Most people are not economists: Citizen preferences for corporate taxation

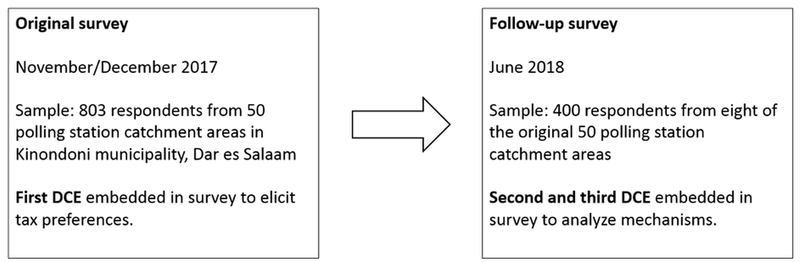

Figure 1. Structure of data collection

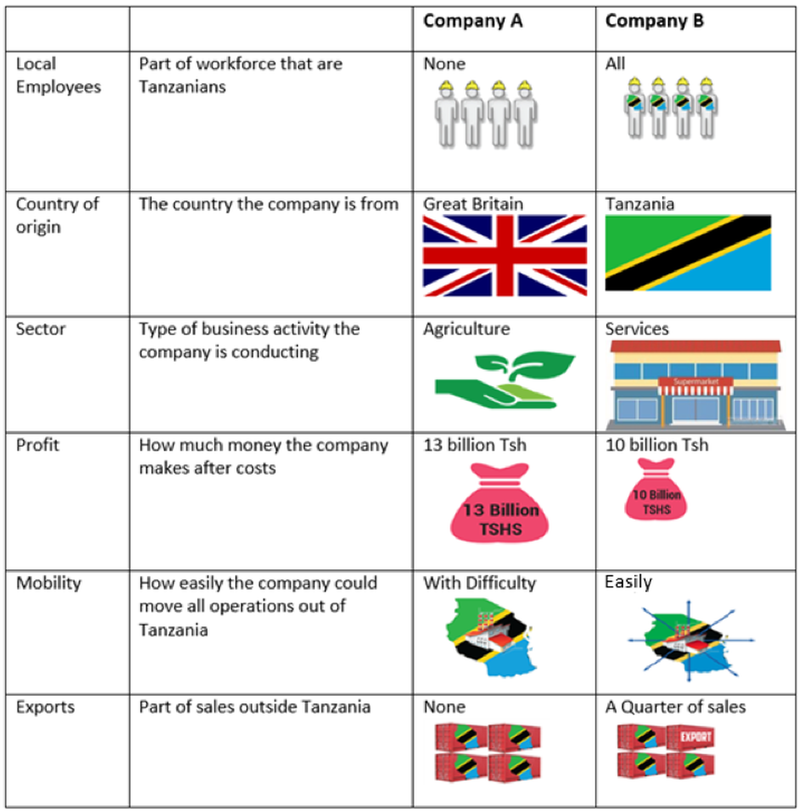

Table 1. Attributes, levels and variable names of first discrete choice experiment

Table 2. Results first discrete choice experiment. Odds ratios from conditional logit estimation

Figure 3. Sample comparison second discrete choice experiment

Table 3. Results second discrete choice experiment. Odds ratios from conditional logit estimation

Figure 4.Sample comparison third discrete choice experiment

Table 4. Results third discrete choice experiment. Odds ratios from conditional logit estimation

Appendix A. Definitions and descriptive statistics

Table A 1. Summary statistics for respondent characteristics, original survey

Table A 2. Attributes, levels and variable names, second DCE

Table A 3. Attributes, levels and variable names, third DCE

Appendix B. Additional results

Table B 2. Results from mixed logit estimation of first DCE

Table B 3. OLS regressions of inequality aversion index and risk aversion index on gender

General structure of questions used to construct inequality aversion index:

How to cite this publication:

Odd-Helge Fjeldstad,Ivar Kolstad,Arne Wiig (2018). Most people are not economists: Citizen preferences for corporate taxation. Bergen: Chr. Michelsen Institute (CMI Working Paper WP 2018:11)

On what bases should corporations be taxed? This article presents evidence from a series of discrete choice experiments designed to elicit the tax preferences of ordinary citizens. We find that respondents favour higher taxes on more profitable companies, but not high enough to make taxes progressive. Moreover, respondents prefer higher taxes on more internationally mobile companies, which is at odds with well-known results from optimal tax theory. The experiments were conducted in Tanzania, making this result all the more striking as developing countries are particularly sensitive to location decisions of corporations. We also find that citizens favour lower taxes on companies that have more local employees, and higher taxes on foreign owned companies compared to domestic ones. The latter result is not due to perceived differences in local or foreign employment or other local impacts, suggesting a strong home bias in respondent preferences. Furthermore, we find significant gender differences. Men appear more efficiency oriented in their tax preferences. Both men and women are primarily in favour of companies that offer employment to their own gender, and male respondents focus more on job growth than on job security. The results have important implications for debates on the legitimacy of tax policies.

Introduction

One of the gravest challenges to state and public policy legitimacy of our time is the continuing reduction in corporate taxation resulting from the high international mobility of and competition for capital. Reduced capital taxation has the potential to greatly increase inequality, and undermine the social contract on which our societies are based. The literature on tax competition largely suggests that international tax competition is negative, resulting in reduced tax bases with which to fund necessary public goods (Wilson, 1986; Zodrow and Mieszkowski, 1986). However, from the point of view of any individual country, optimal tax theory points out that taxing corporations according to the inverse of their geographical elasticity will lead to the highest level of GDP, and lower taxation of more mobile firms may hence be rational for the individual country (Sørensen, 2007; Devereux et al., 2008). While a number of studies argue that the welfare consequences for ordinary citizens of reduced taxation on mobile firms are negative compared to a better coordinated international tax regime, there is little systematic study of the extent to which citizens agree or disagree with low taxes for mobile capital. One possibility is that while citizens see the negative sides of such a policy, they might view it as a necessary or unavoidable strategy to remain competitive in an increasingly globalized economy.

This paper presents the results from a series of discrete choice experiments designed to elicit the views of citizens on the appropriate bases for corporate taxation. The experiments were conducted among ordinary citizens of Kinondoni municipality in Dar es Salaam, Tanzania. In the first of our experiments, respondents were presented with pairs of hypothetical companies differing on a number of attributes including international mobility, profitability, sector, local employment, country origin, and export orientation. They were asked to choose which of the pair of companies ought to be taxed the highest, and from their responses we could then analyse which of the attributes affected tax choices and how. The results show that respondents do not agree with the implication of optimal tax theory discussed above; in fact, they prefer significantly higher taxation of more mobile corporations. Moreover, our approach ensures that this is not due to a perceived correlation of mobility with profitability, sector or foreign ownership, which might otherwise confound our results. For the other attributes, we find that respondents favour higher taxes on more profitable companies, but at a rate of increase that makes taxes regressive rather than progressive. Moreover, we find strong preferences for lower taxes for companies with many local employees and for higher taxes for foreign owned companies. There are also a number of significant differences across gender in terms of tax preferences, which we study further in two additional discrete choice experiments. Male respondents seem more efficiency oriented in their choices, respondents from both genders solely or predominantly favour companies that provide employment opportunities for their own gender, and men have a relatively stronger preference for job growth over job security.

The choice of a developing economy as the location for our experiments provides a strong test of the level of agreement between citizen preferences and optimal tax theory, since these economies are particularly sensitive to the location decisions of footloose industries employing highly interchangeable unskilled labour (Goldberg and Pavcnik, 2007). If the citizens of any economy should be concerned about tax disincentives to mobile corporations, we should find them here. As a matter of policy, the Tanzanian tax regime incorporates substantial tax incentives to attract mobile, international investors, in the form of tax holidays and reduced tax rates (Moore et al., 2018). Whether citizens agree with such preferential treatment is unclear; our results suggest they do not. To the extent that citizen preferences are well-founded and informed, this apparent clash creates challenges not just for the legitimacy of tax policy, but also for the policy advice often offered by economic professionals. Several qualitative studies argue that economists tend to act as advocates or entrepreneurs of efficiency in their advisory work (Schultze, 1982; Nelson, 1987), and given our results, efficiency-based recommendations to lower taxes on mobile capital seem democratically problematic or at the very least require further deliberation and justification. We show in a separate experimental paper that providing information on citizen views on the taxation of mobile corporations, changes the views of economic professionals on the appropriate design of tax policy (Kolstad et al., 2018). This demonstrates the importance and potential impact of mapping citizen preferences on economic policies in the manner done here.

More broadly, our results complement an experimental literature examining whether efficiency or equality considerations drive people’s distributive choices. The conclusion appears to be that efficiency is important for economists, but relatively unimportant for everyone else (Fehr et al., 2006). We contribute to this literature by examining the efficiency-equality trade off in choices not involving individual subjects in a lab setting, but corporations, and in a context where the explicit focus is on public policy. Our results for the profit attribute suggest that efficiency considerations may play a larger role in this type of setting, as regressive taxation leads to increases rather than reductions in inequality. As noted, though, our respondents do not appear to endorse efficiency arguments related to mobility. Our results across gender are broadly consistent with findings from lab experiments as summarized in Croson and Gneezy (2009). While both men and women prefer regressive corporate taxes, our female respondents exhibit less regressive preferences, suggesting a greater emphasis on equality over efficiency compared to men. The greater emphasis on job growth over job security among men is also consistent with findings of lower risk aversion in males.

A considerable literature suggests that the presence of multinational corporations confer important advantages on host economies, in particular in terms of knowledge transfer (Markusen and Venables, 1999). Our results, however, suggest that our respondents do not seem to agree that attracting foreign corporations is particular important, preferring instead to tax them more heavily than domestic ones. These findings speak to ongoing debates about the distribution of gains and losses from globalization (Stiglitz, 2002; Lakner and Milanovic, 2016), and international electoral trends towards protectionism (Autor et al., 2016). We document that widespread protectionist sentiments towards trade (Mayda and Rodrik, 2005) also extend to tax policy preferences. Interestingly, we find no difference in views of Western and emerging market corporations in our data, British and Chinese companies are taxed on a par according to our results. This is relevant to the extensive literature on the relative merits of Western and Chinese companies in promoting development in host economies (Kolstad and Wiig, 2012; Busse et al., 2016; Chen et al., forthcoming), and suggests that citizens of the economy we study do not perceive much of a difference.

Our discrete choice experiment approach explicitly permits analysis of how respondents trade off different tax subject characteristics in reasoning about appropriate tax burdens. We see this as an advantage over the approach used in Fisman et al. (2017), where respondents are asked to set appropriate tax rates for one taxpayer at a time. We also modify the standard discrete choice experimental approach, by including a second, continuous outcome variable, which allows us to study preferences towards progressivity. While we focus on corporate taxation, the approach can be equally useful in studying preferences towards other types of taxes, such as the personal income tax. Ballard-Rosa et al. (2017) use a discrete choice experiment to analyse respondent choices between tax systems characterized through tax rates for different income brackets and revenues generated, but the approach has to our knowledge not been used to elicit preferences over other taxpayer characteristics. Analyses of this kind are of obvious importance in increasing the perceived fairness of taxation, which a number of studies links to tax compliance (Spicer and Becker, 1980; Luttmer and Singhal, 2014; Besley et al., 2014). Our study is conducted in a developing country context where creating a legitimate tax system has been argued to be particularly important for state building processes, however, fairness in taxation seems key to the social contract of any society. In addition, we add to the literature on gender and taxation, which has predominantly looked at gendered impacts of tax policies (Keane, 2011; Fuest et al, 2018) rather than gender differences in tax preferences.

The article is structured as follows. Section 2 includes a brief conceptual framework. Section three presents our empirical approach and data. The main results from our first discrete choice experiment are presented in Section 4. Mechanisms behind the results are discussed in Section 5 using findings from our second and third discrete choice experiments. Section 6 concludes.

Conceptual framework

The idea that public opinion of taxation and the “ideal” taxation models of economists may differ substantially, in particular in the case of corporate taxation, was noted by Sheffrin (1994). Classic models of optimal taxation typically assume a social planner with a Bergson Samuelson social welfare function `W(v^1, ... ..., v^h)` which is increasing in the direct utilities of the h individuals. This general formulation incorporates both efficiency and inequality concerns, the latter through an assumption that individual marginal utilities are decreasing in income or consumption. The social planner is hence welfarist consequentialist, with utilitarianism as a special case of additive aggregation with equal weights. For the case of commodity taxes, the optimal tax is a function of an efficiency term reflecting the effect of taxes on labour supply, and an inequality term reflecting social marginal utilities of the individuals involved (Diamond, 1975; Atkinson and Stiglitz, 1976). A corresponding formulation for income taxes is provided in Dixit and Sandmo (1977).

These models do not assume that the social planner is democratic, but if we take this to be the case, a number of studies suggest that the weight placed on inequality would be sufficiently high to lead to progressive taxation for persons (McCaffery and Baron, 2004; Hennighausen and Heinemann, 2015; Ballard-Rosa et al., 2017). Models of optimal corporate taxation tend to focus on efficiency concerns through a representative agent assumption (Sørensen, 2007). However, in principle a similar type of trade-off with equity can be imagined as in the case of personal taxation. Efficiency in the corporate case is related to effects of taxes on investment, while effects of profits on the wealth of owners would be the corresponding inequality concern (in addition to tax incidence effects which we discuss below). Preferences of citizens towards corporate taxation do not appear to be extensively studied. In theory, there are possible differences in the efficiency – inequality assessment that may lead to views of corporate taxation that differ from personal taxation. Firstly, if owners of corporations are generally wealthier than people exposed to personal income tax, diminishing marginal utility of income means that a redistribution of a dollar in corporate taxes yields less of a redistribution of utility. This in itself may make views of appropriate corporate taxation less progressive. Secondly, if capital is more elastic to taxation than labour, this entails a high efficiency loss which also points in the direction of less progressive taxes on corporations. Thirdly, the type of citizens we study have little or no investment in the corporate sector, which means that self-interest does not come into making tax allocations between pairs of companies. Again, this suggests less progressive views on corporate taxation than on personal taxation. We test preferences for progressivity in corporate taxation through the profit attribute included in our company comparisons.

When we control for profits, international mobility of corporations becomes a pure efficiency issue. From standard models of optimal corporate taxation, even if we include an inequality element, the implication should hence be that mobile companies should be taxed less heavily than immobile ones. If we find preferences to deviate from this, this suggests that standard models are missing some element that is part of popular preferences. Several possible motives could lead to higher taxation on mobile firms. One is that people tax not just the realization of corporate income, but also the options available to tax subjects, a form of tax on positive freedom. Another possibility is that citizens reward companies that are likely to remain in a country, or indeed invest in staying put if mobility is seen as a choice. While it may be difficult to discern the precise underlying motivation, the inclusion of mobility alongside profits in our experiment provides a test of whether the assumptions of the standard models are valid as a representation of popular preferences.

If citizens are utilitarians, the nationality of a corporations (and hence its owners) should matter for imposed taxes only to the extent that owners from one country are wealthier than those from another country (and this is not reflected in the profit attribute). In our case, this could provide a reason for lower taxation of Tanzanian companies than foreign companies. However, this type of reasoning should also lead to a differentiation of taxes between foreign companies, Western companies should pay more than companies from emerging economies such as China or India. By including all three types of companies we are able to address this possible mechanisms through our experiment. In the more general formulation of the social welfare function used in optimal tax models, it is possible that citizens place higher weights on domestic owners than foreign ones. This could be for relational reasons, such as a shared nationality, or identity-based reasons. By including origin of companies in our experiment, we test for these types of effects, and also try to distinguish national favouritism in preferences from other beliefs in local impacts of foreign companies.

In principle, tax incidence concerns could also affect the choices of our respondents, with lower taxes imposed on the corporation believed shift less of the tax burden onto workers or consumers through wages or product prices. Fuest et al. (2018) point out that fair wage and efficiency wage models predict stronger negative wage effects of a corporate tax increase on more profitable firms, and find empirical support for this prediction using German data. In theory, this could be an additional argument to expect less progressivity in views of corporate taxation. Moreover, Fuest et al. find smaller effects on wages of tax increases for foreign-owned firms, which they relate to their greater ability to shift profits across jurisdictions. In our case, this should lead to lower taxes on foreign compared to domestic firms. In our context, however, it seems unlikely that respondent rely on such relatively complex arguments about tax incidence, and we therefore do not place much emphasis on these types of mechanisms. The general absence of incidence arguments in expressed tax preferences is also noted by Sheffrin (1993).

For sub-groups of a population, tax preferences can be expected to track their impact on a particular group. However, the limits to incidence considerations suggest that impact and preferences may not track each other perfectly, and tax preferences may also reflect other considerations than the self-serving. Given the findings of substantial differences of tax impacts on labour market decisions and outcomes for men and women (Keane, 2011), analysing differences in gender preferences for taxation is important. Differences in socio-economic characteristics across gender, such as occupation and related skills, may lead to different assessments of the effect of taxes on local employment depending on whom the jobs are perceived to be available to. Moreover, to the extent that foreign companies bring in foreign workers, labour market competition theories of migration would suggest that a more negative view of foreign companies in the group that is in more direct competition with foreign workers (Scheve and Slaughter, 2001). In terms of taxes on profits, greater inequality aversion in women would lead us to expect them to have more progressive taxation preferences than men. An alternative way of viewing the tax allocation task posed to our respondents, however, is as an investment decision by the state in the two different businesses. It is well known from other contexts that women tend to pursue more conservative investment strategies (Charness and Gneezy, 2012). A different, more subtle reason, for expecting female respondents to choose higher taxes for profitable (and perhaps also internationally mobile and outward oriented) corporations, could be a perception that these types of companies carry greater risk. In the following, we explore gender differences in preferences and their relation to socio-economic differences and inequality and risk preferences.

Data and empirical strategy

The data collection was conducted in two stages, as illustrated by Figure 1. An original survey was conducted in November and December 2017, with the aim of using a discrete choice experiment embedded in a survey to elicit the preferences of Tanzanian citizens on the appropriate bases for corporate taxation. For the original survey, we randomly selected 50 polling stations in Kinondoni municipality in Dar es Salaam from the 2010 general elections. From each of these locations, eight enumerators fanned out in pre-specified directions on maps downloaded to the tablets used for data collection, interviewing a randomly selected member aged 18+ from regularly spaced households along the way, resulting in a sample of just over 800 respondents. Based on the results of the original survey, we designed a follow-up survey to analyse underlying mechanisms. This survey contained a second and third discrete choice experiment in addition to other survey data. The follow-up survey was implemented in June 2018 in eight polling stations randomly sampled from the original 50, using a similar sampling procedure around each station. A total of 400 respondents were interviewed for the follow-up survey.

Figure 1. Structure of data collection

In the first discrete choice experiment, we randomized respondents into ten blocks, and presented the respondents in each block with a series of eight company comparisons of the type shown in Figure 2. Two companies, A and B, were described in terms of the six attributes listed in the first two columns. The full set of levels for each attribute is presented in Table 1, and the comparisons or choice sets presented to the respondents were chosen through an efficient design approach based on prior estimates from a pilot conducted in February-March 2017. Since literacy levels are low among many of our respondents, we used symbols to represent the various attribute levels, as illustrated in Figure 2. The order or attributes were randomized across blocks to avoid order effects.

For each pair of companies, respondents were asked two questions:

- “Which of these two companies do you think should pay the most in taxes?”

- “If you were to distribute 100 million TSh in taxes between the two companies, how much would you take from company A?”[1]

Responses to these two questions form the basis for our two dependent variables. The first question is a standard discrete choice formulation, resulting in a dichotomous dependent variable. In keeping with the discrete choice experiment literature, we focus our presentation of results around this dependent variable. The second question is more novel in this type of experimental approach, resulting in a continuous variable ranging from 0 to 100. There are two reasons for adding this second dependent variable to our experimental design. The first reason is that when answering the first question, it is possible that respondents think that choosing one company over another for the heaviest taxation will result in larger total tax receipts. The second question avoids this by asking respondents to extract a fixed sum of taxes from the two companies. The second reason is that a choice of which company to tax the heaviest, does not tell us whether or to what extent our respondents favour regressive or progressive taxation. Taxing a company with higher profits more heavily can be consistent with both regressive and progressive taxation preferences, if we do not know how much more heavily respondents think the more profitable company should be taxed, we cannot tell whether the tax rate in their opinion should increase with profits. The second dependent variable allows us to calculate this.[2]

Table 1. Attributes, levels and variable names of first discrete choice experiment

| Attribute | Explanation | Levels | Variable name | Variable type |

| Profits | How much money the company makes after costs | 10 billion TSh | Profits | Continuous |

| 11 billion TSh | ||||

| 12 billion TSh | ||||

| 13 billion TSh | ||||

| Mobility | How easily the company could move all operations out of Tanzania | Easily | Mobile | Dummy |

| With difficulty | (omitted category) | |||

| Sector | Type of business activity that the company is conducting | Manufacturing | Manufacturing (sector) | Dummy |

| Mining, oil, gas | Mining, oil gas (sector) | Dummy | ||

| Services | Services (sector) | Dummy | ||

| Agriculture | (omitted category) | |||

| Local employees | Part of workforce that are Tanzanians | None | Local employees (share) | Continuous |

| Half | ||||

| All | ||||

| Country of origin | The country the company is from | China | China (country of origin) | Dummy |

| Great Britain | Great Britain (country of origin) | Dummy | ||

| India | India (country of origin) | Dummy | ||

| Tanzania | (omitted category) | |||

| Exports | Part of sales outside Tanzania | None | Exports (share of sales) | Continuous |

| A quarter of sales |

The design of our experiment generates 16 observations for each respondent (eight choice sets, two companies in each), which brings the number of observations to 12848. We use conditional logit estimation to analyse the effect of the attributes on our first dichotomous dependent variable, with the attribute variables specified as reported in Table 1. Our main specification is:

`Pr(y_(ijt) = 1|x_(ijt) ) = F(alhpa + x_(ijt) beta)` (1)

where is our dichotomous dependent variable and the vector of attribute levels for individual i’s choice set j and alternative t. This is essentially a logit estimation with fixed effects at the choice set level, where F is the cumulative logistic distribution In addition to our main specification, we also run estimations where we interact the vector of attributes with respondent characteristics, notably gender, in order to study heterogeneous effects of attribute levels. We stress that our analysis of gender differences in preferences is explorative, providing a starting point for analysing what lies beneath heterogeneous tax preferences, rather than attributing the differences to gender per se.

For our second and continuous dependent variable, we use a standard panel data approach with fixed effects at the choice set level (essentially using the options in each choice set as the “time” dimension). The main specification can be written as:

`z_(ijt) = alpha_(ij) + x_(ijt) beta + epsilon_(ijt)` (2)

where is the amount of taxes assigned to alternative t in individual i’s choice set j. To assess whether our respondents favour progressive taxation, we test whether the coefficient for the profit variable is greater than a critical value x calculated by setting the tax rate equal in for the two extreme values of profits.[3] Notice that in our estimations, we measure profits in billion TSh, so the coefficient and critical value x reflect the million TSh in taxes levied on an additional billion TSh in profits. Hence, with all sums expressed in million TSh, taxation is progressive if the tax rate at 10 billion TSh is lower than the tax rate at 13 billion TSh, i.e. if:[4]

`(50 - 1.5 x) / 10000 <= (50 + 1.5x)/13000` (3)

The cut-off value x for progressive tax preferences is hence:

`x >= 4.35` (4)

If the coefficient on profits is significantly higher than this value, the tax difference between high and low profit firms is large enough for taxation to be progressive, if the coefficient is significantly lower than x, the difference in taxes is too small and hence regressive.[5]

The second and third discrete choice experiments included in our follow-up survey, and designed to capture additional detail and mechanisms behind the results from the first DCE, are different in content from the first DCE, but similar in structure. For both these subsequent DCEs, the dependent variable is dichotomous, and we use estimations analogous to that given in equation (1). For ease of exposition, however, we present the details of these two additional DCEs in Section 5, after the results from the first DCE have been examined in Section 4.

In addition to the discrete choice experiments, both surveys included a number of standard survey questions which allow us to provide descriptive information on our respondents, test for heterogeneous effects, and provide additional tests and supporting information for our results and underlying mechanisms. For our original survey, Table A1 in Appendix A provides descriptive statistics on the background of our respondents. The background of our respondents is fairly typical of the poor, urban context in which we are conducting the study, with a substantial proportion working in the informal services sector. Respondents are young with an average age of 34 years, and while it is most common to have only completed primary education, nearly 50 per cent have secondary or tertiary education. In terms of wealth or assets, 89 per cent of respondents are from households that own a radio, 85 per cent a tv, 35 per cent a motor vehicle, and the mean household has a 4-room dwelling. There are significant gender differences in the sample, in particular in household headship status and occupational categories.

Main results

Our main results are presented in the first column of Table 2. The results are presented in terms of odds ratios rather than coefficients from the conditional logit estimation, to ease interpretation. In other words, estimates above one for a variable mean that a company with the corresponding characteristic is more likely to be chosen as the one to tax more heavily, estimates below one make the company less likely to be chosen. The results show that our respondents prefer more profitable companies to be taxed more heavily. This suggests an egalitarian bent in our respondents, however, since the results using our first dependent variable does not say anything about amounts levied on high and low profit companies, we cannot from this conclude that respondents favour progressive and hence inequality-reducing taxes. While the amount of tax increases with profits, its proportion may not. Our results using our second dependent variable sheds light on this, and the results are presented in Table B1 in Appendix B. These in fact show that our respondent prefer corporate taxation to be regressive. As noted earlier, for taxation to be progressive in our case, a one billion TSh increase in profits would have to lead to an increase of the taxed amount of more than 4.35 million. The coefficient for profits is much smaller than this at 2.45 million, and statistically significantly so (p=.0000). The imposed tax amounts for the different levels of profits in our case hence results in regressive rather than progressive taxation. This is consistent with respondents making trade-offs between equality and efficiency/incentive considerations in expressing tax preferences.

While efficiency considerations may shine through in tax choices related to profits, this is not the case for mobility. Our respondents manifestly disagree with the implication of optimal tax theory that mobile companies should be taxed less heavily, and instead prefer them to be taxed more heavily. The result suggests 23 per cent larger odds of choosing a mobile company for higher taxation, compared to the odds for choosing a less mobile company (the excluded category). The results using the second dependent variable in Table B1 are consistent with this, suggesting almost 3 million TSh higher taxes are preferred for a mobile over a less mobile company. This result is not due to an association of mobility with differences in profitability, sector, employment created, geographic origin, or exports, as these are all controlled for in the analysis. Several reasons for the result are possible. A simple egalitarian reason would be that people associate mobile companies with wealthier owners, but this is likely captured by the profits attribute. As discussed above, another possibility is that the respondents tax options rather than simply the current economic situation, a redistributive tax on positive freedom. Alternatively, to the extent that mobility is viewed as a choice, our result may also reflect a reciprocity motive where companies that are seen as loyal or invest in some form of commitment to the domestic economy. In terms of economic activity, that generated by mobile companies may be seen as more risky and unstable, reflected in a tax premium on mobile companies. Some interesting implications of these findings seem to be that there is little popular support for hold-up policies, where taxes are increased if a company makes country-specific investments. Moreover, the result is an interesting one in light of the widespread use of incentives to attract footloose manufacturing industries to low income countries (Moore et al., 2018).

Some of the strongest effects, however, we see for local employment and the origin of companies. A company whose workforce is entirely local has one-third the odds of being selected for higher taxation than a company whose workforce is completely foreign. Moreover, foreign owned companies have 80 per cent higher odds of being taxed more heavily than domestic companies (the excluded category), with little difference between Chinese, British or Indian companies. There is hence a strong home bias in our results, in terms of employment created and in terms of ownership.[6] The favouritism could be based on preferences for international redistribution in taxing companies from richer countries more heavily. However, in that case we should see a significantly higher odds ratio for British companies than for Chinese and Indian ones, which we do not. The result could also reflect other greater perceived local impacts of domestic companies than employment. In the second DCE, we test these mechanisms more carefully, and provide additional evidence that country of origin matters per se, rather than these other mechanisms. We also provide further evidence on how deep the home bias runs in our respondents, estimating the willingness to pay terms of jobs our respondents would sacrifice to keep a local establishment Tanzanian rather than foreign (see section 5).

Table 2. Results first discrete choice experiment. Odds ratios from conditional logit estimation

| (1) | (2) | (3) | (4) | |

| Sample | All | Male respondents | Female respondents | All |

| Dependent variable | Company choice | Company choice | Company choice | Company choice |

| Profits | 1.185*** | 1.133*** | 1.247*** | 1.247*** |

| (0.02) | (0.02) | (0.03) | (0.03) | |

| Mobile | 1.234*** | 1.148*** | 1.338*** | 1.338*** |

| (0.03) | (0.05) | (0.05) | (0.05) | |

| Manufacturing | 1.195*** | 1.247*** | 1.165** | 1.165** |

| (0.06) | (0.09) | (0.08) | (0.08) | |

| Mining | 1.541*** | 1.704*** | 1.452*** | 1.452*** |

| (0.08) | (0.13) | (0.10) | (0.10) | |

| Services | 0.973 | 0.975 | 0.968 | 0.968 |

| (0.05) | (0.07) | (0.06) | (0.06) | |

| Local employees | 0.352*** | 0.271*** | 0.435*** | 0.435*** |

| (0.02) | (0.02) | (0.03) | (0.03) | |

| China | 1.800*** | 1.629*** | 2.035*** | 2.035*** |

| (0.10) | (0.13) | (0.16) | (0.16) | |

| Great Britain | 1.858*** | 1.751*** | 2.042*** | 2.042*** |

| (0.10) | (0.13) | (0.15) | (0.15) | |

| India | 1.810*** | 1.729*** | 1.966*** | 1.966*** |

| (0.09) | (0.12) | (0.13) | (0.13) | |

| Export share | 2.546*** | 1.643*** | 4.017*** | 4.017*** |

| (0.27) | (0.26) | (0.60) | (0.60) | |

| Male*Profits | 0.908*** | |||

| (0.03) | ||||

| Male*Mobile | 0.858*** | |||

| (0.05) | ||||

| Male*Manufacturing | 1.071 | |||

| (0.11) | ||||

| Male*Mining | 1.173 | |||

| (0.12) | ||||

| Male*Services | 1.007 | |||

| (0.10) | ||||

| Male*Local employees | 0.623*** | |||

| (0.07) | ||||

| Male*China | 0.800** | |||

| (0.09) | ||||

| Male*Great Britain | 0.857 | |||

| (0.09) | ||||

| Male*India | 0.879 | |||

| (0.09) | ||||

| Male*Export share | 0.409*** | |||

| (0.09) | ||||

| Pseudo R2 | 0,069 | 0,120 | 0,064 | 0,092 |

| N | 12848 | 6400 | 6448 | 12848 |

Note: Odds ratios from conditional logit estimation, robust standard errors in parentheses, *** indicates significance at the 1% level, ** at 5%, * at 10%.

For the other attributes, the fact that our respondents want to tax mining companies the highest (the differences to all the other sectors are significant at p=.0000) is not surprising. While this is in line with economic theory stressing heavy taxation of natural resource rents, it more likely reflects respondent views of the minerals extracted as being nationally owned, and a history of mining in African countries where local benefits are perceived to be minor and adverse effects substantial (Berman et al., 2017). More surprising is the fact that citizens want to tax manufacturing industries more heavily than other industries, and companies that export higher than companies that do not. This is at odds with a development literature that sees manufacturing as a key sector in generating employment, and in increasing productivity and growth (Kaldor, 1967; van Wijnbergen, 1984; Rodrik, 2013). It also clashes with ideas of export-led growth as the appropriate strategy for development of a country economy (Balassa, 1978). The preference for higher taxes on manufacturing over services and agriculture (the omitted category) could in our case reflect the fact that most of our respondents work in the informal services sector, and have a close connection to agriculture through kin, history, and culture. The tendency to tax companies that export higher is more puzzling, but could reflect a historical political emphasis on import substitution and self-reliance (Coulson, 2013; Lofchie 2014; Gray 2018).

The last three columns of Table 2 suggest significant gender differences in tax preferences. For ease of exposition, we provide results for the subsamples of male and female respondents in columns two and three, respectively, and for the full sample with interaction effects for male respondents in column four (where the main effect of gender is included in the fixed effects). While the former two and the latter columns are essentially different representations of the same analysis, the former two columns provide immediate information on whether each of the attributes has a significant effect on company choice for each subgroup, whereas column four provides information on whether the effects for male and female respondents are significantly different. As the results in columns two and three show, the results for each of the subsamples are qualitatively similar to those of the full sample in column one. The same company attributes drive company choices, and in the same direction. However, as seen in the fourth column, male respondents more aggressively favour lower taxes for companies with higher local employment than female respondents. Moreover, while men also favour higher taxes for profitable, mobile, foreign, exporting companies, they do so to a significantly lesser extent than women. For our second dependent variable, columns two and three in Table B1 show that both men and women have regressive preferences for corporate taxation (p=.0000 and p=.0021, respectively). However, male preferences are more regressive, a gender difference which is statistically significant (p=.0001, not shown in Table B1).

The uncovered gender differences are remarkably robust to including additional interaction variables of attributes with respondent asset and skill levels and occupational background, suggesting that they to a limited extent reflect socio-economic differences between men and women in our sample.[7] Nevertheless, an important question is whether these results reflect some systematic differences in preferences, or merely the context of the choices we present to the respondents. The results on local employment could reflect less emphasis among women on local job creation effects of taxation. However, if there is a perceived or real difference in labour market attachment or possibilities between men and women, and the employment attribute in our experiment are seen as primarily jobs for men, another explanation of our results could be that men have a stronger preference for promoting male jobs than women do. Similarly, the result that men are less likely to impose greater taxes on foreign (or to be precise, Chinese) companies could reflect more of a home bias among women than men. However, additional survey questions on national favouritism suggest no such difference; Table B3 in Appendix B documents no significant gender difference on a national favouritism index constructed from three survey questions. An alternative explanation is that women and men may perceive local impacts of foreign and domestic companies differently, and when these are controlled for, the difference in home bias may change. In our second DCE, we test these different explanations for gender differences in employment and country origin emphasis, by introducing new choice situations including the necessary distinctions.

Moreover, the relatively lower odds of taxing profitable, mobile, export companies among our male respondents suggest that they place a greater weight on efficiency over equality compared to the female respondents. In our follow up survey, we collect additional information to analyse whether this is the case. As noted in Section 2, a different, more subtle reason for these differences could, however, be that our respondents perceive more profitable, geographically mobile, outward-oriented companies as taking on greater risk. One possibility is then that the relatively higher taxes imposed by women on the high performing, internationally oriented firms reflects a greater preference for safety and stability, compared to risk and growth. In our third DCE, we hence explore whether there is greater emphasis on employment growth over job security or stability among male respondents.

Mechanisms

Our second discrete choice experiment (the first of two such experiments included in our follow-up survey) was designed to analyse the following issues; the strength of the preferences for favouring national over foreign companies, the extent to which these preferences are based on national origin in itself rather than other local impacts respondents might associate with them, and the reasons and robustness of the gender differences suggested by the first DCE, focusing on different views of local employment and national origin of companies. To these ends, we subjected our respondents to comparisons of the kind presented in Figure 3. While the second DCE contains the same number of attributes as the first one, it is simpler in only including two levels for each attribute, the levels being the ones presented in Figure 3.[8] In terms of structure, the second DCE was similar to the first, with respondents randomized into ten blocks, in which they face eight successive comparisons of companies, and with the order of attributes randomized across blocks.

The choice put to respondents after each comparison in the second DCE was the following:

Assume these companies produce the same thing and pay the same wages to their employees. If only one of the companies could be given a licence to set up production in your ward, which one would you give the licence to?

We posed the question this way in order to force a choice between companies of different origins; choosing to give the licence to the Tanzania-owned company entails sacrificing the local presence of the Chinese-owned company, and vice versa. Moreover, the levels of the local employment attributes were presented in number of employees, rather than share of the workforce as in the first DCE. This allows us to calculate how many local jobs (male and female) respondents are willing to sacrifice to have a domestically owned company set up shop locally, rather than a Chinese-owned company. In other words, we estimate the willingness to pay for domestic ownership of local employers in terms of local jobs. The higher this willingness to pay for domestic ownership, the stronger is the home bias. We chose to focus on companies setting up production in the home wards of respondents in order to make the question more relevant to them; this is an establishment that could hypothetically offer them an employment opportunity. The total number of local jobs range from 100 to 200 in the comparisons, which means that the companies would be quite substantial employers in Kinondoni wards which number around 50,000 inhabitants[9] of whom a little more than half are adults, and a little less than half of those again are self-employed. We have also specified the employment and profit numbers of the companies to put them just above the thresholds for being classified as large companies in official Tanzanian statistics, which is 100+ employees and 800+ million TSh in revenues, which given an assumption of reasonable profit rates of between 6.25 and 12.5 percent results in the round number profit levels included in Figure 3.

Figure 3. Sample comparison second discrete choice experiment

|

|

Company A |

Company B |

|

Local female employees |

50 |

100 |

|

Origin of owners |

Tanzania |

China |

|

Local male employees |

50 |

100 |

|

Contributions to local community |

2 million TSh |

1 million TSh |

|

Foreign employees |

50 |

0 |

|

Profits |

100 million TSh |

50 million TSh |

To analyse the question of whether respondents are sceptical to foreign owned companies in themselves, or if this is due to other concerns about their local presence and impacts, we included the number of foreign employees of the companies, and the value of their financial or in-kind contributions to the local community, as attributes. If a bias against foreign owned companies remain after controlling for these attributes, there is a stronger case for saying that the uncovered preferences in our first experiment reflect national favouritism rather than concern for local impacts. The levels for local community contributions have been specified to range between 1 and 4 per cent of profits.

Finally, to assess whether the differences in emphasis on local employment in our first DCE may have been due to perceptions that the jobs in question were male jobs, we explicitly distinguish between male employees and female employees in our second DCE. This will allow us to study gender differences in preferences for employment, and specifically whether respondents favour employment opportunities for their own gender more than for the other gender.

The results of the analysis of the data from the second DCE are presented in Table 3. The layout of the table mirrors that of the earlier result table, with results for the full sample in the first column, and a breakdown according to gender in the last three columns. Notice, however, that the dependent variable reflects favourable treatment (getting a licence) in this case, as opposed to unfavourable treatment (paying more in taxes) in the first DCE. Odds ratios above 1 in this case indicates that the attribute in question leads to more favourable treatment of a company, as compared to less favourable treatment in the first DCE. From the full sample results in column one, we see that both greater male and female employment increase the relative odds of a company being given the licence to set up production by our respondents. A higher number of foreign employees is, however, seen as negative by our respondents, reducing the odds that a company is chosen. Local contributions, on the other hand, count positively. The inclusion of these local impacts do not, however, eradicate the effect of foreign ownership. Even controlling for foreign employees and local contributions, the odds of a Chinese company being chosen for the licence is only about a third of the odds of a Tanzanian company (the excluded category). We hence have a strong case for saying that national origin of a company matters per se; in choosing which companies to incentivize and permit to set up production, there seems to be an element of home bias present in our respondents’ preferences. If we calculate the willingness to sacrifice jobs to keep local companies domestically owned, we also see that this domestic bias runs fairly deep. This willingness to pay is calculated as the log odds of the China dummy in the conditional logit results, divided by the log odds of male or female employment. The calculations reveals that our respondents are willing to sacrifice 152 female or 270 male jobs to have a domestic company operating locally rather than a Chinese one, which in our context appear to be substantial numbers.

We have no comparative basis for stating whether home bias in terms of corporate ownership is greater in Tanzania than in other countries. However, it should be noted that our data was collected in a political context where national ownership is increasingly being emphasized as a government priority. While the current government frequently emphasizes that Tanzania is open to foreign investors, President Magufuli has on several occasions expressed that he is “fighting an economic war”, accusing foreign investors of draining Tanzania’s natural resources wealth.[10] Moreover, in December 2017, the President launched the ‘Nchi yangu kwanza’ (‘My country first’) campaign.[11] The main argument behind this campaign is that “the country cannot industrialise its economy unless all people come together under the same nationalism spirit”. The tax system is now actively used to implement policies of national favouritism (URT 2017; 2018). However, whether such government policies and priorities, and ensuing debates, have affected or been affected by the sentiments we uncover in our data, is of course hard to say.

Table 3. Results second discrete choice experiment. Odds ratios from conditional logit estimation

| (1) | (2) | (3) | (4) | |

| Sample | All | Male respondents | Female respondents | All |

| Dependent variable | Company choice | Company choice | Company choice | Company choice |

| Profits | 1.000 | 1.001 | 0.999 | 0.999 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Male employees | 1.004*** | 1.006*** | 1.001 | 1.001 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Female employees | 1.007*** | 1.002* | 1.011*** | 1.011*** |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Foreign employees | 0.998** | 0.995*** | 1.001 | 1.001 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Local contribution | 1.493*** | 1.254*** | 1.770*** | 1.770*** |

| (0.06) | (0.08) | (0.10) | (0.10) | |

| China | 0.369*** | 0.303*** | 0.433*** | 0.433*** |

| (0.02) | (0.02) | (0.03) | (0.03) | |

| Male*Profits | 1.001 | |||

| (0.00) | ||||

| Male*Male employees | 1.005*** | |||

| (0.00) | ||||

| Male*Female employees | 0.992*** | |||

| (0.00) | ||||

| Male*Foreign employees | 0.994*** | |||

| (0.00) | ||||

| Male*Local contribution | 0.709*** | |||

| (0.06) | ||||

| Male*China | 0.699*** | |||

| (0.06) | ||||

| Pseudo R2 | 0.201 | 0.246 | 0.193 | 0.220 |

| N | 6400 | 3200 | 3200 | 6400 |

Note: Odds ratios from conditional logit estimation, robust standard errors in parentheses, *** indicates significance at the 1% level, ** at 5%, * at 10%.

The results broken down by gender in columns two through four of Table 3, confirm our suspicion that gender differences on the local employment attribute from the first DCE may be due to an assumption that the job opportunities in question were predominantly male. When male and female employment feature as separate attributes, we see that men favour companies with more male employment (and also have a mild preference for female employment), while women favour companies with more female employment (but do not care about male employment). In fact, comparing the results in columns two and three, women care more strongly about female employment than men do about male employment (p=.0003). Concluding from our previous results that employment effects are unimportant to women when expressing their preferences for tax or regulation choices would hence appear premature and incorrect.

Some other interesting differences are also revealed by the decomposition by gender. Male respondents are critical to companies with more foreign employees, but this is not a factor in the decisions of our female respondents. It is possible that this reflects a greater observed influx of male immigrants, which may have increased competition for employment predominantly in male-dominated occupations. On the other hand, female respondents favour companies more for their local contributions than men, perhaps due to greater reliance on social goods offered by government or in this case private organizations. What is particularly notable is that once these two attributes of local presence and impact are included in the analysis, the China attribute has a more negative impact on the choices of men than of women. In other words, controlling for local impacts flips the relative uncovered national favouritism of men and women, compared to what we found in the first DCE. In the second DCE, men exhibit greater home bias, where in the first DCE they exhibited less. This suggests that to the extent that national favouritism follows gender lines, this is highly dependent on context.

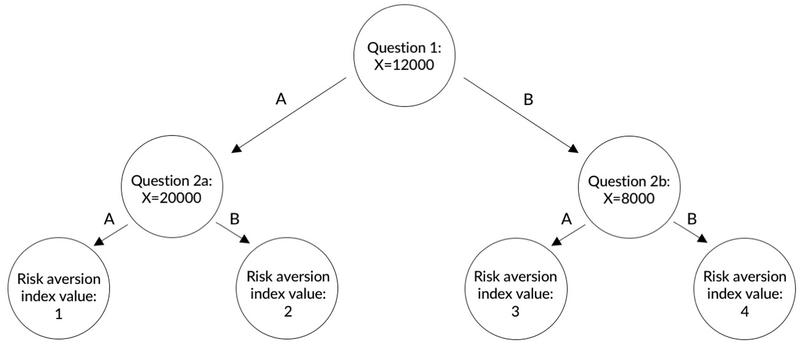

Responses to standard survey questions from our second survey allow us to probe a little deeper into whether female preferences for higher taxes on profitable, mobile, exporting firms in the first DCE are due to a greater preference for equality, or a greater aversion to risk. Using a sequence of redistribution questions as explained in Box C1 in Appendix C, where we vary the efficiency loss from redistribution, we classify respondents into eight classes of increasing preference of equality over inequality. Moreover, a sequence of hypothetical gambling choices as presented in Box C2, where the value of the safe option is varied, is used to classify respondents into four groups of increasing willingness to take risks. Regressions of these classifications on gender are presented in Table B3, and as the results show, female respondents are both more inequality and risk averse, which is consistent with the literature on gender preferences but also means that our results are consistent with either of the two explanations.

To analyse whether these types of preferences for safety over growth also translate from a gambling into a labour market context, we conducted our third DCE, which exposed respondents to a sequence of comparisons exemplified in Figure 4. Asked to consider two managers characterized by the attributes gender, age, nationality, experience, and management objective, our respondents were asked:

If you could choose, which manager would you rather work for?

As before, random assignment was done to ten blocks across which the order of the attributes were varied. However, to avoid tedium, we limited the number of comparison for each respondent to four. This limits our statistical power, but this is somewhat mitigated by the lower complexity of this experiment compared to the previous ones; it includes five attributes and only two levels of each, all of which are included in Figure 4.[12] While all attributes provide potentially interesting insights into labour market decisions among our respondents, our emphasis is on the last attribute included in Figure 4; management objective. Here we have explicitly asked respondents to compare a manager with a safe and stable approach of securing existing jobs, with one that takes a more risky and growth-oriented approach seeking to increase the number of jobs.

Figure 4.Sample comparison third discrete choice experiment

|

Manager A |

Manager B |

|

|

Gender |

Male |

Female |

|

Age |

55 years |

40 years |

|

Nationality |

Tanzania |

China |

|

Management experience |

15 years |

5 years |

|

Management objective |

Secure existing jobs |

Create more jobs |

The results of our third DCE are presented in Table 4, which has the same structure as previous results tables. The effect of the management objective attribute on choice of manager is quite striking. For our full sample in column one, the odds of choosing the growth oriented manager if four and a half time those of choosing the stability oriented manager. As seen in columns two and three, both men and women strongly prefer to work for this type of manager. However, as made explicit in column four, men have a significantly stronger preference for this type of management objective compared to women. This provides some support for the idea that women have a weaker preference for employment growth over job security, compared to men.

Table 4. Results third discrete choice experiment. Odds ratios from conditional logit estimation

| (1) | (2) | (3) | (4) | |

| Sample | All | Male respondents | Female respondents | All |

| Dependent variable | Manager choice | Manager choice | Manager choice | Manager choice |

| Age | 0.995 | 0.995 | 0.995 | 0.995 |

| (0.00) | (0.01) | (0.01) | (0.01) | |

| Experience | 1.018*** | 1.011 | 1.025*** | 1.025*** |

| (0.01) | (0.01) | (0.01) | (0.01) | |

| Manager male | 1.057 | 0.966 | 1.142 | 1.142 |

| (0.07) | (0.10) | (0.11) | (0.11) | |

| Growth objective | 4.551*** | 5.530*** | 3.826*** | 3.826*** |

| (0.33) | (0.59) | (0.38) | (0.38) | |

| China | 0.469*** | 0.503*** | 0.438*** | 0.438*** |

| (0.03) | (0.05) | (0.04) | (0.04) | |

| Male*Age | 1.001 | |||

| (0.01) | ||||

| Male*Experience | 0.986 | |||

| (0.01) | ||||

| Male*Manager male | 0.846 | |||

| (0.11) | ||||

| Male*Growth objective | 1.445** | |||

| (0.21) | ||||

| Male*China | 1.147 | |||

| (0.17) | ||||

| Pseudo R2 | 0.353 | 0.400 | 0.319 | 0.360 |

| N | 3200 | 1600 | 1600 | 3200 |

Note: Odds ratios from conditional logit estimation, robust standard errors in parentheses, *** indicates significance at the 1% level, ** at 5%, * at 10%.

For the other attributes, we see that the choice of manager is positively influenced by experience, but negatively influenced by his or her being a foreign national. The difference between male and female respondents in their attention to nationality of the manager is not statistically significant in this case. Respondents pay no significant attention to age when expressing their preferences, which may be a bit surprising in a context in which respect for and deference to age is of considerable importance. The gender of the manager also does not have a detectable effect on the choices of our respondents. While social desirability bias could play a part in the latter result, the DCE approach mitigates this problem as there are several attributes attached to each choice, and it will not be obvious during the experiment which attribute is emphasized by the respondent.

Conclusion

Our discrete choice experiments have allowed us to examine how citizens trade off the efficiency and equity concerns typically included in economic models of optimal taxation. The preference for regressive taxation uncovered suggests that efficiency may be a relatively more important consideration in corporate taxation than in personal income taxation. Moreover, our results also suggest that these types of models may be incomplete in important ways as representations of a democratic social planner. Our respondents favour higher taxes on mobile companies, contradicting a central implication of optimal tax theory that dates back to the model of Ramsey (1927). We also find strong support for domestic favouritism in setting corporate taxes. However, while our results suggest that men and women may be different in the emphasis of efficiency versus equity, and job growth versus job security, they also suggest that other differences in emphasis may be more related to the context and formulation of the choices they are exposed to. Both genders seem concerned with employment effects, but differ in whom they prefer jobs to be created for. Moreover, there is no consistent pattern across our experiments suggesting that either gender favours domestic companies more than the other.

Some limitations of our approach and challenges for further research deserve mention. It should be noted that for each of the attributes included in our experiment, the effect might be due to correlation perceived by respondents with other unobserved attributes, rather than the attribute itself. While we control for important attributes, there are inherent limitations in the number of attributes one can meaningfully include in this form of experiment. Furthermore, the external validity of our results merits further consideration. Our sample is of an urban population from a developing country; responses may not generalize to other populations. As noted, however, the vulnerability of such an economy to corporate location decisions provides a strong test of the extent of agreement with optimal tax theory. Given the importance of tax policy legitimacy, further studies of tax preferences in other contexts are of interest. Future studies should also tackle challenges of examining how informed and stable tax preferences are, and how receptive they are to economic arguments or other types of contextual influence or intervention.

References

Atkinson, A. B. and Stiglitz, J. E. (1976). The design of tax structure: Direct versus indirect taxation. Journal of Public Economics, 6: 55-75.

Autor, D., Dorn, D., Hanson, G., and Majlesi, K. (2016). Importing Political Polarization? The Electoral Consequences of Rising Trade Exposure. NBER Working Paper No. 22637. Cambridge, MA.: National Bureau of Economic Research

Balassa, B. (1978). Exports and economic growth. Journal of Development Economics, 5: 181-189.

Ballard-Rosa, C., Martin, L., and Scheve, K. (2017). The Structure of American Income Tax Policy Preferences. The Journal of Politics, 79(1): 1-16.

Berman, N., Couttenier, M., Rohner, D., and Thoenig, M. (2017). This mine in mine! How minerals fuel conflicts in Africa. American Economic Review, 107(6): 1564-1610.

Besley, T. J., Jensen, A. and Persson, T. (2015). Norms, enforcement, and tax evasion. CEPR Discussion Paper No. DP10372. London: Centre for Economic Policy Research.

Busse, M., Erdogan, C., and Mühlen, H. (2016). China's Impact on Africa – The Role of Trade, FDI and Aid. Kyklos, 69(2): 228-262.

Charness, G. and Gneezy, U. (2012). Strong evidence for gender differences in risk taking. Journal of Economic Behavior & Organization, 83: 50-58.

Chen, W., Dollar, D., and Tang, H. (forthcoming). Why is China investing in Africa? Evidence from the firm level. World Bank Economic Review.

Coulson, A. (2013). Tanzania: A Political Economy. 2nd edition. Oxford: Oxford University Press.

Croson, R., and Gneezy, U. (2009). Gender Differences in Preferences. Journal of Economic Literature 47(2): 448-474.

Devereux, M. P., Lockwood, B., and Redoano, M. (2008). Do countries compete over corporate tax rates? Journal of Public Economics, 92: 1210-1235.

Diamond, P. A. (1975). A many-person Ramsey tax rule. Journal of Public Economics, 4: 335-342.

Dixit, A. and Sandmo, A. (1977). Some simplified formulae for optimal income taxation. Scandinavian Journal of Economics, 79(4): 417-423.

Fehr, E., Naef, M, and Schmidt, K. M. (2006). Inequality aversion, efficiency, and maximin preferences in simple distribution experiments: Comment. American Economic Review, 96(5):1912-1917.

Fisman, R., Gladstone, K., Kuziemko, I., and Naidu, S. (2017). Do American want to tax capital? Evidence from online surveys. Working paper 23907. Cambridge, MA: National Bureau of Economic Research.

Fuest, C., Peichl, A., and Siegloch, S. (2018). Do higher corporate taxes reduce wages? Micro evidence from Germany. American Economic Review, 108(2): 393-418.

Goldberg, P. K. and Pavcnik, N. (2007). Distributional effects of globalization in developing countries. Journal of Economic Literature, 45: 39-82.

Gray. H. (2018). Turbulence and Order in Economic Development: Institutions and Economic Transformation in Tanzania and Vietnam. Oxford: Oxford University Press.

Hennighausen, T. and Heinemann, F. (2015). Don't tax me? Determinants of individual attitudes toward progressive taxation. German Economic Review, 16(3): 255-289.

Kaldor, N. (1967). Strategic factors in development. Ithaca: Cornell University.

Keane, M. P. (2011). Labor supply and taxes: A survey. Journal of Economic Literature. 49(4): 961-1075.

Kolstad, I. and Wiig, A. (2012). What determines Chinese outward FDI? Journal of World Business. 47: 26-34.

Kolstad, I., Wiig, A., and Fjeldstad, O.H (2018). Do economists act like democrats or technocratic paternalists? Mimeo, Bergen: Chr. Michelsen Institute.

Lakner, C. and Milanovic, B. (2016). Global income distribution: From the fall of the Berlin wall to the great recession. World Bank Economic Review. 30(2): 203-232.

Lofchie, M. F. (2014). The Political Economy of Tanzania: Decline and Recovery. Philadelphia: University of Pennsylvania Press.

Luttmer, E. F. P. and Singhal, M. (2014). Tax morale. Journal of Economic Perspectives, 28(4): 149-168.

Markusen J.R., and Venables, A. J. (1999). Foreign direct investment as a catalyst for industrial development. European Economic Review, 43: 335-356.

Mayda, A. M., and Rodrik, D. (2005). Why are some people (and countries) more protectionist than others? European Economic Review, 49(6): 1393-1430.

McCaffery, E. J. and Baron, J. (2004). Framing and taxation: Evaluation of tax policies involving household composition. Journal of Economic Psychology, 25: 679-705.

Moore, M., Pritchard, W., and Fjeldstad, O. H. (2018). Taxing Africa – Coercion, Reform and Development. London: Zed Books.

Nelson, R. H. (1987). The Economics Profession and the Making of Public Policy. Journal of Economic Literature, 25(1):49-91.

Ramsey, F. (1927). A contribution to the theory of taxation. Economic Journal 37(145):47-61.

Rodrik, D. (2013). Unconditional convergence in manufacturing. Quarterly Journal of Economics 128(1): 165-204.

Scheve, K. and Slaughter, M. (2001). Labor market competition and individual preferences over immigration policy. Review of Economics and Statistics, 83(1): 133-145.

Schultze, C. (1982). The Role and Responsibilities of the Economist in Government. American Economic Review, 72(2):62-66.

Sheffrin, S. M. (1993). What does the public believe about tax fairness? National Tax Journal, 46(3): 301-308.

Sheffrin, S. M. (1994). Perceptions of fairness in the crucible of tax policy. In Slemrod, J. (ed). Tax progressivity and income inequality. Cambridge: Cambridge University Press.

Spicer, M. W. and Becker, L. A. (1980). Fiscal inequity and tax evasion: An experimental approach. National Tax Journal, 33(2): 171-175.

Stiglitz, J. E. (2002). Globalization and its discontents. New York: W. W. Norton.

Sørensen, P. B. (2007). The theory of optimal taxation: what is the policy relevance? International Tax and Public Finance, 14(4):383–406.

United Republic of Tanzania [URT]. (2018). Speech by the Minister for Finance and Planning, Hon. Dr Philip I. Mpango (MP), presenting to the National Assembly, the estimates of government revenue and expenditure for 2017/18. Dodoma (14 June).

United Republic of Tanzania [URT]. (2017). Speech by the Minister for Finance and Planning, Hon. Dr Philip I. Mpango (MP), presenting to the National Assembly, the estimates of government revenue and expenditure for 2017/18. Dodoma (8 June).

Van Wijnbergen, S. (1984). The ‘Dutch disease’: A disease after all? Economic Journal, 94: 41-55.

Wilson, J.D. (1986). A Theory of Interregional Tax Competition. Journal of Urban Economics, 19: 296–315.

Zodrow, G. and P. Mieszkowski (1986). Pigou, Property Taxation and the Underprovision of Local Public Goods. Journal of Urban Economics 19: 356–70.

Appendix A. Definitions and descriptive statistics

Table A 1. Summary statistics for respondent characteristics, original survey

| (1) | (2) | (3) | (4) | |

| Sample | All | Male respondents | Female respondents | Male vs. Female sample |

| Head | 0.432 | 0.525 | 0.340 | 0.000 |

| (0.017) | (0.025) | (0.024) | ||

| Age | 35.222 | 35.280 | 35.164 | 0.895 |

| (0.441) | (0.638) | (0.609) | ||

| Primary education | 0.460 | 0.458 | 0.462 | 0.909 |

| (0.018) | (0.025) | (0.025) | ||

| Secondary education | 0.351 | 0.375 | 0.328 | 0.159 |

| (0.017) | (0.024) | (0.023) | ||

| Tertiary education | 0.154 | 0.140 | 0.169 | 0.260 |

| (0.013) | (0.017) | (0.019) | ||

| Asset: Radio | 0.893 | 0.945 | 0.841 | 0.000 |

| (0.011) | (0.011) | (0.018) | ||

| Asset: Tv | 0.854 | 0.863 | 0.846 | 0.512 |

| (0.012) | (0.017) | (0.018) | ||

| Asset: Motor vehicle | 0.350 | 0.357 | 0.342 | 0.655 |

| (0.017) | (0.024) | (0.024) | ||

| Number of rooms in dwelling | 4.045 | 3.637 | 4.449 | 0.001 |

| (0.119) | (0.108) | (0.209) | ||

| Self-employed | 0.439 | 0.484 | 0.395 | 0.011 |

| (0.018) | (0.025) | (0.024) | ||

| Public sector employee | 0.034 | 0.018 | 0.050 | 0.012 |

| (0.006) | (0.007) | (0.011) | ||

| Agriculture sector | 0.042 | 0.043 | 0.039 | 0.839 |

| (0.008) | (0.011) | (0.013) | ||

| Mining sector | 0.014 | 0.009 | 0.022 | 0.251 |

| (0.005) | (0.005) | (0.010) | ||

| Manufacturing sector | 0.078 | 0.089 | 0.061 | 0.220 |

| (0.011) | (0.016) | (0.016) | ||

| Services sector | 0.570 | 0.687 | 0.404 | 0.000 |

| (0.021) | (0.026) | (0.033) | ||

| N: | 803 | 400 | 403 |

Note: Columns 1-3 contain mean values for the respondent characteristics in question, standard deviations in parentheses. Column 4 presents the p-value of a t-test for equality between male and female means.

Table A 2. Attributes, levels and variable names, second DCE

| Attribute | Levels | Variable name | Variable type |

| Profits | 50 million TSh | Profits | Continuous |

| 100 million TSh | |||

| Local male employees | 50 | Male employees | Continuous |

| 100 | |||

| Local female employees | 50 | Female employees | Continuous |

| 100 | |||

| Foreign employees | 0 | Foreign employees | Continuous |

| 50 | |||

| Contributions to local community | 1 million TSh | Local contribution | Continuous |

| 2 million TSh | |||

| Origin of owners | China | China | Dummy |

| Tanzania | (omitted category) |

Table A 3. Attributes, levels and variable names, third DCE

| Attribute | Levels | Variable name | Variable type |

| Age | 40 years | Age | Continuous |

| 55 years | |||

| Management experience | 5 years | Experience | Continuous |

| 15 years | |||

| Gender | Male | Manager male | Dummy |

| Female | (omitted category) | ||

| Management objective | Create more jobs | Growth objective | Dummy |

| Secure existing jobs | (omitted category) | ||

| Nationality | China | China | Dummy |

| Tanzania | (omitted categoryI |

Appendix B. Additional results

Table B 1. Fixed effects estimation using amount allocated in taxes to companies as dependent variable

| (1) | (2) | (3) | (4) | |

| Sample | All | Male respondents | Female respondents | All |

| Dependent variable | Company choice | Company choice | Company choice | Company choice |

| Profits | 2.453*** | 1.720*** | 3.185*** | 3.185*** |

| (0.27) | (0.38) | (0.38) | (0.38) | |

| Mobile | 2.906*** | 1.791*** | 4.011*** | 4.011*** |

| (0.48) | (0.68) | (0.68) | (0.68) | |

| Manufacturing | 4.220*** | 4.880*** | 3.592*** | 3.592*** |

| (0.85) | (1.19) | (1.21) | (1.21) | |

| Mining | 7.991*** | 8.233*** | 7.777*** | 7.777*** |

| (0.90) | (1.25) | (1.28) | (1.28) | |

| Services | 0.987 | 0.540 | 1.455 | 1.455 |

| (0.82) | (1.15) | (1.16) | (1.16) | |

| Local employees | -15.569*** | -17.907*** | -13.259*** | -13.259*** |

| (0.94) | (1.31) | (1.33) | (1.33) | |

| China | 10.423*** | 8.729*** | 12.115*** | 12.115*** |

| (0.93) | (1.31) | (1.28) | (1.28) | |

| Great Britain | 10.926*** | 9.136*** | 12.693*** | 12.693*** |

| (0.91) | (1.26) | (1.28) | (1.28) | |

| India | 10.114*** | 7.543*** | 12.654*** | 12.654*** |

| (0.85) | (1.18) | (1.21) | (1.21) | |

| Export share | 12.556*** | 4.995* | 20.079*** | 20.079*** |

| (1.87) | (2.61) | (2.62) | (2.62) | |

| Male*Profits | -1.465*** | |||

| (0.53) | ||||

| Male*Mobile | -2.220** | |||

| (0.96) | ||||

| Male*Manufacturing | 1.288 | |||

| (1.69) | ||||

| Male*Mining | 0.457 | |||

| (1.79) | ||||

| Male*Services | -0.915 | |||

| (1.63) | ||||

| Male*Local employees | -4.648** | |||

| (1.87) | ||||

| Male*China | -3.386* | |||

| (1.83) | ||||

| Male*Great Britain | -3.557** | |||

| (1.80) | ||||

| Male*India | -5.111*** | |||

| (1.69) | ||||

| Male*Export share | -15.084*** | |||

| (3.70) | ||||

| Constant | 15.862*** | 28.423*** | 3.349 | 15.837*** |

| (3.33) | (4.65) | (4.67) | (3.29) | |

| r2 | 0.067 | 0.097 | 0.069 | 0.083 |

| N | 12846 | 6398 | 6448 | 12846 |

| p-value Profits=4.35 | 0.0000 | 0.0000 | 0.0021 |

Note: Results from linear regression with fixed effects at the choice set level, robust standard errors in parentheses, *** indicates significance at the 1% level, ** at 5%, * at 10%.

Table B 2. Results from mixed logit estimation of first DCE

| (1) | (2) | (3) | |

| Sample | All | Male respondents | Female respondents |

| Dependent variable | Company choice | Company choice | Company choice |

| Profits | 1.428* | 1.261*** | 1.675*** |

| (0.05) | (0.05) | (0.10) | |

| Mobile | 1.476*** | 1.271*** | 1.754*** |

| (0.09) | (0.09) | (0.16) | |

| Manufacturing | 1.541*** | 1.544*** | 1.461*** |

| (0.13) | (0.18) | (0.20) | |

| Mining | 2.628*** | 2.683*** | 2.995*** |

| (0.28) | (0.38) | (0.57) | |

| Services | 0.999 | 0.979 | 1.011 |

| (0.08) | (0.10) | (0.13) | |

| Local employees | 0.112*** | 0.081*** | 0.142*** |

| (0.02) | (0.02) | (0.04) | |

| China | 3.183*** | 2.364*** | 4.548*** |

| (0.33) | (0.32) | (0.81) | |

| Great Britain | 3.749*** | 2.977*** | 5.339*** |

| (0.39) | (0.42) | (0.96) | |

| India | 3.337*** | 2.710*** | 4.620*** |

| (0.33) | (0.34) | (0.77) | |

| Export share | 5.874*** | 2.296*** | 17.241*** |

| (1.36) | (0.64) | (6.83) | |

| SD | |||

| Profits | 1.687*** | 1.464*** | 1.934*** |

| (0.08) | (0.07) | (0.14) | |

| Mobile | 1.788*** | 1.751*** | 0.448*** |

| (0.29) | (0.19) | (0.07) | |

| Manufacturing | 1.604*** | 1.482 |

0.743 |

| (0.25) | (0.44) | (0.21) | |

| Mining | 2.428*** | 0.506*** | 2.446** |

| (0.61) | (0.10) | (0.89) | |

| Services | 0.732 | 0.724 | 0.655 |

| (0.20) | (0.31) | (0.21) | |

| Local employees | 9.294*** | 9.380*** | 8.676*** |

| (1.20) | (2.04) | (1.52) | |

| China | 0.716 | 0.624 | 0.845 |

| (0.22) | (0.29) | (0.30) | |

| Great Britain | 0.903 | 0.923 | 1.008 |

| (0.16) | (0.22) | (0.79) | |

| India | 0.949 | 1.050 | 1.657** |

| (0.41) | (0.18) | (0.37) | |

| Export share | 21.347*** | 0.127*** | 39.231*** |

| (9.74) | (0.07) | (26.80) | |

| Log Likelihood | -3406.165 | -1649.226 | -1686.402 |

| N | 12848 | 6400 | 6448 |

Note: Odds ratios from mixed logit estimation in upper panel, and their standard deviations in the lower panel. Robust standard errors in parentheses, *** indicates significance at the 1% level, ** at 5%, * at 10%.

Table B 3. OLS regressions of inequality aversion index and risk aversion index on gender

| (1) | (2) | (3) | |

| Sample | Original survey | Follow-up survey | Follow-up survey |

| Dependent variable | National favouritism | Inequality aversion | Risk aversion |

| Male | 0.034 | -1.055*** | -0.210** |

| (0.06) | (0.23) | (0.10) | |

| Constant | 3.776*** | 7.210*** | 3.625*** |

| (0.04) | (0.12) | (0.06) | |

| R2 | 0,001 | 0.049 | 0.012 |

| N | 736 | 400 | 400 |

Note: Results from ordinary least squares regressions, robust standard errors in parentheses, *** indicates significance at the 1% level, ** at 5%, * at 10%. National favouritism is an index that averages responses (on a scale from 1 – disagree strongly to 5 – agree strongly) for the following three questions: i) “Tanzanian companies should be protected from competition from foreign companies”; ii) “It is a problem in Tanzania that foreign workers take our jobs”; iii) “We should restrict immigration of foreign citizens to Tanzania”. Inequality aversion is an index 1-8 calculated from responses to the questions presented in Box C1 in Appendix C. Risk aversion is an index 1-4 calculated from responses to the questions presented in Box C2.

General structure of questions used to construct inequality aversion index:“Imagine two people that you don't know who work equally hard at the same job. One person receives 20.000 TSh for the job, the other person gets nothing. You can take some money from the first person and give to the second. But taking from one and giving to the other is costly, due to administration costs. So the two people get less money in total the more equally you divide the money. If you were to choose among these two options, which one would you choose?