VAT receipt lotteries: Can they increase tax revenues in Sub-Saharan Africa?

Introduction: VAT is underperforming in Sub Saharan Africa

The research project: understanding and improving VAT compliance in Tanzania

How to cite this publication:

Odd-Helge Fjeldstad, George Hellar, Ephraim Mdee, Ingrid Hoem Sjursen, Vincent Somville (2021). VAT receipt lotteries: Can they increase tax revenues in Sub-Saharan Africa? Bergen: Chr. Michelsen Institute (CMI Insight 2021:8)

Value Added Tax accounts for about a fourth of all tax revenues in Sub-Saharan Africa (SSA), but studies show that there is potential to collect substantially more revenues from the VAT in most countries in the region. Non-compliance is a major challenge facing revenue administrations in SSA. VAT receipt lotteries are increasingly being used as a tool to improve compliance and enhance tax revenues in countries outside Africa. This brief describes the idea behind VAT lotteries, experiences from different countries, and discusses prospects and challenges for introducing such schemes in Sub-Saharan Africa, with a particular focus on Tanzania.

Introduction: VAT is underperforming in Sub Saharan Africa

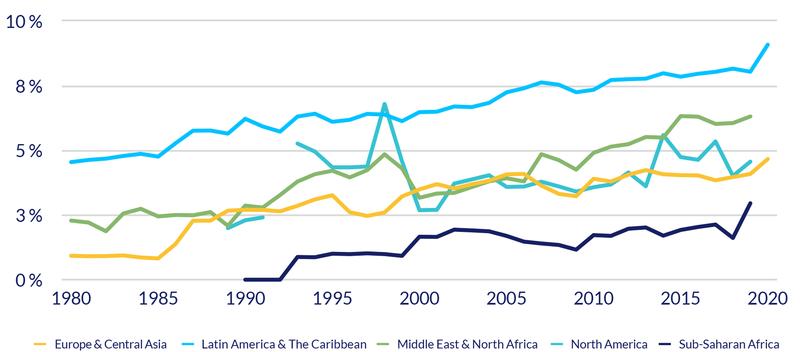

Value Added Tax is a consumption tax on goods and services (for more details see Box 1). It is now in place in more than 160 countries, including most of Sub-Saharan Africa (Keen, 2013; IMF, 2021). Figure 1 is based on the UNU-WIDER Government Revenue Dataset (2021) and show average VAT revenues in percent of GDP by world regions in the period 1980–2020. The figure shows that VAT has become more important in all regions during the last 20 years. Figure 1 also shows that Sub-Saharan Africa is the region with the lowest collection of VAT measured in percent of GDP. Analyses by the International Monetary Fund (IMF, 2021) show that countries in Sub-Saharan Africa collect less VAT revenues than their potential when taking level of consumption and VAT rates into account (IMF, 2021). Thus, VAT is significantly underperforming with respect to revenue generation in the region. This low performance can be explained by both policy factors (such as extensive use of exemptions) and compliance factors.

Box 1: Value Added Tax (VAT)

VAT is a tax levied on sales of commodities at every stage of production. It is added on the purchase price for the buyer, and the seller gains tax credits to offset any taxes previously paid on inputs. Because the sellers can only realize tax credits on their inputs if they have an invoice for the taxes paid, VAT gives sellers incentive to collect the tax and pay it to the government, and to trade with other formalized firms (Keen and Lockwood 2010; Cnossen 2015). This creates a paper trail for transactions along the production chain and provides the government with essential information. When transactions are observed, collection and enforcement of taxes becomes easier. VAT is therefore argued to increase compliance. Because of this built-in incentive for businesses to demand receipts from their suppliers, VAT is often referred to as “self-enforcing” (Kopczuk and Slemrod 2006; Pomeranz 2015).

However, the self-enforcing property of the VAT often breaks down at the final stage of the supply chain, where a sale is made to an end-customer that cannot claim a deduction on taxes paid and does not have an incentive to ask for the receipt, which will typically imply a higher price. If a receipt is not issued at this final stage, the government cannot observe and enforce the tax, the seller does not have an incentive to ask for a receipt on inputs from suppliers, and non-compliance trickles up the supply chain.

The research project: understanding and improving VAT compliance in Tanzania

Tanzania’s tax-to-GDP ratio is well below the average of low income countries, and lower than the average for the countries in the East African Community. The country’s low revenue performance is, according to the International Monetary Fund, mainly driven by the low VAT collection (3.3 percent of GDP compared to the 4.4 percent average of the EAC countries between 2011 and 2013) (IMF 2016). In an ongoing research collaboration we are studying VAT compliance of businesses in Dar es Salaam. Like other countries in Sub-Saharan Africa, Tanzania has been striving to improve their VAT collection by improving tax compliance (…). An important aspect of these efforts was the introduction of Electronic Fiscal Devices (EFDs) in 2010. The EFDs are electronic tills that record and transmit data on sales transactions directly to the tax administration systems. It is mandatory for businesses above a certain threshold to acquire and use EFDs to register all business transactions. The aim of their implementation was to reduce administrative and compliance costs for both the tax administration (TRA) and for the businesses, and to improve VAT compliance through ensuring more accurate reporting of VAT.

In the first phase of our project, we studied to what extent businesses in Dar es Salaam are complying with the EFDs and the factors explaining differences in compliance between businesses. To do this, we surveyed 314 VAT-registered businesses obliged to use EFDs.

For each business, we randomly selected a customer leaving the business premises to check if they had received a receipt printed from the EFD. This way, we could directly observe each business’ compliance with the EFD. Overall, we found that 75% of the businesses in the sample used the EFD to register the transaction we observed. Among these, we found that customers played an important role in determining whether a receipt was issued or not: 30% of the salespersons only issued a receipt after they were prompted by the customer. This finding suggests that motivating customers to ask for EFD receipts could be a powerful tool in increasing compliance with the EFD, and ultimately compliance with the VAT (see Box 2).

Box 2: Tax Compliance, VAT Revenues and Business Development in Tanzania

In the project we will conduct a randomized field experiment with a lottery. VAT receipts are used as tickets in the lottery, and the probability of winning is proportional to the amount spent. The idea is that increasing the issuance of EFD receipts will make more information about transactions available to the government. This, in turn, makes enforcement easier, and is therefore expected to increase VAT compliance. In addition to studying the effect of the lottery on tax revenues, we will examine the effect of taxation on business development by investigating how the VAT affects the prices paid by the customers, business outcomes and formalization. The project is funded by the Research Council of Norway and implemented in collaboration between Chr. Michelsen Institute and the Research, Policy and Planning Department of the Tanzania Revenue Authority.

VAT lotteries

One way to motivate taxpayers to ask for EFD receipts is to introduce VAT lotteries in which EFD receipts double as tickets in a lottery to win a prize (see also IGC, 2021) for an overview of other relevant forms of consumer incentives). The idea is that the prospect of winning the prize gives customers an incentive to ask for the receipt, thereby inducing salespersons to use the EFD to register the transaction.

VAT lotteries have so far been implemented in several countries (see IGC (2021) and Burger & Schoeman (2021) for overviews), but few studies have investigated their effects on VAT compliance and revenues. An exception is a study from Brazil where Naritomi (2019) finds that businesses’ reported sales increased by 21 percent, and tax revenues by 9 percent, over a period of 4 years after the implementation of the lottery. Furthermore, a study by Wan (2010) finds a positive effect of the VAT lotteries on sales reported and tax revenues in China. In Portugal and Slovakia, VAT evasion decreased after the introduction of VAT lotteries. However, in both countries, several other policy changes were implemented simultaneously with the lottery, and we cannot say if the reduction in evasion was due to the lottery or the other policy changes, or both (Fenchietto & Benitez 2021).

To our knowledge, Rwanda is the only country in Sub-Saharan Africa that has attempted to implement a VAT lottery. Research on the effect of the lottery on revenues reported and VAT revenues collected has not yet been published. However, according to a policy brief by IGC (2018), the implementation faced some challenges. First, many customers were not aware of the lottery. Second, many consumers reported that requesting a VAT receipt led to salespersons charging a higher price. Third, consumers reported that they would be more willing to participate in the lottery if it offered smaller, but more frequent prizes.

Thus, while some studies suggest that VAT lotteries can be a useful and self-financing tool in increasing VAT compliance and revenues, we still lack knowledge about whether and when they work. Furthermore, existing research has not investigated whether and how VAT lotteries affect other outcomes that are important for economic development and revenue generation, such as prices and formalization.

An opportunity to increase VAT revenues in Tanzania?

In the second phase of our project, we will implement a VAT lottery in Tanzania. To evaluate the effects of the lottery, we will randomly select some areas (group A) in which taxpayers will be part of the VAT lottery, meaning that their customers can participate in the lottery by requesting EFD receipts when they trade with them. In other areas (group B), taxpayers will not be part of the lottery. We can then compare income reported and VAT paid by taxpayers in group A and taxpayers in group B to evaluate whether the lottery is successful in increasing VAT revenues.

Some challenges and potential pitfalls need to be carefully considered in the details of the design of the lottery. First, as highlighted by the Rwandan experience, it is crucial that customers are aware of the lottery for it to have an impact on their behavior. Thus, advertising the lottery is a crucial part of a successful implementation. Second, it should be easy to participate in the lottery, to obtain information about winners and prizes and to collect prize money. Third, the frequency and size of lottery prizes need to be calibrated to make it attractive for customers to participate in the lottery. Forth, for increased use of EFDs to translate into increased VAT revenues, the tax administration needs to have the knowledge and capacity to use the information recorded to follow up with non-compliant taxpayers and enforce compliance. Fifth, there is a risk that even if a VAT lottery scheme is initially effective in increasing compliance, it may not persist over time.

VAT lotteries have had promising results in Brazil and China, and if the challenges outlined above are addressed in a good way, a VAT lottery in Tanzania can potentially increase VAT revenues substantially.

References

Burger, M. & Schoeman, A. (2019). VAT lottery incentives: An opportunity for South Africa? South African Journal of Accounting Research, 35(2), p. 111-129

Cnossen, S. (2015). Mobilizing VAT revenues in African countries. International Tax and Public Finance, 22(6)

Fjeldstad, O-H., Kagoma, C., Mdee, E. Sjursen, I.H., & Somville, V. (2020). The customer is king: Evidence on VAT compliance in Tanzania. World Development, 128

IGC (2021). Consumer incentives for VAT. Website.

International Monetary Fund [IMF] (2021). Value Added Tax. Tax Policy Assessment Tool (TPAF). Website.

International Monetary Fund [IMF] (2016). United Republic of Tanzania: Selected Issues. International Monetary Fund African Dept. Country report, No. 16/254

Keen, M. (2013). The anatomy of the VAT. IMF Working Paper WP/13/111.

Keen, M. & Lockwood, B. (2010). The value added tax: Its causes and consequences. Journal of Development Economics, 92(2), 138-151

Kopczuk, W. & Slemrod, J. (2006). Putting firms into optimal tax theory. American Economic Review, 96 (2): 130-134.

Naritomi, J. (2019). Consumers as tax auditors. American Economic Review, 109(9), 3031-72.

Pomeranz, D. (2015). No Taxation without information: Deterrence and self-enforcement in the value added tax. American Economic Review, 105 (8), 2539-3569

UNU-WIDER Government Revenue Dataset (2021). Version 2021. https://doi.org/10.35188/UNU-WIDER/GRD-2021

Wan, J. (2010). The incentive to declare taxes and tax revenue: The lottery receipt experiment in China. Review of Development Studies, 14(3).

Odd-Helge Fjeldstad

George Hellar

Ephraim Mdee

The TaxCapDev-network (phase III)