income, be split between consumption of goods and services and investment. In fact domestic savings is by far the main contributor to domestic investments, many times larger than FDI and foreign aid. And with aid to a large extent being spent on salaries, aid will have a limited direct effect on investments. Thus the main effect of aid on investment is likely to come from the savings on salaries in the aid industry, as well as those who benefit from the Keynesian multiplicator effects. Some of the direct investments of aid may, however, contain technology that is new to the recipient country and thus constitute embedded transfers of knowledge. And potentially more important, the salaries may go to experts, or training of new experts, which thus also constitute transfer of knowledge. Foreign aid may thus shift the production frontier in terms of investments and new technology, and create multiplicator effects that utilize available labor and other local resources so that the local economy reach the production frontier.

To conclude, any empirical analysis of the impacts of foreign aid on economic growth should ideally attempt to separate these effects, so that we can learn where the bottlenecks may be. This implies a series of empirical questions: 1) How much of aid is directly spent elsewhere as salaries in donor countries, immediate purchases of goods and services, and immediate financial transfers? 2) To what extent does aid increase the different components of the national accounts, that is, private and government consumption, investments and net import? 3) Does aid lead to technological progress? 4) Does the sum of these effects imply that aid increases economic growth?

These questions hide some underlying mechanisms that may dilute the impacts of aid. And we will add these here as additional empirical questions: 5) Does aid lead to rent seeking and other unprofitable reallocation of domestic resources? 6) Does aid crowd out private investments? 7) Does aid crowd out government spending by reallocation of spending to other sectors (fungibility), reduction of government incomes, or reallocation of other donors’ spending (coordination of aid). Note that a reallocation of private and government resources may not necessarily be negative for economic growth, but means that the planned aim for the aid may not be reached. An example can be support for primary education. If donors support a school sector program, then the local government can instead spend available government incomes in sectors they find more important, for example road building. And households may decide to spend less on education, and more on other goods and services, if the aid in fact improves the quality of government schools.

Thus, although we may not expect aid to necessarily lead to economic growth, it may have impacts on poverty and other welfare indicators. In principle this implies the same estimation problems as for economic growth. Aid to the health or education sectors may be fungible so that the recipient country reallocates funds to other sectors, let us say the military, or road building. Or aid may lead to economic growth, but primarily for high income groups, and thus only have a limited impact on poverty. In recent times we have seen a steep increase in impact evaluations at the project level showing that aid may work in different contexts. But if these projects attract the most qualified personnel both domestically and internationally, then we shall not expect similar impacts on a grand scale. We will thus below focus on two additional empirical questions: 8) Does aid have an impact on poverty reduction. 9) Does aid at an aggregate level lead to improvements in other welfare indicators?

In line with the literature we review, we lump the questions raised above in different sections. First we discuss how foreign aid is initially spent (1). Second we discuss whether foreign aid leads to economic growth, including any measured impacts on the components of national accounts and technological progress (2-4). Third we discuss some mechanisms that may dilute the impact of aid on growth, that is, incentive problems and reallocation of other investments and funds (5-7). Fourth we discuss whether aid leads to poverty reduction (8). Finally we discuss whether aid improves other welfare indicators (9). In the two last sections we will use findings from the aid-growth literature whenever they report on other outcomes, but we will also rely on impact evaluations of large programs that are likely to have impacts beyond the local effects. This report will thus focus on aggregate impacts of aid, while we in other reports have reviewed more localized development policies.

1. How is foreign aid initially spent

In the rest of this report we will discuss how aid may lead to reallocation of other resources, whether by crowding out of private capital, reallocation of government spending, or a reduction in government incomes. All these factors may counteract the impact of foreign aid on GDP and social indicators. Before we go on to that discussion we would ideally cite estimates on how aid is initially spent in terms of salaries, and other direct outlays, as this may help us understand how aid may contribute to economic growth and other outcomes. We have, however, not been able to find any such estimate. We will thus here rely on common knowledge, as is known to anyone who have read the accounts of aid programs. A majority of funds go to salaries, either in the donor country or the recipient country. This will be salaries to everyone from the head of donor agencies, via consultants and researchers who evaluate or analyze aid and development policies and programs, to frontline workers such as teachers, nurses, drivers and administrative staff at different levels of government and NGO bureaucracies. Below we will argue that knowledge transfer is a major part of the positive contribution foreign aid may have on development, and this requires well paid development workers. But we will also discuss how high salaries may lead to a reallocation of staff from private and government sectors to the aid industry, where their contribution to development may be lower than in their previous jobs.

2. The impact of aid on economic growth

One strand of the aid debate is based on econometric analysis of country level data for the last decades. This started with an influential paper by Burnside and Dollar where they found that aid leads to economic growth, but only in countries with good institutions. Oher researchers quickly replicated the analysis, and found that the findings are not robust. This led to a large number of publications, and reviews of these, and the core authors still disagree on the findings 20 years later. Seen from the outside this is surprising. It is a small dataset, with all variables well known. The authors tend to make a point of using the same dataset with the same variables, and thus only differ in the econometric specifications, and we will make an attempt at explaining these differences.

The dataset consists of annual data (in principle from the 1960s or 70s onwards) from countries receiving aid. In principle this means excluding poor countries that did not receive aid, but in reality the opposite problem is larger, that is, inclusion of richer countries receiving small amounts of aid. To avoid this some studies exclude these countries, as they may blur the real effects of aid on development.

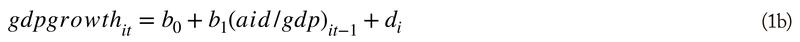

As a first step in the analysis one may correlate the rate of economic growth (gdpgrowth in country i in year t) with aid dependency (aid/gdp), and all the econometric analysis has this as a starting point:

Normally this gives a negative correlation (b1 is negative), since donors may give more aid to poor countries with a low growth rate, but also via a direct effect as high growth will give a high GDP, and thus a lower aid/gdp ratio. This is clearly just a correlation and says nothing about the impact of aid on growth. So what is the next step taken by econometricians to get closer to a causal estimate?

One step is to argue that it takes time for aid to be invested and thus lead to growth. It takes time to build infrastructure, and investments in human capital in terms of education and health may even take decades before it leads to economic growth. The approach taken is to measure lagged aid from some years earlier (symbolized below by year t-1) instead of current aid. Still, this may not solve the challenge of detecting the causal relationship between aid and growth. We know these variables are correlated over time, so that a poor country today was also poor some years ago, so the aid/gdp ratio in the two years will reflect the same underlying variables that also explain the low GDP-growth. One solution is to use aggregate aid over a longer time period, which in turn may affect GDP-growth some years later. We shall see in the results section below that both approaches have been used.

An alternative, or additional, second step is to focus on within country changes, that is, how an increase in aid is associated with a change in the rate of GDP-growth. While a higher aid level within a country assumedly may lead to higher economic growth, there may be other reasons for why aid and growth differ between countries. The solution is to add country fixed effects (symbolized by di for country i) in the regression model:

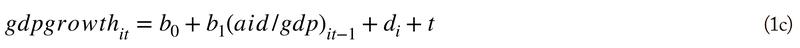

This implies to estimate parallel lines, one for each country, assuming that the effect of aid on the growth rate is the same in all countries. Without the fixed effects there would be only one line through the cloud of data, which will tend to decline faster than the parallel lines, since it goes through the full set of data-points, and thus also reflects variation in the growth rate between countries. A third step will normally be to add year fixed effects as aid dependency may have changed over time for all countries:

Note that if we show the data points in a two-way scatter diagram, these econometric analyses appear to make order in chaos. The data will appear as a cloud, with no apparent relation between aid and economic growth. Even for a single country there appears to be no relation. The R-squared when we run the regression (without lag) for Nepal is 0.01, thus aid explains 1% of the variation in GDP growth. This increases to 5% if we add a squared term (which allows the effect on growth to decline, or increase, as aid dependency increases). In that case aid is associated with a lower growth rate when aid dependency is larger than 6% as it was during the 1980s and 90s. Then as the economic growth increased after the civil war ended the aid dependency declined (as the numerator GDP increased). Since economic growth drives down the aid/gdp ratio we should not interpret this as aid having any effect on growth, there are other factors affecting economic growth, and thus GDP, and as a consequence our measure of aid dependency. And note that this is within a single country, so a country-fixed effect will not solve the problem of spurious correlation between aid and economic growth. Such country specific changes (trends) over time will apply to all countries, which leads us to the fourth step taken by some of the contributions to this literature.

There is a need to establish an exogenous variation in our measure of foreign aid that is not related to the country’s economic growth as in the case discussed above. That is, we need a second econometric model where aid is a function of something else, an instrumental variable (IV), that does not affect economic growth other than via the aid variable. This may be decisions in donor countries that reflects political trends that are completely unrelated to the growth process in recipient countries, such as change in government in donor countries. One first estimates an aid allocation function:

Then one calculates the predicted aid, which removes any other variation in aid levels that could be correlated with economic growth. Finally, the predicted aid level replaces aid in the growth regression above. This procedure adds noise to the analysis, so if one afterwards find that the two estimates for b1 are not statistically different, then one may rather report, and base recommendations upon, the more efficient model where the IV, and thus the aid-regression, is not used. If we believe we have a good IV, then this implies that the analysis has a causal interpretation.

Many of the core contributions to the literature does not report IV analysis. They argue that no convincing IV exists, as all candidates are likely to have an independent effect on economic growth, or the IV estimate gives basically the same results, as just discussed. But if the IV gives the same findings as the standard (OLS) approach, it appears to us that this strengthens the findings, so it is not clear why one would only report the OLS if there are reasonable IVs available. We will discuss some of these below, as the use of IV, or not, explains some of the variation in findings in this literature.

Before we do so, we need to add that the regression models above are always supplemented with other variables that affect economic growth. By controlling for these the negative correlation between aid and economic growth normally turns positive. This reflects that aid dependency is correlated with other variables that affect growth. In our Nepal example this could be the level of civil conflict. As the conflict ended, there was both an increase in aid, and higher economic growth. Without controlling for the conflict level, the parameter for aid could pick up both the direct effect of aid, and the effect of the conflict since that is correlated with the aid level. One may also add aid-squared, as mentioned, to allow for a non-linear relation between aid and economic growth. So if aid is estimated to have a positive effect on growth for low levels of aid-dependency, the marginal effect may decline as dependency increases, and may even become negative for high levels of aid-dependency.

2.1 Identification of causal effects

Turning now to IVs that may affect the aid level, but not GDP in the recipient country, some obvious candidates are donor-specific factors. The election of Donald Trump, let us say, may have led to a reallocation of aid between countries that depended more on donor country priorities rather than the growth performance of recipient countries. This gives us a natural experiment where aid is reduced in some countries, and we can study the impacts. A generalization of this idea is to use variation in government (and in some cases parliament) composition as an IV, or more precisely variation in the number of parties (fractionalization) in government, assuming that many parties increases government spending and thus also foreign aid. This is the identification (of causal impacts) strategy used by Dreher and Langlotz in one of the main articles we will rely on below. Note that this variable alone would give the same shock to all countries that receive aid from a particular donor, so it is weighted with the probability of each country receiving aid from that donor. This idea is motivated by a similar study of the impacts of US wheat production on US food aid, which is used to estimate the impact of food aid on civil conflict. In this case it was not political outcomes in donor countries that affected the aid levels, but in stead wheat production in the US, which also in unlikely to have a direct effect on the economic growth of poor countries, other than via the effect on foreign aid.

An alternative to natural experiments in donor countries, such as election outcomes or wheat harvests, is an IV defined by donor-recipient pairs. The idea here is that countries tend to receive aid for historical, strategic, or ideological reasons. Some of the papers we will rely upon in the results section use colonial history, together with the relative population size of the two countries, as instruments. The argument being that a donor is likely to give aid to previous colonies and to smaller countries, since in both cases they expect to have more influence over the recipient. As for all IVs it is easy to find counter-arguments, as both colonial links and size of recipient country may not only affect aid, but also have a direct effect on GDP-growth. Thus, in our mind, it is the variation in findings below, including the correlation analysis where no IVs are used, that will be informative.

Another alternative IV, which also rely on external conditions, but to a larger extent on recipient country developments, is to focus on a sub-set of countries that passed the IDA threshold of receiving aid. It is found that they in fact receive less aid after they passed the threshold, and as a result economic growth slowed down as compared to a well selected comparison group.

Another analysis on a sub-set of countries is also using external conditions, in this case how changes in the oil price affect aid to Muslim countries relative to non-Muslim countries, and in turn how predicted aid affects economic growth and a number of national accounts components.

2.2 Early results

We will focus on the findings in a few core contributions to the impact of aid on economic growth literature that is based on cross-country regressions. One should maybe expect the findings to converge after decades of research, since they all work on practically the same dataset, and thus should potentially only disagree on some simple technical issues. It is not clear to this author to what extent the methodological choices, and thus the conclusions on the narrow question of whether aid leads to economic growth, is influenced by the contributors view on development aid in general. Researchers may be optimists in different ways. Some may be convinced that foreign aid is needed to help people with health services, education, infrastructure, and in general lift them out of poverty, while others may be convinced that people themselves are best positioned to pull themselves out of poverty. These stands may influence methodological choices. With this warning, we will now focus on the core contributions. For any references to instruments, see the previous sub-section.

One may argue that Burnside and Dollar started this debate. Their regressions were published in a leading journal, the American Economic Review. To avoid fluctuations they aggregated over four-year periods and ended up with a panel of six four-year periods covering 1970-1993. Many of the papers that followed used the same structure to make the analyses comparable. But the more recent contributions tend to add country fixed effects to remove any spurious cross-country correlation between aid and economic growth. With country fixed effects it is not uncommon to measure the variables on an annual basis, quite often with time-lags. Burnside and Dollar used a set of IVs, but with no discussion of why these may be valid, that is, why they are likely not to have a direct impact on growth. To complicate matters further, there is no explicit list of the IVs, one is invited to identify the IVs by comparing two lists of independent variables. The IVs are population size, arms imports, region and a set of variables interacted with their policy variable. They find that the IV estimates are basically the same as in the OLS, indicating that there is no endogeneity bias, assuming that the IVs are valid.

Burnside and Dollar found that aid has, on average, no significant impact on economic growth. But when they interact the aid variable with a measure for good (macroeconomic) policy, they find that aid has a positive effect on growth, and more so in low-income countries. Poor countries are far below the normal (steady-state) growth path, they argue, and with good policy there is a high potential for aid to be saved and invested, and thus contribute to economic growth. In the best case they find that a percentage increase in the aid/gdp ratio will increase the GDP per capita growth rate by 0.47. In their data-set there are very few countries with good policy in this “best case” range, and most of them receive only small amounts of aid, the exception being Botswana. Thus if Botswana had received aid at the 4% aid/gdp level in stead of 5% during the period considered (1970-1993) the prediction would be that the rate of economic growth would be 7% instead of 7.5%, which would give a doubling of incomes in 10 years in stead of nine years.

Many have pointed out that the Burnside-Dollar findings are not robust. A core contribution was by Hansen and Tarp. When they basically replicated Burnside and Dollar they confirmed that on average there is no impact of aid on growth, but their main finding is that adding a quadratic term for aid gives a better fit than interacting aid with the good policy index. They go on to more advanced econometric methods that confirm this finding. They conclude that an increase in the aid/gdp ratio from 6% to 7% will give a one percentage point increase in the GDP per capita growth rate, thus the double of Burnside and Dollar. The quadratic term implies that the marginal effect of aid declines with aid-dependency, and they find that, at least for the Burnside-Dollar specification, the negative slope is within the support of the data, which means that in some countries there is a negative impact of aid on economic growth.

Another influential contribution is by Clemens and co-authors. They argue that no valid IV exists, and thus rely only on OLS estimates, but with lagged aid and country fixed effects (or rather first-differences, which should in principle be the same). They also look at components of GDP that they argue are more likely to be affected by aid. They find that a one percentage-point increase in aid/gdp leads to a 0.3–0.5 percentage-point increase in investment/gdp and a 0.1–0.2 percentage-point increase in the gdp/capita growth rate. The latter is quite modest as compared to Burnside-Dollar and Hansen-Tarp. In line with Hansen-Tarp they also find that additional aid has a negative effect (lowering the growth rate) if aid/gdp is larger than 20%.

Clemens and co-authors claim to reconcile earlier findings. But their paper led to an immediate rebuttal from Roodman arguing that their findings are not robust. With some relatively minor changes in the econometric specifications Roodman finds no significant effect of aid on growth. This analysis is again re-analyzed by Clemens’s co-authors, and they find Roodman’s analysis not to be robust. Roodman himself had at an earlier stage in the debate made attempts to reconcile the contributions, but found that the previous analyses by Burnside-Dollar and others were not very robust. In a similar vein Rajan and Subramanian attempted to reconcile previous studies, and found no robust effect of aid on growth.

To conclude before we go on to the literature that introduces new IVs, it appears to us that the findings are not very robust. The set of IVs used in the early literature appears not to be a major factor, as in many of the specifications the IV and OLS findings are in the same range. The specification of time-lags appears to be more important, as argued by Clemens and co-authors, while Roodman argues that the findings are not sensitive to the lags.

The concavity of the function, however, seems to matter. Aid is more likely to have a positive impact at lower levels of aid, with the contribution becoming negative in aid-dependent countries. Note that by adding a second-order term one will always tend to get a curved function where the upward sloping curve is steeper than a straight line through the same cloud of data. So we should maybe not be so surprised that there will be some effect at low levels of aid. Shall we believe Clemens et al., even these positive effects are quite modest. Keep in mind, however, that most of these contributions also conclude that there are severe problems in identifying the causal impacts of aid, and Clemens et al. do not even attempt to identify valid IVs. Let us now turn to some recent studies that have introduced new IVs to get around the causality problem.

2.3 New instruments

As discussed above the early literature, including Burnside and Dollar, used colonial history together with the relative population size of the two countries, as instruments. The argument being that a donor is likely to give aid to previous colonies and to smaller countries, since in both cases they expect to have more influence over the recipient. But small recipient countries that may still be tied to the colonial power may also have a different growth trajectory, independently of the aid allocations, thus creating a spurious correlation between aid and economic growth. It is hard to find any variable that plausibly can explain variation in aid levels between countries without also having a direct effect on economic growth. As discussed, one partial solution is to add country fixed effects, and focus on variation over time within country.

Galiani and co-authors study countries that have passed the IDA threshold for receiving concessional aid, and argues that this gives an exogenous decline in aid levels, and in turn a reduction in the growth rate. The counterargument is that a country that passes this threshold is more likely to be at the end of a positive business-cycle, and thus would anyhow meet a decline in the growth rate. The authors say they check for this, and find that a one percentage point increase in aid/GNI raises GDP-growth by 0.35 percentage points, almost the double of the upper end of the range reported by Clemens et al.

Since all events in the recipient country may arguably have a direct effect on economic growth, one should perhaps look for changes in aid levels that are independent of recipient countries. This is the strategy followed by Dreher and Langlotz. As discussed they use government fractionalization in donor countries as the IV. This is based on a political economy argument, where countries with many political parties end up with larger government budgets, including a larger aid budget. Linking this to the historical importance of that donor for each recipient countries they get a weighted increase in aid for each recipient that they consider exogenous to events in the recipient country. They find that a one percentage point increase in aid/gdp leads to 0.22 percentage point increase in economic growth, thus within the range of the Clemens et al. estimates. In fact this is not a surprise as Dreher and Langlotz find that the IV estimation is not significantly different from the OLS (with only the more efficient OLS estimates being significant), and Clemens et al. also rely on OLS. In line with Clemens, they also find that the marginal effect of aid is lower at higher levels of aid-dependency.

To conclude: Many economists considered the Clemens et al. paper to have settled the discussion. The conclusion was that aid had a moderate effect on economic growth. This is a bit surprising, since there were no attempts to solve the potential spurious correlation problem by way of IVs. In fact the authors recognized the problem: “Clearly, the fact that increases in aid are typically followed by increases in growth is a necessary but not sufficient condition to demonstrate scientifically that aid causes growth”. But they still argued that aid is the most likely explanation for the economic growth that followed an increase in aid. The contributions that have followed Clemens et al. have attempted to find IVs that can solve the causality problem, with the most recent contribution being the Dreher and Langlotz paper that we have discussed. They found that the IV estimation was not significantly different from the OLS, and in that sense we are back to Clemens et al. The OLS point estimate in Dreher-Langlotz is at the upper end of the Clemens et al. estimates. But if we look at the specifications that creates that range, the one most similar to Dreher-Langlotz is in fact at the lower end. Thus while Dreher and Langlotz find a linear effect of 0.22 (column 3 of Table 2), the comparable estimate in Clemens et al. seems to be (the non-significant) parameter 0.096 (column 4 of Table 7), which is also noted by Dreher and Langlotz.

The corresponding curved concave functions have a turning point at 45% aid/gdp in Dreher and Langlotz and 23% aid/gdp in Clemens et al. The turning point in Dreher-Langlotz is not relevant, as most observations are on the upward sloping part of the curve. The Dreher-Langlotz estimation gives approximately the same increase in the growth rate for the concave and linear functions in the range where we find most of the observations, while the Clemens et al. concave function is more curved, and thus give larger estimates at the lower end. This, in turn implies that within the normal range of the aid/gdp ratio the estimates are in the same range, at about 0.2. Thus a doubling of aid/gdp from 5% to 10%, which would be a large increase in foreign aid, would lead to about a one percentage point increase in the GDP-growth rate, from for example 2% to 3% growth per year. While the former gives a doubling of GDP in 35 years, the latter will give a doubling in 23 years.

This estimate is higher than what is reported by Tarp and co-authors, they say that 10% aid/gdp, assumedly compared to zero aid, is needed to increase the growth rate by one percentage point. Thus the main difference between aid optimists and pessimists appears not to be the point estimates, but rather whether one believes that the findings are robust and have a causal interpretation. Keep in mind that Clemens et al. argue that good IVs are not available, and when Dreher and Langlotz apply IVs their estimates are no longer significant. Although Clemens et al. go on to argue that aid is still the most plausible explanation, others are more critical, and will argue that the estimated positive relation between aid and economic growth is a spurious one. It is not sufficient to say that the increase in aid happened prior to the increase in economic growth, there may be other events that first led to an increase in aid, and later to economic growth, such as democratic reforms, or a peace solution. The literature attempts to control for such variables in the regression analysis, but it is difficult to find variables that measure these changes in a comparable manner across countries. In short, an increase in aid is followed some years later by a noticeable increase in the growth rate (but with large variation between countries), and this increase may or may not have a causal interpretation.

3. The impact of aid on components of GDP

Above we concluded that foreign aid may have an effect on economic growth, depending primarily on how one interprets the fact that an increase in aid appears to be followed by an increase in economic growth. Note that if the interpretation is causal, then it is a very strong finding, as a variable that may contribute to the level of GDP explains the growth in GDP. If aid contributes to increased consumption, and thus production, this will give a very short term growth effect unless there is a continuous increase in the aid level. If aid is instead directly invested, or saved and thus potentially later invested, then production capacity will increase and thus lead to short-term growth. It may also lead to a permanent increase in the growth rate, depending on the underlying growth process. The latter is linked to a broader discussion of whether there is convergence in GDP levels and growth rates over time. If we believe poorer countries will grow faster than richer ones, due to decreasing marginal returns, then the growth rate may increase in the short run (if investments increase in response to an increase in foreign aid), but then potentially decline at a later stage.

A recent review of the convergence literature concludes that there is no convergence, poor countries are still lagging behind, while other studies indicate that there is a recent trend of convergence. While the literature may disagree on convergence, a common denominator in the economic growth literature is that foreign aid is rarely mentioned as a relevant factor for economic growth. The literature is still relevant, if foreign aid in fact leads to increased investments, without crowding out private or government investments. On top of any increase in investments, there may be technical progress, which makes those investments more productive. Thus any estimated impact of aid on economic growth in a cross-country data-set will reflect a number of growth episodes as different countries move to a higher growth path. In this process aid will affect consumer spending, savings, investments and technical progress. And since most aid is spent on salaries, the initial effect will be an increase in consumer spending. Do we find these expected results in the empirical literature?

Dreher and Langlotz investigate exactly this issue, and find that there is an increase in investments (which is also found in Clemens et al.). Furthermore, Dreher and Langlotz find that aid increases private consumption, which is as expected since aid is to a large extent financing salaries. They find no effect on savings and government consumption, and a negative effect on net export. The latter is easily explained, since aid comes as foreign currency and will thus lead to increased imports (and by that a decline in net-export). That government consumption is not affected may reflect a reallocation to government investments, or a reduction in tax levels as less funds are needed when aid is received. The increase in investments and private consumption are likely to increase short term growth, and for the case of investments potentially also the long term growth rate.

The point-estimate for the increase in investments is larger than the estimate for the growth rate, but this is as expected. In fact, if there is no crowding-out of foreign aid, then a one percent increase in aid should on average give a one percent increase in the GDP components, while there is no reason why the GDP growth rate should increase by one percent. Private consumption increases more than one percent, while savings barely change, indicating that foreign aid is consumed, rather than saved. The increase in private consumption may still lead to an increase in domestic production via Keynesian multiplicator effects, which in turn may explain the increase in investments.

In principle these effects on components of foreign aid may be spurious correlations, similar to the overall correlation between aid and the growth rate. For example, a democratic reform may lead to more aid and also economic reforms that in turn leads to investments and economic growth. An increase in import would, however, be an automatic consequence of the increase in aid as foreign currency will have to end up abroad, but this effect is not necessarily linked to economic growth.

4. Aid and transfer of technology

In standard growth models there may be a declining return to capital, which means that any initial investment, due for example to an increase in foreign aid, will later be compensated by a reallocation of capital to other countries where capital is more productive on the margin. In more recent growth models it has been pointed out that there may be positive externalities with the return to capital being far from diminishing, which in turn may explain that some countries end up in poverty traps as capital moves to the capital rich countries. As discussed above there may be a more recent reversal of this trend with many poor countries now taking off on a steeper growth path. In both types of models, transfer of knowledge may contribute to economic growth, and some of that knowledge may be embedded in foreign aid, either in terms of human capital, of for example aid workers, or embedded in the physical capital.

Transfer of knowledge is a main factor in economic growth in poor countries. One review concluded that: “For most countries, foreign sources of technology account for 90 percent or more of domestic productivity growth”. And the review argues that productivity explains a major part of income differences between countries, with reference to earlier research by Easterly and Levine that argue that the technology factor we just discussed above explains much more of the variation between countries than capital accumulation. Technology diffusion comes in terms of imported goods, both goods for consumption and physical capital. There may also be transfer of knowledge by way of human capital as people return from education and jobs abroad. One channel for technology transfer is FDI, with its own extensive literature. A relatively recent mega study finds that FDI leads to transfer of technology, although publication bias implies a tendency to overstate the effects.

Foreign aid is rarely discussed as a factor in this literature, but the mechanisms should be the same. That is, aid will have a larger impact on economic growth if it comes with new technology and the knowledge necessary to utilize that technology, as well as new ways to utilize existing resources. This includes the service sector, and also government services. In the health sector, to take an important example, new vaccines should be integrated in local health systems that ideally are upgraded in parallel with training of existing staff and recruitment of well trained new staff.

5. Crowding out effects

Why are some researchers, and even policy makers, skeptical to foreign aid? Isn’t it just a reallocation of funds from the rich to the poor? There are in principle three reasons why this is not the case, which all are variations on crowding out:

a) Crowding out of private firm activities

b) Crowding out of government activities

c) Crowding out of labor efforts

By crowding out we mean that the initial increase in resources to a particular sector by way of foreign aid leads to a reallocation of other resources. In extreme cases there may be full crowding out. An example will be aid to a sector where the market is mature and fully covered by existing firms. Microfinance may be an example, where one may support informal economic activities, such as petty trading in urban areas.

5.1 Crowding out of private firm activities

A number of aid agencies support so-called private sector development. Some of this support intends to correct market failures, including support for public goods that would otherwise be under-funded. But large amounts are going directly to private firms. In Norway these grants goes primarily via Norfund, the investment fund that received 5% of Norwegian ODA in 2020 as grants. Norfund says they invest in profitable firms, thus assumedly firms that are credit rationed, since they need additional funds. Before we go on to discuss the likely degree of credit rationing, and thus the potential need for funds in different industries and locations, we will point out that the rationale for using ODA grants to support firms that are expected to be profitable is very problematic. If the firms are profitable, then the development fund should be profitable in the long run, and thus have no needs for grants. One may imagine that a start-up capital was needed, but Norfund has now received ODA grants for more than two decades.

Credit rationing may be the result of asymmetric information, that is, the potential lender is not as well informed as the borrower about the borrower’s profitability. This is an intrinsic problem, which will be more serious the further away the financial institution is located. The way around this would be for the international institution to finance local financial institutions, such as microcredit institutions, or local banks. Norfund, and similar development finance institutions (DFIs), has this as one of their strategies, while they also support firms directly.

Another source of credit rationing will be market power, in some countries there are few banks, which may even collude on high interest rates. In some African countries, such as Malawi, Mozambique, Uganda and Tanzania the real interest rate, according to the World Development Indicators (WDI) data, is in the range of 15-20%, which is far higher than what we observe in the international capital market. Malawi, for example, have two banks that dominate the market, and it does not help that most of the competitors are foreign owned, they all benefit from the large difference between savings and lending rates. This contrasts with Botswana, Niger, Benin and Senegal, where the real interest rate is in the range of 5%, similar to most Asia countries. But also in countries where the interest rates are relatively low, there may be local market power, in particular in remote rural areas.

If development banks are able to get around the market imperfections that create local market power, for example by financing micro credit programs, then we may expect crowding out to be less of a problem. The DFI will provide new funds, and hopefully finance profitable businesses that would otherwise not exist. The returns on the investment could then finance other development programs within the same aid budget.

If the DFI instead finance businesses in competition with private, or other government, financial institutions, including other DFIs, then there is likely to be crowding out. In a fully competitive market, with interest rates near those found in international financial markets, there will be full crowding out. The supported firm would have been financed independently of the aid financed DFI, and if this is a new firm in a mature market, then it will take over market shares from other firms. A typical example of the latter will be a microcredit program that help women start a small shop in a village where there are already multiple shops, which is not uncommon.

We have already discussed the impact of foreign aid on domestic investments in the GDP-component section, where it was found that aid appears to increase domestic investments. But when it comes to aid to the private sector, then the FDI literature is also relevant. In this literature there has been a debate similar to the aid-growth literature, that is, whether FDI will give a one-to-one increase in domestic investments, or whether there is some degree of crowding out. The conclusion seems to be that there is some degree of crowding out. Instead of analyzing the impacts of foreign aid and FDI separately, one may compare different forms of finance, and how they affect domestic investments. One study compared investments across different types of funds, including foreign aid and domestic savings. As we may expect, domestic sources are the most effective in financing domestic investments. FDI was found to have a smaller effect, while in this study foreign aid and remittances had no statistically significant effect on domestic investments.

To conclude, direct support to private firms is likely to partially crowd out domestic firms, and even if there is no crowding out it is hard to defend the use of grants (instead of loans) to support profitable economic activities that should be able to raise funds from domestic sources that will be better informed about each firm’s profitability. But are there alternative ways of supporting private sector development? One may consider to reallocate more of these funds to finance public goods and other investments where there are large fixed costs. The latter may be hydropower, which is a priority of Norfund, in addition to electricity transmission lines, roads and other infrastructure. Priority should be given to very poor countries that may otherwise not be able to raise the necessary funds to cover large fixed costs. Beyond this, one may provide credit where it is likely to overcome market imperfections and thus contribute to new economic activities. This is far from straightforward as the development banks will meet the same information problems as other financial institutions. But again, efforts should be made to add credit and thus counteract existing market concentration in remote areas where it is more likely that a few lenders dominate the market.

5.2 Crowding out of government activities (fungibility)

Money is fungible. Thus any increase in foreign aid to a particular sector may be met with a reallocation of, or reduction in, domestic funds. The local government will have its own priorities both in terms of domestic tax-burden and allocation of local and donor funds between sectors. If the donors provide less funds to a particular sector, let us say primary education, than the local government would do by itself, then there is room for full fungibility. The local government may reallocate funds to other sectors, and the donors would achieve the same as with a general budget support.

In an influential contribution, using data for 1971-1990, it was found that earmarked loans for agriculture, education, and energy reduce domestic resources going to these sectors, while loans to the transport and communication sector were fully spent on the purposes intended by donors. Expanding the period to 2000, another study finds a higher degree of fungibility: At the aggregate level a one percentage-point increase in the aid-to-GDP ratio is associated with an increase of only 0.3 percentage point in total government spending, thus 70% of total aid is fungible. This number is even higher for investment aid, with 80-90% being fungible. A recent study expands the period to 2012, and confirms the findings, 80% of total aid is fungible, that is government expenses increase by only 20% and thus leads to a reduction in domestic taxes, or a reduction in the need to borrow. This study also provides a good review of other contributions.

The most optimistic contribution basically refutes all these negative findings, but without any reference to the rest of the literature despite being a review. It is, for example, argued that the impacts on domestic taxation are not robust with reference to a non-published working paper that in turn is a critique of Benedek et al. that we cite above. While there is no reference to Marć, Chatterjee et al., or Feyzioglu et al. As Marć points out, a reduction in tax levels may be efficient, as taxes can be distortionary. Fungibility in the sense of reallocation between sectors may, as Morrisey points out, be effective. The local government may know better than donors where aid is needed. Still the general finding in the literature is that there is not full fungibility between sectors, aid allocated to a sector tend to stick to that sector, even if the budget is relatively small. This means that the receiving government could in principle reallocate the same amount to other sectors, but it appears to stick. This is named the flypaper effect.

To conclude, aid receiving governments are likely to respond to an increase in foreign aid by reducing international borrowing and by adjustments of domestic taxes, thus as a result domestic spending will not increase with the same amount as the aid received. Furthermore, the receiving government may reallocate some of its own budget away from sectors they find less important than the donors. The latter is an argument for budget support, which should be weighted against the donor’s need to follow own priorities. One may well imagine that local governments will prioritize infrastructure development, while donors put relatively more weight on local governance, civil society, health and education among marginalized groups.

5.3 Crowding out of labor efforts

Donors have a tendency to compare local wages in aid funded programs with salaries paid to international staff. This implies that local staff in aid agencies may be paid multiple times what the same people may earn in the local market, whether that is in the private or government sectors. This problem applies also to irregular staff hired on short term contracts, and NGO activists scrambling to get a part of the aid budget. If the aid sector jobs contribute comparably more to social welfare in the receiving country this would not be a problem. The obvious concern is that local jobs in both private and government sectors are probably at least as important for social welfare as jobs in the aid industry. While we may risk that the best qualified people are tempted to work for higher wages in the aid agencies, despite the status permanent local jobs may give. Additional complications come from the fact that jobs abroad are also an option, and not only those facilitated by aid agencies. Thus aid agencies do not only compete with local employers, but also international ones.

In principle there is thus a market with four options in this high-end of the labor market: a normally permanent job in the government sector, a slightly better paid but not necessarily permanent job in the private sector, a job abroad, or a potentially equally well paid job in the aid industry. The main focus in the literature has been on the general issue of a potential brain-drain, that is, the choice between domestic and foreign jobs. One study is, however, linking international and local brain-drain, although in both cases via recruitment into aid agencies. Some contributions point out that migrants earn more, and are thus able to send back funds to be invested at home. They may also return with new knowledge that will contribute to both businesses and the society at large, and thus creating a brain-gain instead of a drain.

The findings from the brain-gain literature may be relevant for jobs in the aid-industry. It gives extra incomes that, as we have discussed above, give Keynesian multiplicator effects if the aid workers are based in the receiving countries. In theory the aid workers may also gain new knowledge they can bring with them if they transfer back to local jobs, although there is a risk that this will be knowledge that is more useful for rent-seeking activities. In general rent-seeking is a concern. Large parts of foreign aid comes as projects, and there is a large NGO sector set up only to benefit from this aid.

A core underlying problem is that aid agencies compare local wages and payments to NGO and other project workers to the salaries of international staff. There is, as mentioned above, regular coverage of the unfair salary differences between local and international staff in the media covering the aid industry. On top of this comes a demand for the use of more local staff, so there is an upward pressure both on the number of people hired and the salary level. The aid agencies should consider to revise the strategy of hiring local staff. The obvious alternative is budget support, with the local government spending the aid funds on regular salary payments. This may allow for slightly better wages for government employees that may otherwise end up in the private sector.

Now, budget support has its own problems. Large amounts allocated to a Ministry may in principle open up for corruption, but smaller amounts also allow for corruption, and if one on top of this can avoid extensive rent-seeking activities, the total loss may be smaller. And budget support is of course fully fungible, unless one is able to enforce strict conditionality, which may in turn counteract the underlying idea of budget support. But if the focus is on keeping the best people in the government sector, rather than in the aid industry, then the appropriate strategy is to combine modest salaries in the aid industry with direct support to government sector salaries.

6. The impact of aid on poverty reduction

We will cover two relevant strands of literature. The first builds upon the aid and growth literature, as poverty reduction will follow economic growth unless only the higher income groups benefit. Thus any cross-country study of the impact of aid on growth may in principle add poverty as a dependent variable, and some studies have done so. We shall see in the next section that some studies also report on other social welfare indicators.

The second strand focuses on particular programs for poverty reduction, which may, or may not, be funded by foreign aid. While this report focuses on aid, and not development programs in general, we still add a core finding from the impact evaluation literature, as it regards some very large programs that may be costly, and thus in need of funding, and at the same time have macro-level impacts and thus may successfully replace competing uses of aid. Now, of course, there is a risk that programs become less effective if aid agencies take over, but that is hardly an argument against the programs themselves, but rather an argument for funding existing programs.

6.1 Country level evidence on aid and poverty reduction

For poverty to decline we need an increase in the incomes of the poor. This can be a direct result of an increase in foreign aid, even if the increase does not lead to higher economic growth: also at a constant growth rate there will be an increase in incomes every year, and if this also applies to people just below the poverty line, then poverty will decline. Thus one may in principle find that aid leads to poverty reduction and not to an increase in the growth rate. So a modest target of maintaining economic growth, even at a low level, will in the long run lead to poverty reduction as long as the poor take part in the growth process. In fact, if programs are designed to target the poor, this may come at the expense of a lower growth rate as budgets are normally limited. Thus there may be a trade-off between, let us say, direct cash transfers to the poor, and new infrastructure. Some will even argue that transfer programs limit work-incentives, and thus have a negative impact of growth beyond the budget effect. So we may find that aid leads to poverty reduction, while the growth rate stay the same, or even decline.

The normal case is, however, likely to be a combination of economic growth and poverty reduction. The speed at which economic growth leads to poverty reduction depends on who benefits from the growth process. If the growth takes part in labor intensive industries, where China is a leading example, then wages are likely to increase in the long run as labor becomes a scarce resource. In many countries we observe that economic growth is followed by an increase in inequality, as in the upward-sloping part of the Kuznets curve. With an increase in inequality the growth rate also has to be much higher to give the same poverty reduction. India is a case in point. Despite decades of economic growth, there was for long a discussion of whether poverty in fact declined. The debate was settled in favor of poverty reduction, but a modest one. Going beyond India, we may imagine that foreign aid contributes to higher growth via for example investments in infrastructure that primarily benefit the non-poor. This was the motivation for the shift in development strategy in many donor countries away from large-scale infrastructure towards a focus on basic needs.

Any cross-country analysis of the relation between foreign aid and poverty will thus reflect a variation between countries in the development over time in foreign aid, economic growth, inequality and poverty levels. As a result we should maybe not expect to find solid evidence for a relation between foreign aid and poverty reduction at the aggregate level. There are not many available studies.

Finn Tarp and co-authors are considered aid optimists, but in their core paper on aid and poverty there is barely any significant relation between the two. They report that aid leads to an increase in the growth rate in line with what we have reported earlier, a one percentage increase in aid/GDP leads to a 0.3 percentage point increase in the growth rate. This is based on a parameter that is barely significant (at the 9% level). The corresponding effect on extreme poverty is significant at the same level, with two other reported estimates not being significant. The variables are transformed, so one cannot read more out of the tables, but the authors say that 5% aid/GDP will reduce poverty by as much as 15 percentage points. We recall from the aid and growth section that the same team concluded that 10% aid/GDP would give a one percentage point increase in the growth rate. Now over a time period these numbers may be consistent. But one may wonder whether the estimates imply that an increase from zero to 10% aid/GDP will give a 30%-point decline in poverty.

Now, we need to keep in mind that the number of years covered by the data is essential, since one year of economic growth, even if constant, will lead to an increase in incomes, and thus potentially poverty reduction. The data is covering 37 years, so in principle one can imagine even a 30%-point decline in poverty if the growth rate is increased by one percentage point. As discussed earlier an increase from 2% to 3% growth implies that incomes double in 23 years instead of 35 years.

Another study reports that a one percentage increase in aid/GNI gives a 1.8 percentage decline in poverty. The estimated model is on log-form, so we cannot directly compare the estimates to the percentage point estimates above. Others report much lower, and not significant, parameters. Most of the authors that do not find an effect on economic growth do not go ahead and estimate the effect on poverty, as we may expect. But if we believe that aid leads to economic growth, then it is not unlikely that aid also leads to poverty reduction. In conclusion, whether we believe that aid leads to poverty reduction will depend on whether we believe that the increase in economic growth that follows an increase in foreign aid in fact has a causal interpretation.

6.2 Project level evidence on aid and poverty reduction

As mentioned, this report does not review the full impact analysis literature that would provide evidence on the effects of programs, potentially aid funded, on poverty reduction. We will focus on what we consider the largest remaining challenge, village level poverty in remote areas. Most poor people live in rural areas, although they are not necessarily working in agriculture. Policies that may help people escape poverty depend on whether they live among mostly non-poor, where the labor market will be an essential mechanism, or they live among other poor people in remote areas. In the first case we expect trickle down policies to work. In Nepal, for example, we have seen a decline in poverty as unskilled wages have increased due to lack of labor, which in turn can be explained by massive outmigration for work. Policies that promote economic growth, preferably in labor intensive industries, and potentially combined with safety nets for those who may not be able to enter the labor market, will target this group. The decline in poverty in China, and now in South Asia, is of this type.

In the next decades most poor people will live in Sub Saharan Africa, according to World Bank estimates. And the majority of them live in remote rural areas. Poor people who live in villages where most people are poor are likely to be in a village level poverty trap. They meet multiple constraints, and tackling only one at a time may not be sufficient to pull people out of poverty. Access to credit is normally one constraint, and some people may be so poor that even regular payments on a loan will be beyond their reach due to subsistence level incomes. The variation in income over seasons and years adds to their burden as they may need to save, quite often in terms of livestock, to be able to meet bad times in the future, or they may depend on powerful people in the village for loans and help in case of need. This implies a need for a combination of insurance, basic income, access to basic assets including livestock, and access to credit. There is normally also a need for improved market access, and investments in human capital in terms of both basic education and different types of skill training, including agricultural extension services.

The solution, which seems to be successful, is so-called graduation, cash-plus, or multifaceted development programs. These aim to simultaneously overcome the multiple constraints, or market failures, discussed above, including lack of credit, subsistence constraints, access to insurance, lack of knowledge, and market access. These programs have now been implemented in many countries, and evidence from large scale randomized control trials (RCTs) indicate that they have long term impacts on poverty reduction, as well as other welfare indicators. In the short to medium term (three years) the programs increase households’ net worth, income, consumption, and health. Some of the programs have now been studied for 10 years, and show continued impacts on the same indicators, including spillovers on people who were not targeted. It is also found that if one drops some of the program components, then they may not work.

7. The impact of aid on welfare indicators

Even if aid may not lead to increased incomes, as reflected in economic growth and poverty reduction, it may still be justified as a means to improve education and health outcomes. In fact many aid programs have this as the core success criteria. Norway, as well as other donors, prioritize primary education, improved health systems, reproductive health, vaccinations, nutrition, food security, and other outcomes that may be achieved even at modest growth rates. If so, then an increase in the growth rate, as discussed above, may not even be a goal. In fact some of the other outcomes seem to be relatively independent of incomes, malnutrition (as measured by stunting), for example, seems to be delinked from income levels. A study based on DHS data from 36 countries find small to null association between GDP per capita and different measures of malnutrition. Malnutrition has stayed particularly high in India, a country that have seen decades of economic growth, although the situation has recently improved. It is found that for India malnutrition is particularly a problem among later born children, which is found to be consistent with son-preference.

Since there is not necessarily a relation between income growth and other welfare indicators, we will have to return to the cross-country literature for any empirical evidence. Some of the studies that reports on GDP and poverty also report on other indicators. Arndt, Jones, and Tarp report on a number of indicators. We recall that they found relatively large effects on economic growth and poverty reduction, although the latter was barely statistically significant. They find a significant effect on years of schooling, but not at the primary level. While they find no significant effect on mortality rates, except for infant mortality in one of their specifications (and only significant at the lowest level of significance).

One study looks at aid allocated to education. We recall our discussion of fungibility, which implies that we may have an effect of any aid on different outcomes, even if there is no effect of aid allocated to a particular sector on outcomes within that sector. Still it is found that aid to education, in contrast to aggregate aid, improves primary school enrollment (and completion). Thus with disaggregated data, aid has an effect on primary education, in contrast to the findings above.

Another study looks only at aid allocate to the health sector. It is found that aid to the health sector improved infant mortality, but the authors say the effect is small, a doubling of health aid will give a 2% reduction in infant mortality. For the average country in their sample this means that an increase in health aid from USD 1.6 to USD 3.2 per year will give a reduction from let us say 75 deaths per 1000 births to 73.5 deaths.

We have in this report relied mostly on cross-country evidence. There is now geo-coded data available for analysis at the project level, which we believe will lead to more research in the future. There are not many studies available yet, but one study focuses on infant mortality within Nigeria. It is found that aid projects, with only a few of them being health projects and the largest group being within agriculture, contribute to a decline in infant mortality near the project sites. Note that this study is very different from studies of aggregate aid, since any project implemented at the national level is not included. A general conclusion can be that aid disaggregated by sector, or by geo-location, appears to have a significant effect on health and education outcomes.

8. Conclusions

Foreign aid provides foreign currency to developing countries in line with FDI and remittances. As all foreign currency, aid will ultimately end up abroad, but may in the meantime create economic activities in the receiving country. As most aid comes as salaries, both in receiving and donor countries, these Keynesian multiplicator effects may in fact be the most important ones. Increased consumption of goods and services may, however, in turn lead to investments that add to the direct investments of foreign aid. Similarly, the savings made by employees in the aid sector will add some small fraction to other domestic savings, which is the main source of finance is poor countries. In sum these effects explain why cross country studies find that aid contributes to domestic investments. There is also an increase in private consumption, while aggregate government consumption, in contrast to investments, appears not to increase. As expected, foreign currency ultimately end up abroad by way of import, explaining a significant decline in net-export.

Consistent with the increase in investments it is found that aid is followed a few years later by an increase in the rate of economic growth. There is no agreement on whether this increase has a causal interpretation. An increase in the rate of growth will in fact be a very strong result. One may well imagine that aid increases incomes, and thus potentially leads to a decline in poverty, even at a constant growth rate. There are not many studies that look at the relation between aid and aggregate poverty levels, but those that exist indicate a positive effect. There is, however, strong evidence that more targeted aid towards village level poverty traps, so called multifaceted anti-poverty programs, does have an effect.

Similar to incomes among the poor, one may also see impacts on other welfare indicators, even if aid has no impact on the rate of economic growth. Even at modest economic growth, and maybe more so in relatively poor countries, one may find that aid has a positive impact on other outcomes. In particular there is evidence that there is not full fungibility of aid, and aid targeted to education and health seems to stick and have positive impacts on schooling and modest impacts on infant mortality.

Magnus Hatlebakk